For the third day in a row, the price of the EUR/USD is trying to correct upwards. Gains, however, did not exceed the 1.1849 resistance after the profit-taking sales last week, which pushed the pair towards the 1.1754 support, and the pair stabilizes around 1.1835 at the time of writing amid the mixed US economic data as was also evident in the readings of consumer confidence and new home sales. The pair is in a cautious stability position until important statements are received from international central bank officials at an important event at Jackson Hole symposium under the leadership and sponsorship of the US Federal Reserve.

The Euro received some support from optimistic sentiment among investors, a positive review of German GDP data for the second quarter, and a further increase in the IFO business climate index. The single European currency was higher against most major currencies and its prices are still above 1.18 against the USD despite the fact that the rise in the EUR/USD pair weakened in the wake of the IFO survey results for August, which saw the Business Climate Index rise from 90.5 to 92.6, less than expectations of 92.5.

The IFO Institute confirmed that German companies rated their current business situation significantly more positively than last month, with more optimistic expectations for the future. Both manufacturing and service firms said that current conditions and their six-month outlook improved in August. “In general, this data really only confirms what we already know, which is that economic activity is now recovering after the crash during the lockdown to contain COVID-19,” said Claus Vistesen, chief economist for the Eurozone at Pantheon Macro Economics. “As with PMIs, the main test in the next few months will be whether it stabilizes at its current level after it has already recovered significantly. If that happens, that will indicate that the recovery is ongoing”.

The IFO survey indicates that the German industry in August was not affected by the second wave of Coronavirus infections that began appearing in Europe's largest economy, with more than 1,500 new cases recorded daily in the past week.

At the end of last week, IHS Markit PMI data told a different story regarding economic recovery in Germany and the Eurozone, with the German services sector recovery sharply fading while manufacturing and services in France and the wider Eurozone saw disappointing expectations in August. The IFO survey for August was tough on the heels of an upward revision of the German statistics agency Destati’s preliminary estimate of German GDP growth in the second quarter of 2020. Which confirmed that the German economy contracted by -9.7% in the second quarter, less than the initial contraction of -10.1% announced the past month.

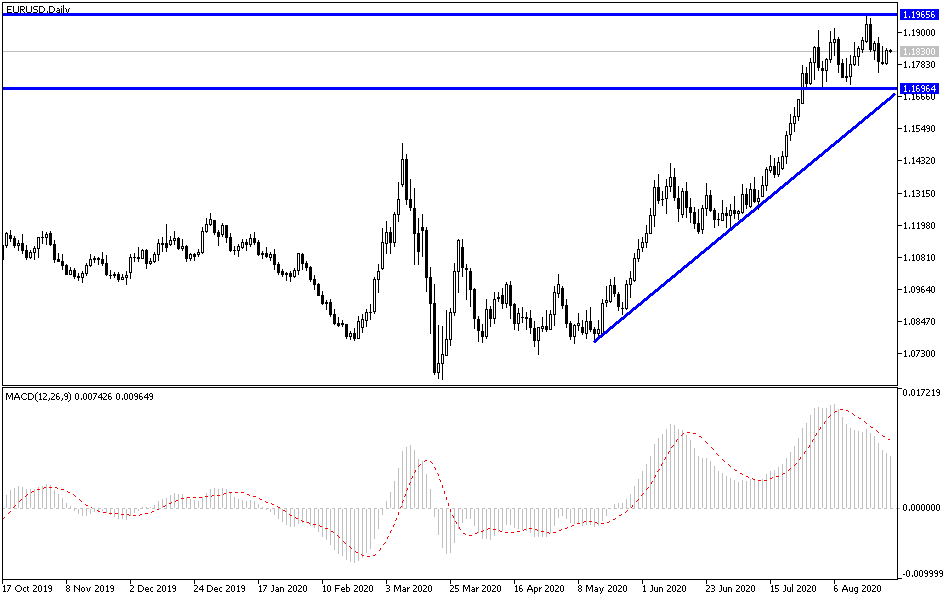

According to the technical analysis of the pair: No change to my technical view of the EUR/USD pair, as a return to breaching the 1.1900 resistance will increase the bulls' control to move the pair to the 1.2000 psychological resistance, which symbolizes the extent of the bulls control over performance and increasing the pair's gains. On the downside, bears will try to push the pair below the 1.1750 support, which confirms the strength of breaking the general trend, as is the performance on the daily chart. The divergence in the economic performance between the Eurozone and US economies in recovering from the pandemic and updating the Federal Reserve’s policy will be important factors affecting the pair in the coming days.

Regarding today's economic calendar data: There are no important European data today. And all focus well be on US durable goods order numbers.