Despite the recent strength of the US dollar, the EUR/USD, is trying to consolidate near the 1.1800 resistance to confirm the continuation of the bullish momentum. The recent downward correction pushed the currency pair towards the 1.1710 support before settling around 1.1788 in the beginning of trading on Thursday. The US currency retreated yesterday after a short-term rebound and attempted to rise again after better-than-expected US inflation results, which may exacerbate investor concerns about declining inflation-adjusted returns and fuel demand for precious metals.

Official data showed that US inflation rose 0.6% in June, and expectations were for a lower increase of 0.3%. Core CPI, which the market closely watches because it is seen as a better measure of inflation as it excludes volatile items like food and energy, rose 0.6%, its strongest increase since January 1991.

Commenting on the results, CIBC Capital Markets economist Kathryn Judge, referring to the annual core inflation rate that came in at 1.16% and still below the federal rate, said: “Although it is much stronger than expected, it is still much lower than the readings seen before the pandemic and well below the Fed's target.” And added: “With the U.S recovery stalled due to the re-emergence of the virus in August, additional upward pressure on prices could have been somewhat limited”.

Markets are interested in inflation data because it is price pressure expectations that increase the changes in interest rate policies, which are the main driver of currencies, although it is widely expected from central banks in the 2020 world affected by the Coronavirus to keep borrowing costs close to zero for years. As it is known, the long-term policy of low-interest rates feeds on investors’ returns when combined with economic recovery and the extraordinary amounts of new money flowing around the financial system that raises inflation. Real yields could fall because of both reductions in bond yields as well as increases in inflation.

The EUR/USD gains helped facilitate further losses in the Turkish lira, pushing the EUR/TRY higher by 1.63% amid a simultaneous advance in the USD/TL pair.

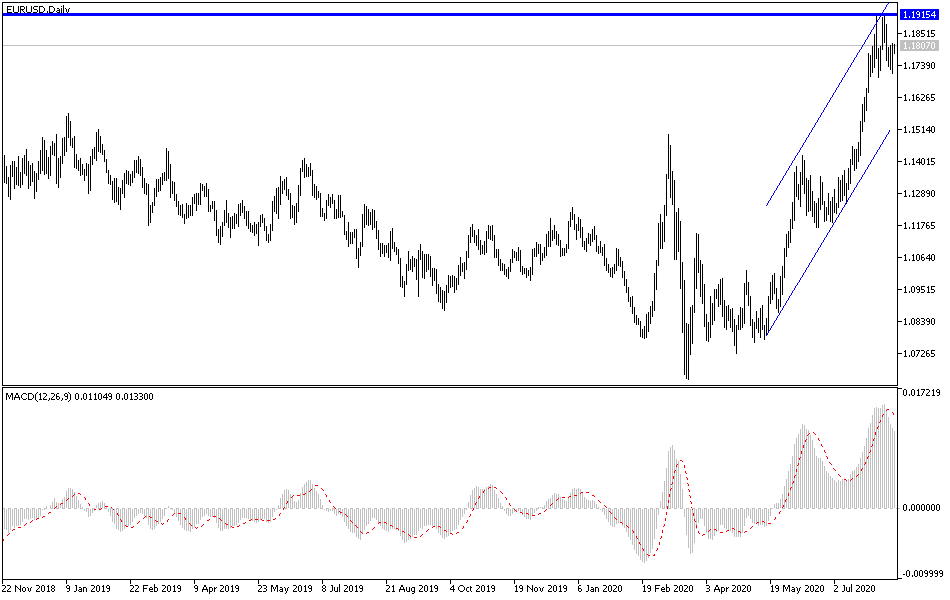

There has been a noticeable increase in forex market analysts in major financial institutions and investment banks in the world who are looking for a short-term drop in the EUR/USD exchange rate, as most of them still see short-term weakness eventually. The calls come after a multi-week sharp rise in the exchange rate that appears to have stalled just above 1.19, and since then a bounce back to 1.1750 has emerged with data indicating that trade has become congested and more vulnerable to any fundamental setbacks.

According to the technical analysis of the pair: I do not see any change in my technical view for the future of the EUR/USD, as the 1.1800 resistance is still supportive of the bulls' control over the performance because it may pave the way for a stronger upward move that may reach the 1.2000 psychological resistance. On the other hand, as I mentioned before, the 1.1660 support may give bears the opportunity to launch and reverse the current upward trend. I still prefer to buy the pair from every lower level.

As for the economic calendar data today: The German Consumer Price Index, followed by the weekly US jobless claims number will be announced.