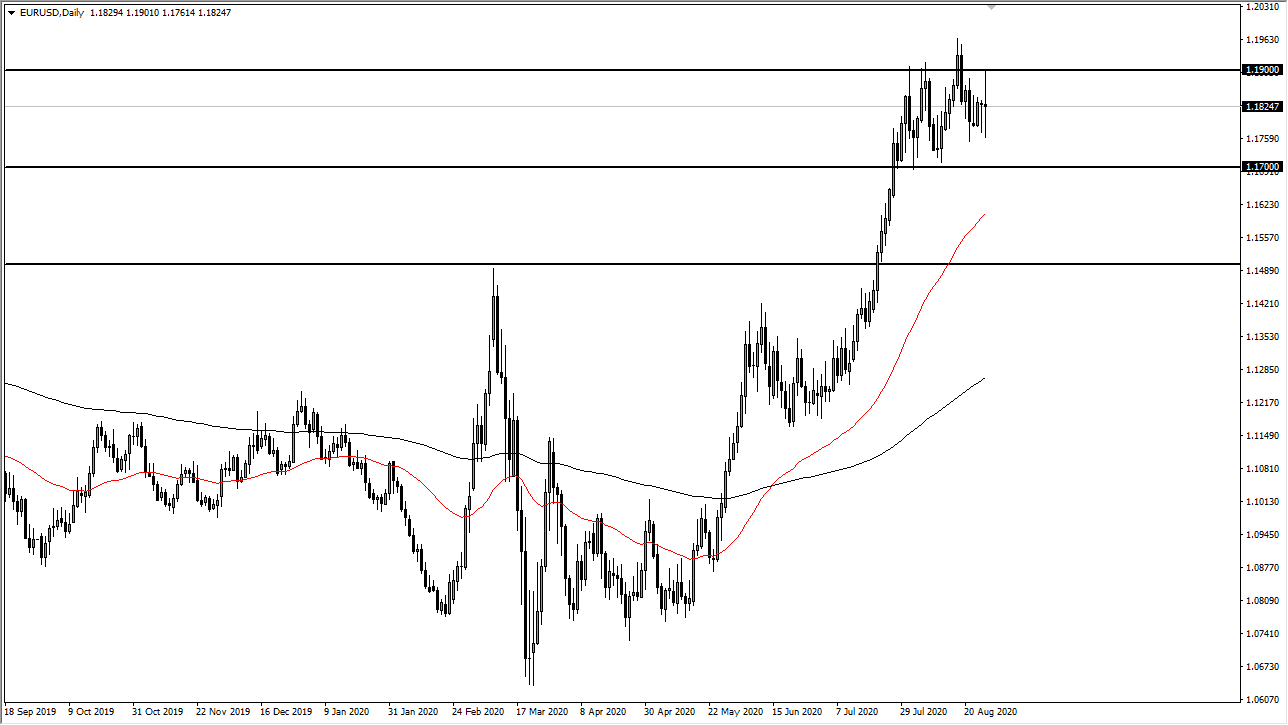

The Euro went back and forth during the trading session on Thursday as Jerome Powell finally had his speech from the Jackson Hole symposium. The market was very confused all day, as we initially rallied all the way towards the 1.19 level, which is a level that has been resistance in the past. We then fell hard to reach down towards the 1.1750 level, before turning around to finish the day somewhat unchanged. At the end of the day, this tells me that the market has not changed much, only took out a lot of traders and stop losses during the day.

With that being said, we are still in the same consolidation area that we have been in for some time, between the 1.17 level on the bottom and the 1.19 level on the top. We are gradually grinding higher, so I think this will probably move right along with other markets such as the Australian dollar, and believe it or not, the West Texas Intermediate Crude Oil market. This is because this is all about US dollar, and very little to do with anything else right now.

The market also has massive support underneath below the 1.17 level, down at the 1.16 level in the form of the 50 day EMA. After that, we have the 1.15 level is massive support based upon the fact that it had been massive resistance previously. This area has not been retested, so this is still a very real possibility. Having said all of that, when you zoom out to the ultra-longer-term chart, we are currently breaking above a major downtrend line, so I think we are at a major inflection point when it comes to this market. If we can break above the 1.20 level above, I think that this market goes looking towards 1.25 handle, and then much higher after that.

On the other hand, if we were to break down below the 1.15 handle, this is a market that goes down to the 1.12 handle, possibly even the 1.10 level. This would obviously be a major shift in the attitude of the market, and thereby the US dollar. I do not see that happening though, so I still look at this as a “buy on the dips” type of marketplace. Longer-term, I do believe that the US dollar might be in a bit of trouble.