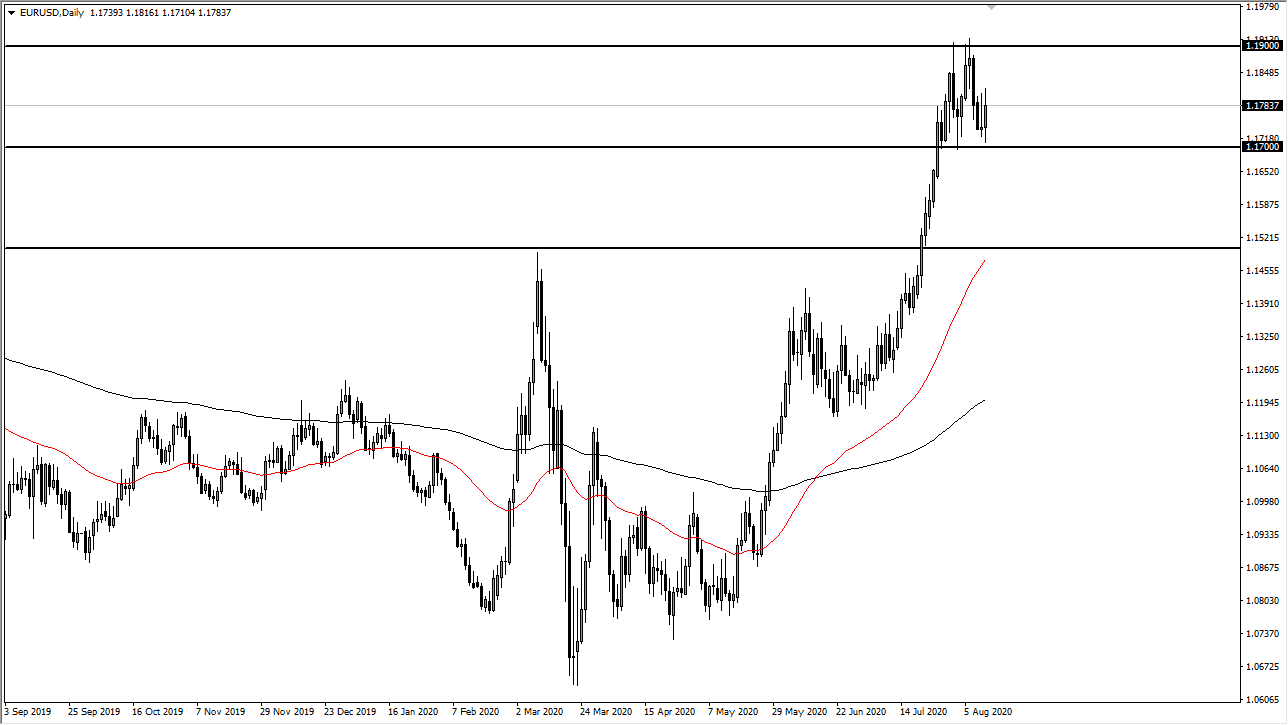

The Euro rallied again during the trading session on Wednesday, as we have tested the top of the inverted hammer from the trading session on Tuesday. The 1.17 level has offered significant support and I think at this point in time it is only a matter of time before the market reaches higher, perhaps reaching towards the 1.19 level above. This is a market that is benefiting from the Federal Reserve trying to kill the greenback, as they flood the market with US dollars. As long as they do that, then the Euro will be a benefactor by default, as it is the largest market traded in the world.

If the market was to break down below the 1.17 level, then the Euro should go down towards the 1.15 level underneath, where I would see even more buyers. The 50 day EMA sits just below there, so that is another technical reason to think that the market would rally. Looking at this chart, we have seen a couple of impulsive waves to the upside, and therefore I think the trend is certainly fixed, but that does not mean we go straight up in the air immediately. Pullbacks should be thought of as buying opportunities and we need to look at it as such.

To the upside, I think if we can break above the 1.19 level, and I do think we will eventually, the market then goes looking towards 1.20 level which is psychologically significant and will attract a lot of headlines. After that, the Euro is likely to go looking towards the 1.25 level which I think is the longer-term target. Quite frankly, there seems to be more growth in the European Union and the recent coronavirus numbers will continue to favor the Euro in general.

I do not have any interest in shorting this market, at least not until the Federal Reserve changes its attitude, something that I do not see happening anytime soon. With that being the case, it makes sense that the Euro rallies, as well as other currencies against the greenback. That does not mean that we get there overnight, but I do think that we continue to go higher over the longer term. Look for value, and then take advantage of it on short-term charts. The currency markets might be a bit slow though, due to the fact that the summertime tends to be quiet overall.