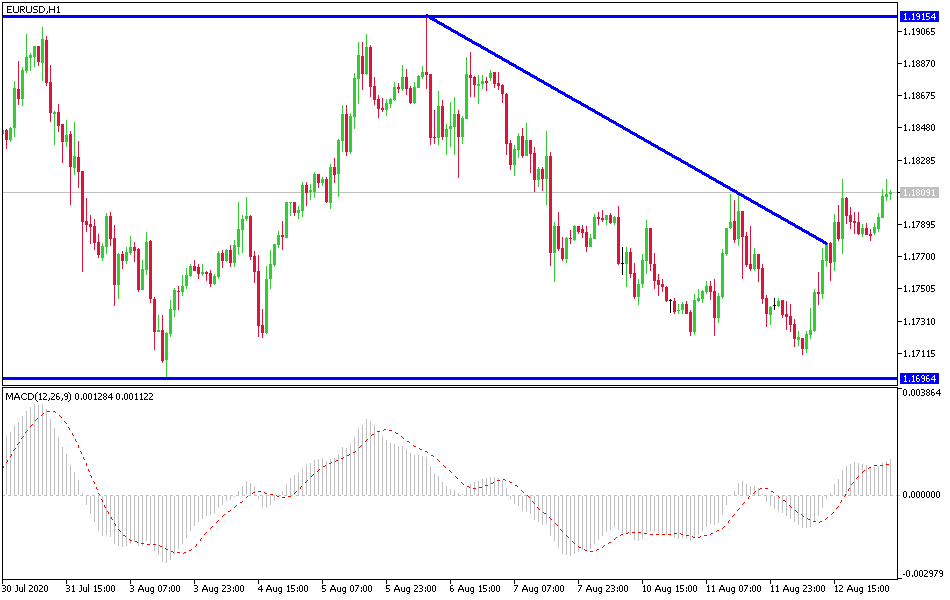

EUR/USD: The chance for the 1.1900.

Today's EUR/USD Signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1765 or 1.1680.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1810 or 1.1900.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The EUR/USD has not taken much notice of the recent US currency gains and as I mentioned yesterday that the bullish opportunity still exists and that it may return to rise again, which happened during yesterday's trading session. when the pair retreated to the 1.1710 support, and soon it rose strongly to the 1.1812 resistance at the time of writing. The single European currency got strong momentum from the approval of the European leaders on the stimulus plans and then the positive results of economic data, which confirmed that the Eurozone has the opportunity for a rapid recovery that might be V-Shaped, unlike the rest of other global economies.

Two issues are on their way to a climax this week, as differences between the United States and Europe have increased, and that divergence may continue on the other side of the US election. First, there is an opportunity to review the tariffs accepted by the WTO for illegal subsidies granted to Airbus. Some reports indicate that the new definitions are under study. Incidentally, the UK may not be in the European Union and may seek a free trade agreement with the US, but it will not protect it on these matters. Second, the United States is pressing the UN Security Council to make the ban on arms sales to Iran permanent.

Europe has failed to achieve a satisfactory solution after the United States withdrew from the nuclear treaty, and Europe has deviated from the US decision to unilaterally withdraw from the deal and does not want to accept the status quo now. Russia and China threaten to veto if it gets a vote, which in itself requires a 2/3 majority.

Data from Eurostat showed that industrial production for the Eurozone grew for the second month in a row in June, after a noticeable easing of measures to contain the Coronavirus. Therefore, the industrial output of the bloc grew by 9.1 percent on a monthly basis, slower than the 12.3 percent increase in May, and the 10 percent rise that economists had expected. On an annual basis, the decline in industrial output slowed to 12.3 percent from 20.4 percent in the previous month. Economists expected an annual decline of 11.5 percent.

Among the major industrial clusters, production of durable consumer goods increased by 20.2 percent and production of capital goods by 14.2 percent. The output of intermediate goods increased by 6.7%, and non-durable consumer goods by 4.8%. Power output grew by only 2.6 percent.

The data showed that industrial production in the 27-nation European Union rose by 9.1 percent on a monthly basis and decreased by 11.6 percent over the same period last year.

I recommend buying the EUR/USD pair from 1.1765 and 1.1675 levels, respectively.

For the Euro, German CPI data will be announced. For the US dollar, weekly unemployed claims will be announced.