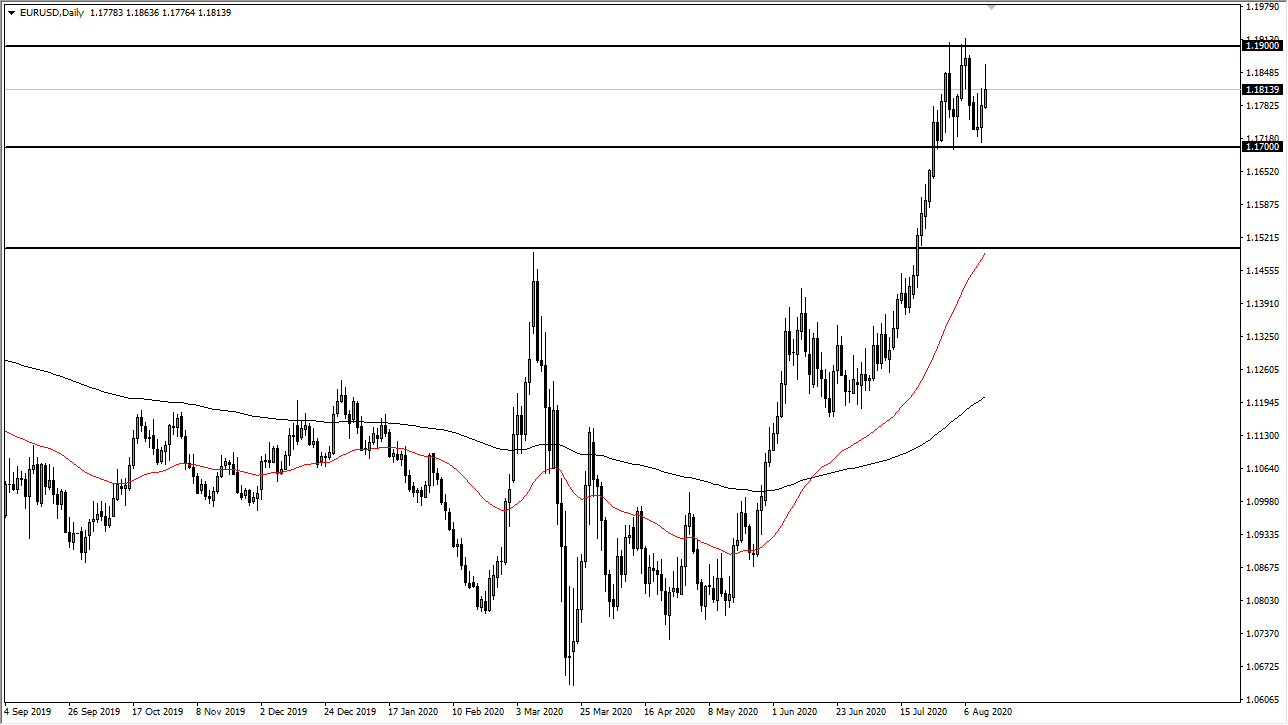

The Euro has initially rally during the trading session on Thursday but gave back about half the gains in order to stay well within the range that we have been stuck in for a couple of weeks. Ultimately, the 1.19 level above has offered significant resistance, just as the 1.17 level underneath has offered significant support. I do not necessarily see this market breaking out during the trading session on Friday, because traders will be looking to put on a ton of risk heading into the weekend.

That being said, I do think it is only a matter of time before we make a bigger move and I certainly prefer the upside over the down. However, we have to keep both sides of the equation in the back of her mind, as the markets will have conflicting attitudes. Looking at this candlestick, it does suggest that perhaps we might get a little bit of a pullback, but it is difficult to imagine that the market breaks down below the 1.17 level easily. However, if it does then the downside of the equation suggests that we could go down to the 1.15 handle. That is an area that was previous resistance, and it should now be massive support. On the upside, if we can break above the 1.19 level then it is likely we go looking towards the 1.20 level. Breaking above their opens up the door to the 1.25 handle which is a longer-term target of mind.

Taking a look at the overall trend, it does make sense that we need to grind away for a little bit in order to digest all of these massive gains that we have had in a relatively short amount of time. Furthermore, the market has to deal with a lot of noise, but at the end of the day this is all about the Federal Reserve flooding the market with greenbacks. That will continue to work against the value of the US dollar, which is quite often expressed in this pair. Buying short-term dips makes sense, but even if we break down below that 1.17 level, I simply sit on the sidelines and wait for an opportunity to pick up “cheap euros.” I do believe that we are in the midst of a major trend change, so this tends to be a very messy ordeal.