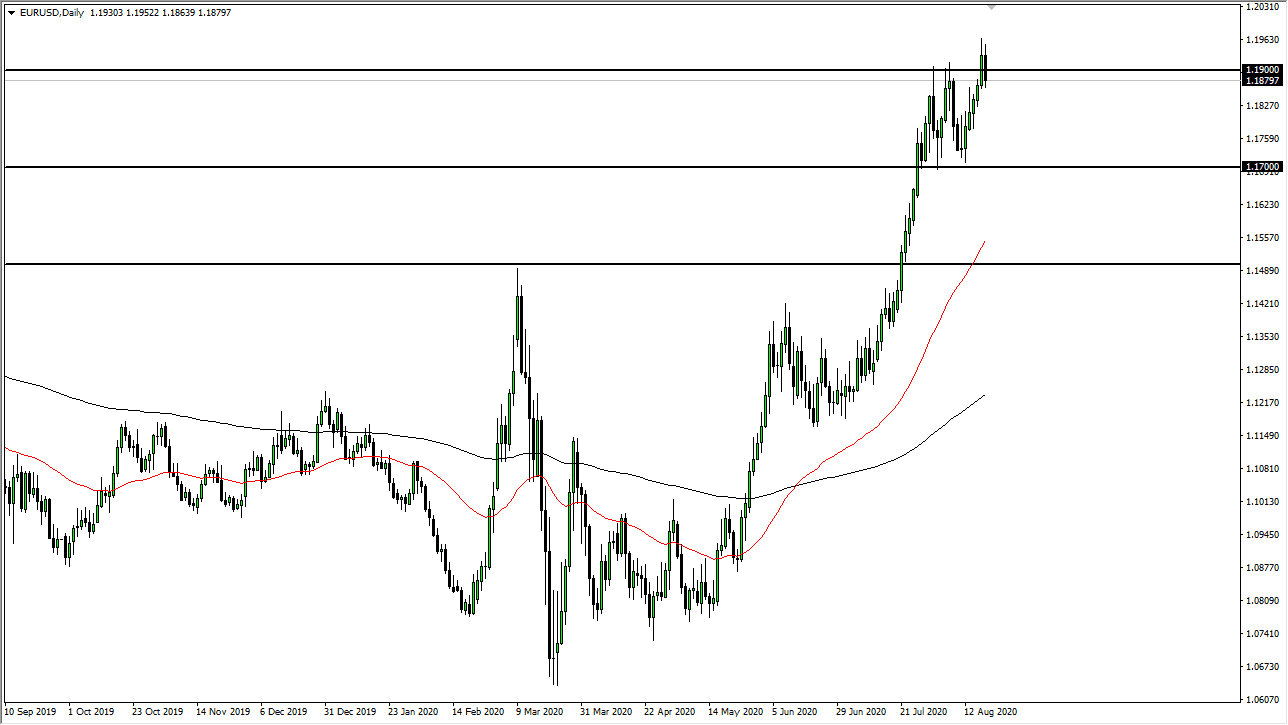

The Euro initially tried to shoot higher during the trading session on Wednesday but has pulled back a bit to show signs of exhaustion above the 1.19 level. By doing so, this shows that perhaps the US dollar is getting a bit oversold and we may have more of a fight on our hands than the massive breakout that occurred on Tuesday leads people to believe. This will set up for very interesting sessions coming up on Thursday and Friday because we could be looking at the beginning of a shooting star and weekly timeframe, but I digress for now.

I still believe that the Euro is more than likely going to go higher over the longer term. This is because of the Federal Reserve flooding the markets with extreme amounts of liquidity. By force-feeding markets, it devalues the dollar, and therefore it makes sense that we would see a rise in the Euro. When you look at the last couple of months, we have gone straight up in the air with only a couple of minor pauses. In other words, we may need to take a bit of a breather. It will be interesting to see how the market behaves but clearly, we have seen a massive shift in momentum towards the Euro. I believe at this point the fact that we are in the midst of vacation season also comes into play, as trading may become a bit choppier.

To the downside, I believe that the 1.17 level will be massive support, so I would not anticipate that we break down below there in the near term. If we were to do so, then the next support level is to be found near the 1.15 handle. Either way, this is a market that I am not looking to short, at least not until something changes from a fundamental standpoint. We are a bit stretched, so it does make quite a bit of sense that we are seeing a little bit of exhaustion. Nonetheless, this is a market that should remain bullish longer-term, but we cannot go straight up in the air forever. Waiting for value is the best way to trade this market from what I see, and even though we have formed a rather ugly candlestick for the trading session on Wednesday, it is the first negative candlestick in six sessions.