EUR/USD: The future of the 1.2000 top

Today's EUR/USD Signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas:

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1855 or 1.1960.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1760 or 1.1690.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

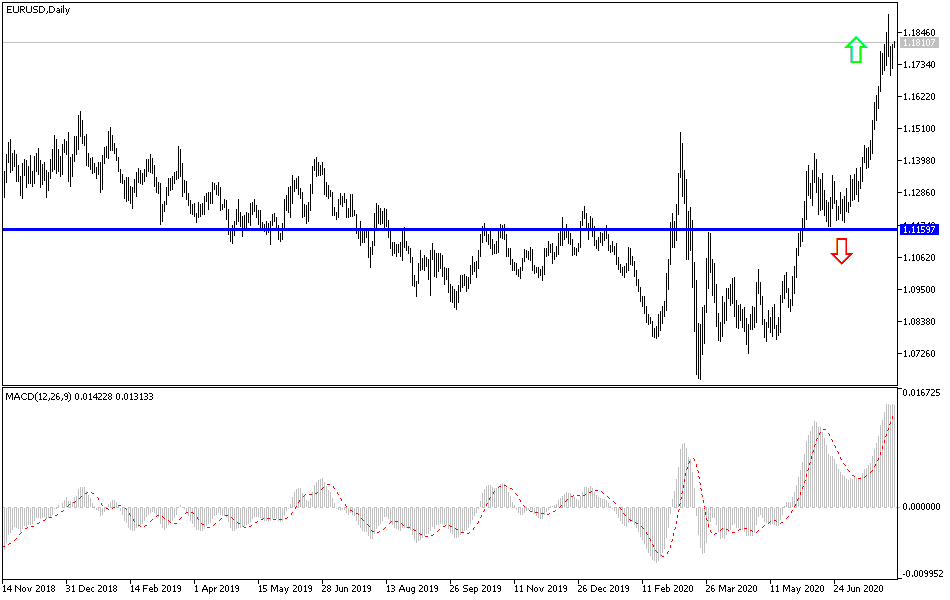

EUR/USD Analysis

Yesterday, I mentioned that the EUR/USD strength is still standing and that Forex traders are waiting for any downward correction opportunity to start new buying positions. The pair is stabilizing around the 1.1800 resistance, with the support of investors abandoning the dollar, amid new failures in negotiations to endorse more economic stimulus plans for the United States. On the other hand, the bloc's economic releases confirm the speed of the economic recovery, unless new closures to contain the second wave of the Covid-19 epidemic.

Today ends the three-month period given by the German Constitutional Court to the European Central Bank to prove "proportionality" to its actions or the German Bundesbank can no longer participate in asset purchases under the public sector purchase program. Both the European Central Bank and the German Bundesbank have indicated that if the proportionality is established, the German central bank will continue to participate in the purchase of bonds. While the details are covered, the broader issue raised by the German court ruling is that the National Court can review the decisions of the European Court of Justice. So it is likely that this risk will not be imminent, as the prevailing feeling was the “unity” demonstrated by the European Union’s unanimous decision on the recovery fund and the issuance of joint bonds.

Some observers suggest that if Democrats seize the White House, the United States will improve its strained relations with Europe. However, the opinion released by the commercial representative of the previous Clinton administration, Barshefsky, warned that it might not be so easy. She objected to what she called "technical nationalism". She warned that if Europe continues on the current path, which includes digital tax, compliance with the application of artificial intelligence, and European cloud infrastructure, the United States will have no choice but to treat Europe as a “strategic threat” and efforts to reach a trade deal will be drowned.

I recommend buying EUR/USD from the support levels at 1.1760 and 1.1680 respectively.

For the euro, the PMI reading for the European economies’ services sector will be announced, and then the retail sales figure for the block will be released. For the US dollar, ISM services PMI, ADP survey numbers for nonfarm sector jobs and trade balance will be announced.