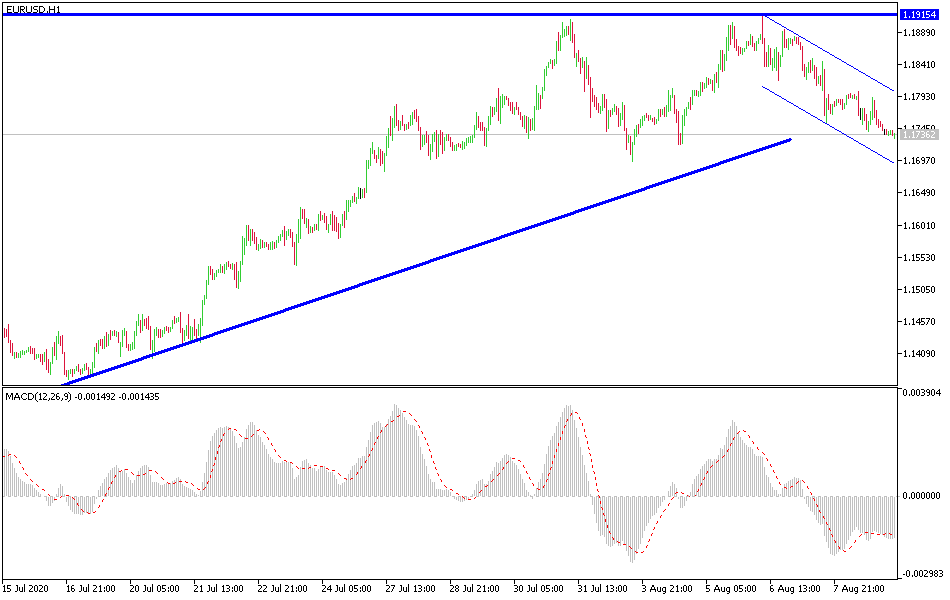

EUR/USD: 1.1680 support threatens the bullish potential.

Today's EUR/USD Signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1780 or 1.1845.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1680 or 1.1590.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The EUR/USD pair started the week’s trading in the range of last Friday’s correction and continued to decline to the 1.1735 support. As I mentioned yesterday, the pair has not yet exited the range of its ascending channel, and the strongest threat to the trend will be the pair moving below the 1.1680 support. Investors' attention may turn to monitor the spread of the COVID-19 in the United States and the Eurozone alike. Although the United States leads global figures, European countries are not far away, albeit at a lower rate than the United States. Italy has requested 28 billion Euros in unemployment aid from the European Commission. Rome has pushed ahead with new tax breaks and wants to cut taxes, including personal taxes, next year. Its financing costs may encourage a rare bond sale in August. It seems that Prime Minister Conte is trying to take advantage of the crisis to revitalize and stimulate the Italian economy, however, his country so far appears to be relying on fiscal stimulus rather than reforms.

Euro losses may be noteworthy in the recovery of the Turkish lira due to the recently improved correlation between the US dollar/Turkish lira and the Euro/Turkish lira, indicating declines in the EUR/USD that would make the single European currency appear as a safe haven instead of a risky currency as is the case recently. The losses in the Turkish lira will cause waves in the performance of the EUR/USD, other major exchange rates and the dollar index, just as investors are also reacting to the increasing tensions between the United States and China after the White House confirmed the ban on some Chinese technology companies last Friday, this helps exacerbate risk appetite.

China’s threat have been met with retaliation by the US Treasury Department’s sanctions on 12 Chinese officials, reportedly including Hong Kong Chief Executive Carrie Lam, steps that may require retaliation in the coming days. Accordingly, it is expected that the result of the six-month review of the Phase 1 trade agreement signed between the two largest economies in the world in January 2020, with the risk that the United States decides to terminate the agreement and re-impose customs duties. These events have a strong reaction to the currency trading market in general.

New tariffs and more tensions will increase pressure on the beleaguered global economy and may keep risky assets in decline as the dollar shines back, although economic data from the United States and daily Coronavirus statistics from European capitals will also help shape market sentiment.

I recommend buying the EUR/USD from the 1.1690 and 1.1600 areas, respectively.

For the euro, ZEW Market Sentiment Index for the German Economy will be announced. For the US dollar PPI will be announced.