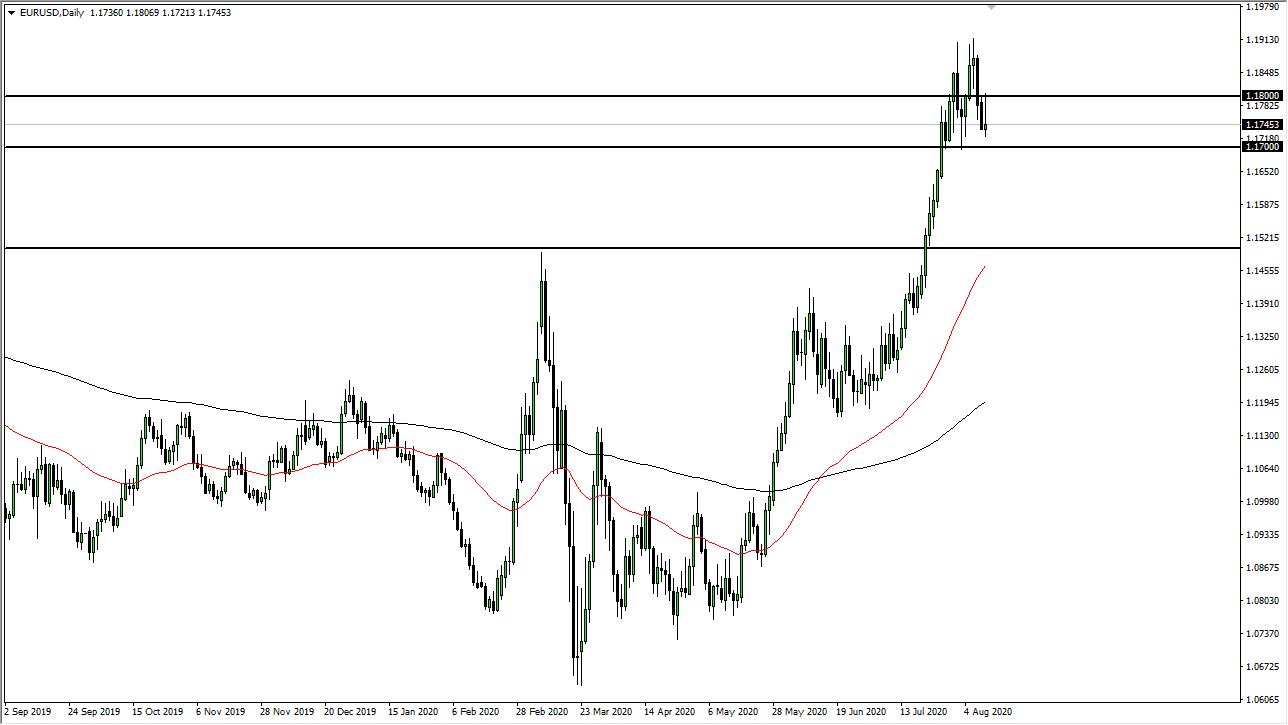

The Euro initially rallied during the trading session on Tuesday but gave back all of the gains essentially to form a shooting star shaped candlestick. The 1.17 level is an area of support and an area that has been important in the past. If we were to break down below the 1.17 level, then it is likely that the market goes looking towards 1.15 handle underneath. I think in that area we would see a lot of buying activity, and it looks as if the US dollar is ready to make some type of come back. Nonetheless, I have no interest whatsoever in trying to short this market, because the Federal Reserve will do what it can to liquefy the markets, meaning that they will be providing the market with more greenbacks going further into the future. This is ultimately a bullish market, but can’t go straight up in the air forever.

At the very least we need to go sideways, but I think the one thing you cannot do is expect some type of huge move in the short term. Short-term traders could go back and forth, but I think we need some type of catalyst to get this thing going. A break down could probably flush out a lot of the “weak hands”, meaning that we could see a sudden flush lower, but I still look at that as a potential value opportunity. After all, we are in the midst of changing the overall trend and that takes quite a bit of effort and causes quite a bit of chaotic trading until everybody gets on the same wavelength.

The European Union is showing signs of getting ahead of the United States as far as the coronavirus issues are concerned, but really at this point, I do not know that it matters as much as the Federal Reserve flooding the markets with greenbacks. That is another reason to be bullish though, so it is worth paying attention to. That being said, the shape of this candlestick is very bearish, so it is worth paying attention to. However, if we were to break above the top of it, you can also say that is a very bullish sign. Either way, caution will be needed, and I think that value will present itself if you give it enough time.