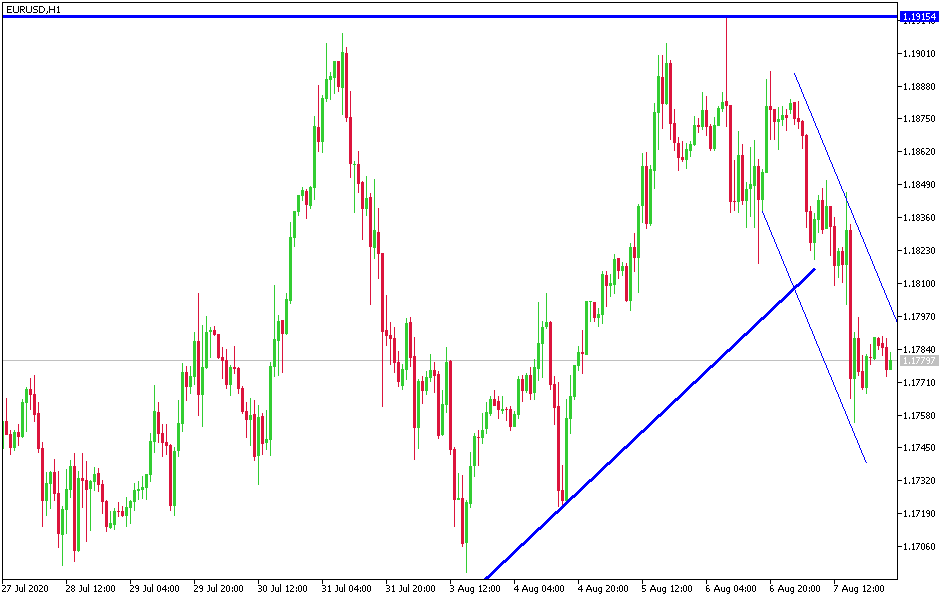

EUR/USD: Correction depends on 1.1630 support.

Today's EUR/USD signal

- Risked 0.75%

- Trades may only be taken today between 08:00 and 17:00 London time.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1720 or 1.1680.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1610 or 1.1575.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

As I mentioned earlier in the recent EUR/USD technical analysis that the price has reached overbought areas and is waiting for a downward correction at any time. This is what happened during last Friday's trading session, as the pair collapsed to the 1.1755 support after gains that pushed it towards the 1.1916 resistance, the highest level for the pair in 26 months. The positive numbers of the US employment report were an important factor in this correction. Since the US currency has been lacking for weeks of incentives to compensate its sharp losses amidst a new and powerful outbreak of the COVID-19 pandemic.

The rift between the US and China has expanded far beyond banning the Tiktok app to WeChat, as sanctions have expanded by tighter disclosure rules for Chinese companies listed in the US. In addition, negotiations between the White House and the Democrats collapsed, preventing or at least delaying the anticipated additional stimulus. The US has re-imposed a 10% tariff on untreated aluminum from Canada, and in return, Ottawa threatened retaliation. Despite this, the United States did not conclude an extradition treaty with Hong Kong as did Germany, the United Kingdom, Australia, and New Zealand.

Recent Euro gains came in support of expectations that the Eurozone recovery from Coronavirus is stronger than the recovery of the US economy, especially after the announcement of industrial production numbers for June. The beginning was from Italy, where industrial production increased stronger than expected, at an 8.2% increase after a 41.6% increase in May. Germany, France, and Spain followed suit, with better-than-expected production numbers. France posted an increase of 12.2% after recovering nearly 20% in May. Industrial production in Spain rose by 14% in June, roughly equivalent to the increase in May. Germany recorded stronger than expected factory orders and an acceleration in industrial production in June (8.9% versus 7.8% in May).

Germany also reported trade numbers that also indicated a broader recovery. Exports rose 15% in June, above market expectations and above the previous month's gains of 8.9%. The pace of imports almost doubled to 7% in June from 3.6% but was below expectations. The net result is to double the monthly trade surplus to 15.6 billion Euros from 7.0 billion Euros in May.

And along with the strength of US jobs, the new record outbreak of the COVID-19 virus within European countries was a factor influencing the recent Euro gains.

I recommend buying the EUR/USD from the 1.1690 and 1.1600 areas, respectively.

For the euro, the Sentix Investor Confidence Index will be announced. For the US dollar JOLTS vacancies will be announced.