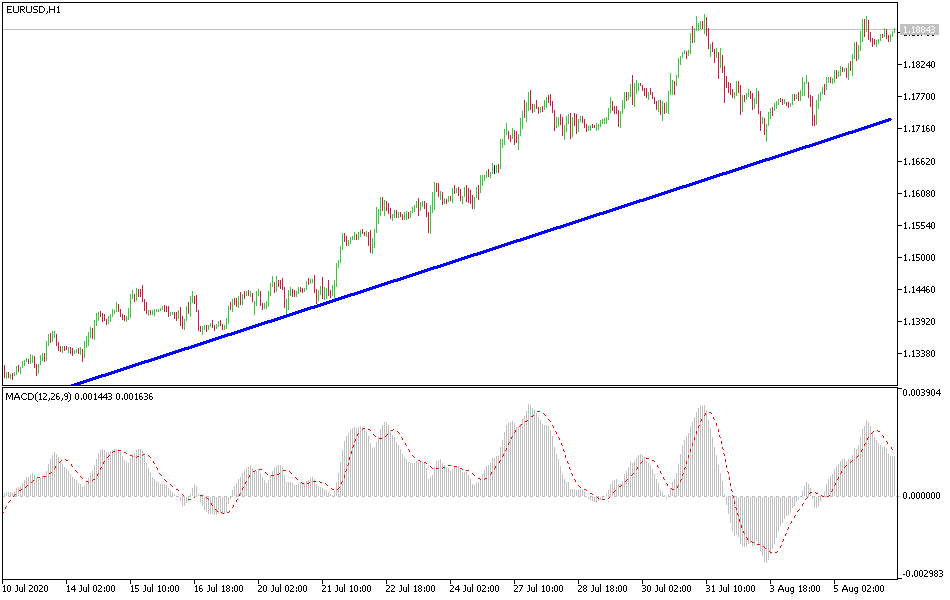

EUR/USD: Where to find the buying opportunity?

Today's EUR/USD signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas:

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.935 or 1.2020.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1790 or 1.1700.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

The EUR continued yesterday's gains, reaching almost $1.1904. Last week's high was around $1.1910. As I mentioned before, the general trend of the EUR/USD remains bullish, so optimism about the economic recovery of the Eurozone may be faster than the pace of the economic recovery in the United States after the global economy collapsed to its lowest level since World War II and the main reason for this is the COVID-19 virus. The direction of technical indicators is still upward.

The main economic news from Europe is the downward revisions to the services and composite PMI’s from Germany and France which were partially snapped at the macro level due to stronger readings in Italy and Spain. The German services PMI reading was revised to 55.6 from 56.7, while the French reading was revised to 57.3 from 57.6. These revisions from the initial estimates saw the composite index - which includes the manufacturing and service sectors together - change to 55.3 (from 55.5) and 57.3 (from 57.6) for Germany and France, respectively.

In July, the Italian Services PMI rose to 51.6 from 46.4, and Spain to 51.9 from 50.2. The Italian reading of the composite index improved to 52.5 from 47.6. Spain rose to 52.8 from 49.7. All of this translates to the EMU Services PMI slightly softer than 54.7 instead of 55.1 from the initial estimate. However, the composite index was revised to a reading of 54.9 from 54.8. The European Monetary Union composite PMI was at a reading of 48.5 in June. Separately, the Eurozone reported that retail sales for June rose 5.7% instead of economists' expectations of 6.1%.

Data from Eurostat showed Eurozone retail sales increasing at a moderate pace in June after a sharp rebound in May. Accordingly, retail sales increased by 5.7% on a monthly basis, after an increase of 20.3% in May. Economists had expected a 5.9 percent increase for the month of June. Sales of food, beverages, and tobacco decreased 2.7 percent, while sales of non-food products rose 12.1 percent in June. Auto fuel sales in specialty stores grew 20.4 percent in June. On an annual basis, retail sales rose unexpectedly by 1.3 percent, in contrast to a decrease of -3.1 percent in May. Sales were expected to drop 0.5 percent. In the European Union, the volume of retail sales grew by 5.2 percent per month in June, bringing the annual growth to 1.3 percent.

I recommend buying EUR/USD from 1.1815 and 1.1765 areas respectively.

Regarding the Euro, German factory orders data will be announced. Regarding the US dollar, weekly unemployed claims will be announced.