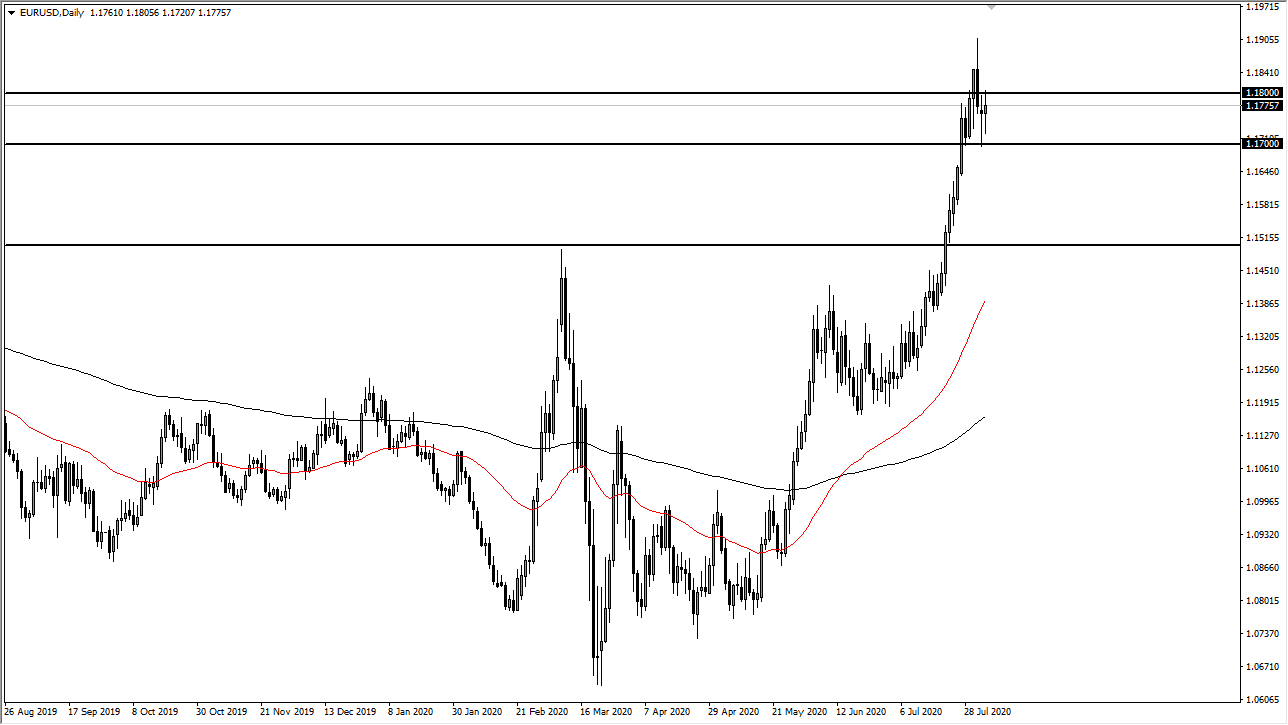

The Euro initially tried to rally during the trading session on Tuesday but found the 1.19 level to be a bit too much to overcome. The fact that we have pulled back from there and then reached towards 1.17 level only to turn around and bounce again suggests that there are plenty of buyers. The candlestick for the trading session is a hammer, just as the previous one was, and that tells me that we are more likely than not to see sideways action due to the shooting star from the previous week. This is a market that I think continues to digest gains, perhaps as we did the last time when we had a parabolic move in the Euro. Ultimately, this is a market that I think is simply looking for a reason to go higher, as the Federal Reserve will continue to loosen monetary policy.

Going forward, I believe that the market will eventually go looking towards 1.20 level, perhaps even the 1.25 level after that. It might take some time to get there, but obviously we are likely to see buyers on dips between now and then. Ultimately, this is a market that will be difficult to short, and if we break down below the 1.17 level, I will be more than willing to buy the Euro closer to the 1.15 level. That is the scene of a previous resistance barrier, and it should now be supported.

This is obviously a major shift in the attitude of the Euro against the US dollar, and now we are more than likely seeing a major trend change for the longer term. We are very early in the trend change, so I suspect that we may see an opportunity to get involved multiple times on dips. I simply have no interest in shorting the Euro unless we get well below the 1.15 level which would obviously be a major shift in attitude. All things being equal, it is likely that the market continues to grind much higher, and probably over the next several months if not years. The Federal Reserve looks like it is light years away from trying to change it soon, and as long as that is the case there is no reason to think that the US dollar will strengthen suddenly.