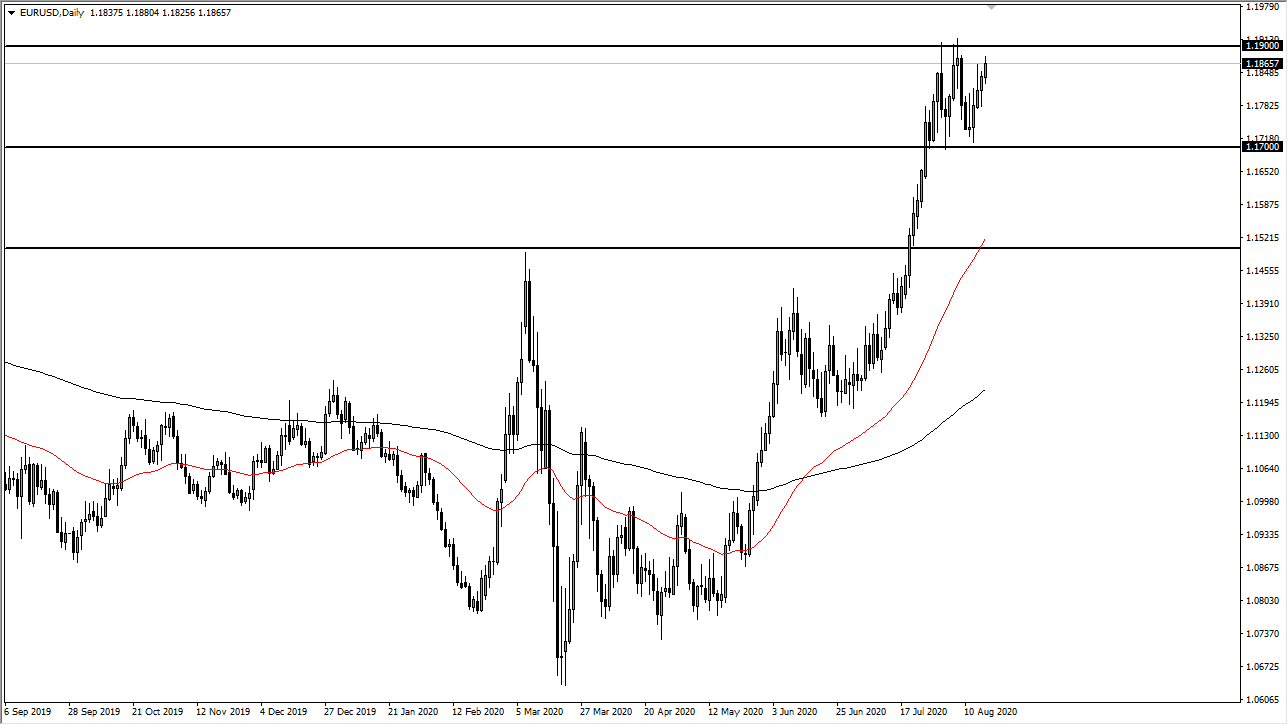

The Euro broke higher during the trading session on Monday, reaching towards the 1.19 level above. That is an area that has caused a significant amount of resistance previously, and therefore it is the top of the consolidation area that I am paying attention to. If we can break above the top of this consolidation, then it is likely that we go looking towards 1.20 level, possibly even the 1.21 level after that. The bottom of the consolidation area is the 1.17 level, so that does measure for that move to 1.21, and you can also make an argument that we are in the midst of a bullish flag again.

Ultimately, the bullish flag opens up the possibility of a move towards the 1.25 handle, which is my longer-term target anyway. This is a market that I think will find plenty of buyers on dips and even if we do pull back from here, I have no interest in shorting. I would be much more comfortable buying the 1.17 level than trying to get too cute with this market and fade the short-term rallies.

The 1.17 level being broken to the downside could open up a move down to the 1.15 handle, where I expect to see even more buying pressure. After all, that is an area that has been important more than once and was the scene of a major breakout. The 50 day EMA is sitting in that same area, so I think it is only a matter of time before buyers would look at that as a lot of value. If we were to break down below the 1.15 handle, that would change the entire trend but right now the US dollar seems to be so far on its back foot that it is difficult to imagine a scenario where you can be a seller for any length of time. Granted, the market is probably far too bearish of the greenback, but the longer-term trend seems to say so unless things change drastically, it is very unlikely that we will see this market fall for any significant amount of time. I look at pullbacks as value that I can take advantage of, perhaps building up a bigger position for the longer-term trade that could be the main theme for the next several months as we go into the fall and winter.