Germany is the twentieth most-infected Covid-19 country globally. While the 240,000+ infections appear to portray the European Union’s economic engine in relative control of the pandemic, the conditions remain dire. Norway recommends mandatory quarantine for German arrivals, as the country reports 1,500 new infections daily. The government agreed to a nationwide fine of €50 for not wearing face masks in public, extended a ban on large events, and limit social gatherings. While the thirty components of the DAX 30 source more revenues from outside Germany, the global GDP outlook remains depressed. It sufficed to pressure this index below its resistance zone, from where more downside is expected.

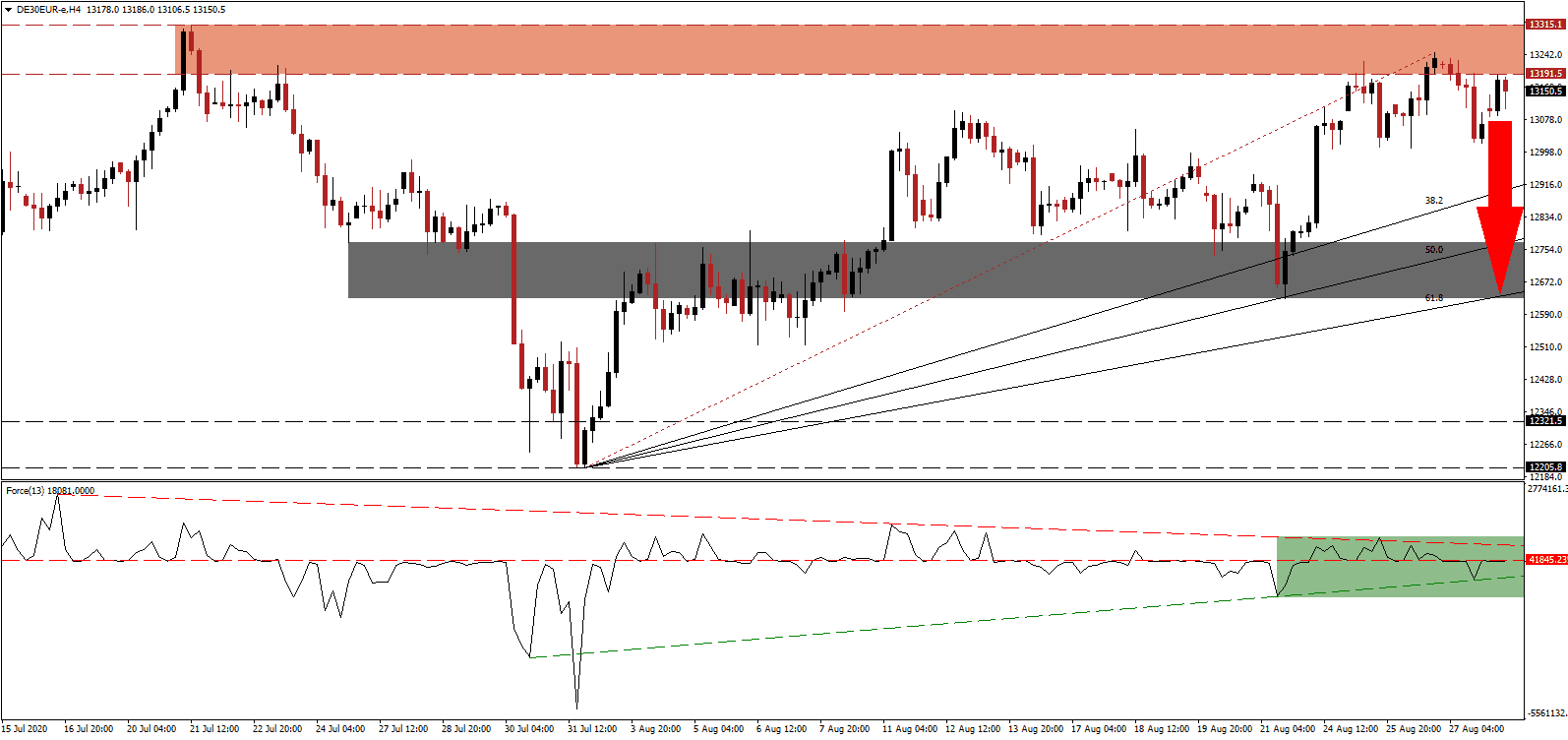

The Force Index, a next-generation technical indicator, confirms the absence of bullish momentum and remains below its horizontal resistance level. A series of higher lows allowed for the emergence of a new ascending support level, as marked by the green rectangle, but the descending resistance level is positioned to pressure for a breakdown. Bears wait for this technical indicator to cross below the 0 center-line to regain full control over the DAX 30.

Per data from the German Federal Statistical Office (Destatis), second-quarter GDP plunged by 9.7%, representing a record since data monitoring commenced in 1970. It marks a small upward revision from the initially reported 10.1% drop, and German business confidence improved in August, according to data by the Munich-based Ifo Institute for Economic Research. Bearish pressures remain dominant in the DAX 30 following the breakdown below its resistance zone located between 13,191.5 and 13,315.1, as marked by the red rectangle.

Fiscally conservative Germany added to its debt level and violated its constitution, to support its economy with over €1 trillion in support measures. Finance Minister and Vice-Chancellor Olaf Scholz confirmed that 2021 would require more debt and hopes the economy will recover by 2022. Germany is unlikely to revert from its debt-favored approach, adding long-term pressures on the economy. The DAX 30 is well-positioned to correct into its short-term support zone located between 12,629.5 and 12,771.5, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level enforces it.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 13,150.0

- Take Profit @ 12,650.0

- Stop Loss @ 13,275.0

- Downside Potential: 5,000 points

- Upside Risk: 1,250 points

- Risk/Reward Ratio: 4.00

Should the Force Index push through its descending resistance level, the DAX 30 may attempt a reversal. Given the global economic outlook and the new-found support for debt-funded stimuli through the crisis, traders should view any price spike as a secondary selling opportunity. The upside potential remains limited to its intra-day high of 13,403.3, the top of a previous price gap to the downside.

DAX 30 Technical Trading Set-Up - Limited Reversal Scenario

- Long Entry @ 13,320.0

- Take Profit @ 13,400.0

- Stop Loss @ 13,275.0

- Upside Potential: 800 points

- Downside Risk: 450 points

- Risk/Reward Ratio: 1.78