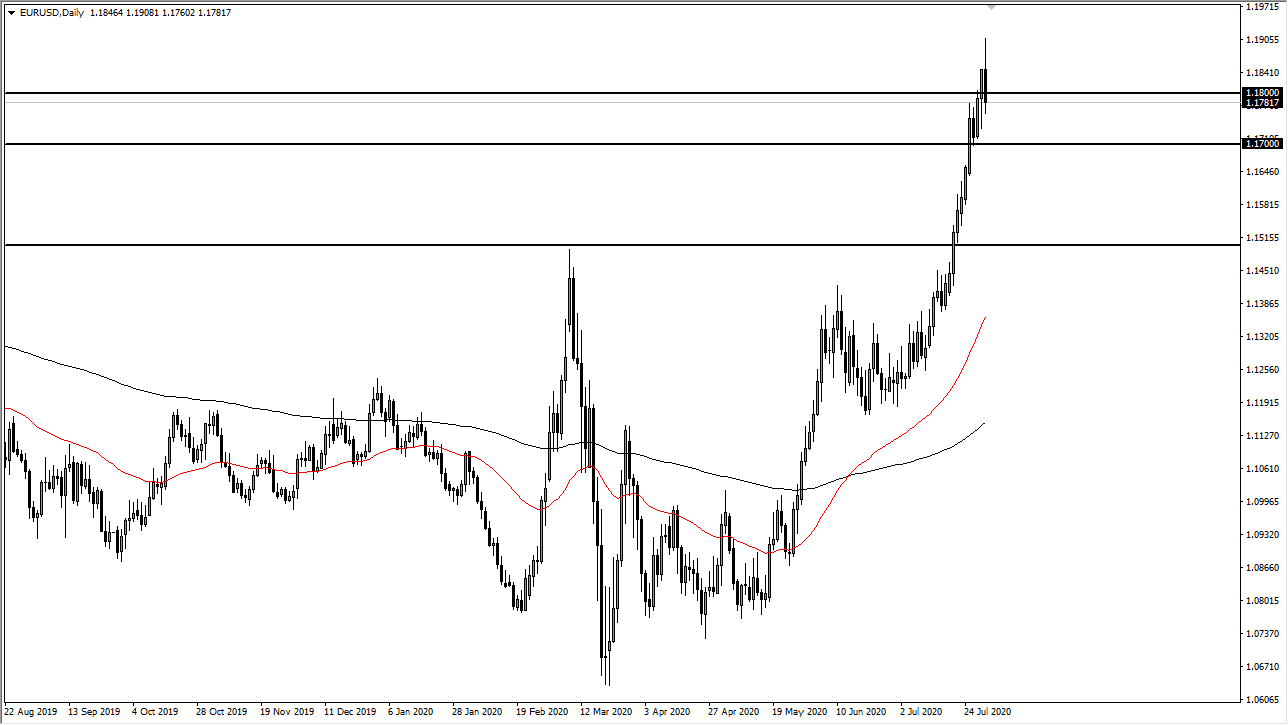

The Euro rallied a bit to kick off the trading session on Friday but gave back the gains again as the 1.19 level had been a bit too much. At this point, it is likely that we will try to go looking towards the 1.17 level, an area of interest that we have seen a bit of support previously. If we were to break down below the 1.17 handle, then it is likely that the market could open up for an even bigger move. Regardless, this market has gotten a bit over bought, so this pullback should be natural. The Federal Reserve working against the value of the US dollar will continue to propel this market higher given enough time, so buying dips will be the best way to deal with it.

When you look at the weekly chart, the 1.18 level was crucial, and therefore it is not a big surprise to see this market pullback from there. Nonetheless, the biggest problem here is simply that we have gotten overextended. Markets cannot go in one direction forever, so it is not a huge surprise this is happened. I am looking for some type of value that will present itself, perhaps in the form of a pullback for a couple of handles.

The 1.15 level underneath is the “floor” in the market, so I would be particularly surprised if we break down below there. I think that there will be plenty of buyers in that general vicinity cell that is what I am hoping to see. If we break above the top of the candlestick for the trading session on Friday, then it would be a bit of a “blow off top”, and as a result I would be very cautious at that point because the taller this tower of bullish pressure gets, the more unstable it becomes. Nonetheless, this has been a massive change into an uptrend and therefore selling is not even a thought at this point in time. I think that the most likely of trading plans to be chosen to be bullish is to wait for value and then take advantage of it. Rushing into this trade is probably not going to pay off. In fact, by the end of the day Friday there were already a lot of people in trouble that bought near the 1.19 handle.