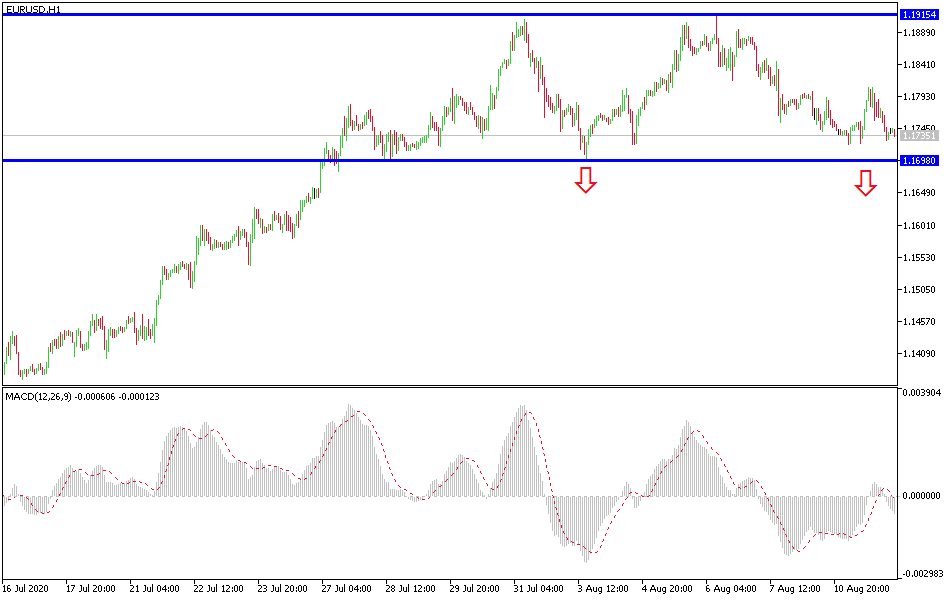

EUR/USD: An imminent shift of trend.

Today's EUR/USD signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1690 or 1.1640.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1770 or 1.1840.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

As I mentioned yesterday, the EUR/USD pair faces an opportunity to reverse the general trend, which is still bullish until now. In yesterday's trading session, the strong struggle between bulls and bears was evident, as the pair moved between the 1.1722 support and the 1.1807 resistance. The better than expected German ZEW indicator reading stopped the bearish correction opportunity. The German ZEW Investor Survey showed a slight deterioration in the assessment of current conditions, but optimism about the future continued to improve. The August survey showed that the view of current conditions fell to a reading of -81.3 from a reading of -80.9. I remember it dipped at -93.5 in May. On the other hand, expectations rose to a reading of 71.5 from 59.3. This was a particularly strong reading, the highest since 2003. Between loan guarantees and actual spending, Germany has been more aggressive than most other European countries in responding to the pandemic. We cannot help but wonder if this lays the groundwork for a new variance in the coming years, even though the European Union has a recovery fund and will issue joint bonds.

The EUR/USD pair still has a chance to rise, especially if it stabilizes above the 1.1800 resistance. A threat to bulls will gain control if it moves towards 1.1660 support. The recent disparity in economic performance between the Eurozone and the United States of America in light of Coronavirus consequences is still in favor of the single European currency's gains. The USD still has a long way to go from political anxiety, tensions with China, and a return to pre-epidemic performance.

The United States continues to mount pressure on China. After the latest sanctions and measures against two Chinese applications, the United States indicated that after late September, goods made in Hong Kong will be classified as "Made in China" and subject to the same tariff schedule as China. This measure, just like punishing Lamm, the CEO in Hong Kong, and as we indicated before, most of the goods that the United States imports from Hong Kong are re-exported from China, and goods actually made in Hong Kong account for less than 1.5% of the US imports from it.

For the euro, Eurozone manufacturing rate will be announced. For the US dollar, CPI (Inflation) numbers will be announced.