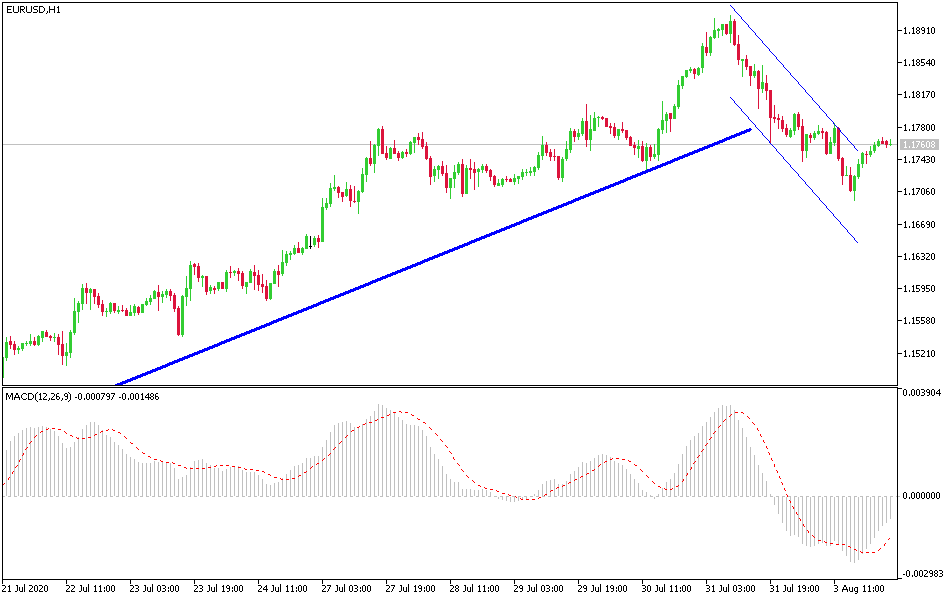

EUR/USD: Buying starting at the 1.1670 support

Today's EUR/USD signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas:

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1780 or 1.1930.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1685 or 1.1610.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The strength of the EUR/USD pair is supported by the faster economic recovery in Europe and increased coronavirus cases in the United States, along with the uncertainty about the fiscal stimulus being implemented. The European continent is witnessing many new coronavirus cases, most notably in Spain - the country that is most attracting to tourism, yet the containment of the virus is still under control. In complete contrast to what is happening in the United States of America where cases exceed 4.6 million cases and deaths exceed 155,000. This keeps the mortality curve on an upward path in the world's largest economy.

The fastest economic situation for the recovery from the pandemic is in favor of the Euro. As the US economy shrank - 32.9% annually in the second quarter - or 9.5% quarterly - worse than the Eurozone economic slowdown of - 12.1%. However, the resumption of the US economic shutdown will affect economic sentiment. The PMI reading for the manufacturing sector, which was released this week, was in favor of the European single currency.

The US exit from the disease depends largely on government support. Where the increase in federal unemployment benefits, which hit $600 per week, played a role in maintaining optimism in consumption. Support from this and other special programs ended at the end of July and lawmakers have failed to reach an agreement on the new support so far. Therefore, the Republicans and Democrats have set up for new negotiations, with markets expecting an imminent agreement - as both parties wanting to polish their images before the elections – and every day that passes causes economic pain for millions of Americans.

I recommend buying EUR/USD from the support levels at 1.11685 and 1.1590 respectively.

The RSI on the 4-hour chart has dropped below 70 - giving up overbought areas, allowing for further gains. EUR/USD will continue to trade above the 50, 100, and 200 simple moving averages, so the momentum remains positive. The immediate resistance is at 1.1780, a temporary high in late July. It was followed by 1.1805 that played a similar role. A break of the recent resistance at 1.1909 will be important for the control of the Euro bulls. On the other hand, the support is at 1.1740, a daily low, and is followed by 1.17 that provided support last week. Further down, the pair will push towards 1.1625 and 1.1540 support levels.

For the euro, the Producer Price Index for the bloc and the change in Spanish employment will be announced. As for the US dollar, the US factory orders numbers will be announced.