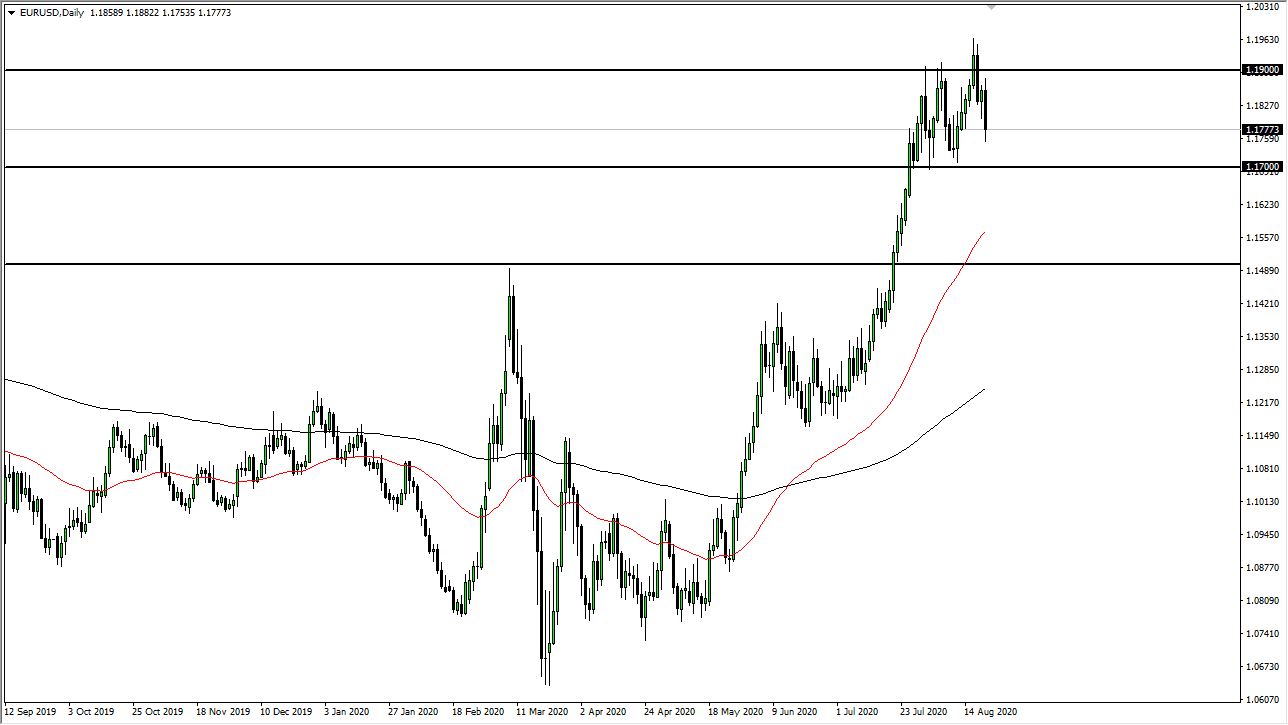

The Euro has fallen hard on Friday but remains within the consolidation area that we have been in for some time. The 1.17 level continues to be an area that people will be paying quite a bit of attention to, as it is an area that has seen a lot of buyers jump into the market. We have recently seen a massive move higher, and the fact that we have had a pullback to that area a couple of times previously suggests that there is institutional interest.

If we do break down below the 1.17 level it is likely that we will go down towards the 1.15 level, an area that was resistant previously and will almost certainly be an area that a lot of people will be interested in due to “market memory.” The 50 day EMA sits just above there and will cause a certain amount of attention to be paid to as well. Longer-term, I do believe that this is a “buy on the dips” type of market as we continue to see upward momentum.

It is not until we break down below the 1.15 level that I would be concerned about the uptrend, and it should be noted that the US Dollar Index is also testing a major uptrend line, so it is not a huge surprise to see that we may pull back here in the short term. However, I do think that if we break above the 1.20 level this market is going to go screaming to the upside as it would signify a major turn of events.

Part of the big problem that we have with the market during the day on Friday was that the German PMI numbers came out lower than anticipated, showing that perhaps Europe is struggling a bit more. Beyond that, we also have to worry about the coronavirus numbers in the European Union picking up again, so this may be more of the trading by virus figures market that we have seen in the past. In general, I like the idea of picking up value as it occurs, and we should also keep in mind that Friday a lot of profit-takings happens as well. Regardless, this will be one of the more important currency pairs to watch next week. I do anticipate that the 1.17 level will create some type of reaction.