For the second day in a row, the EUR/USD price is moving in the downward correction amid profit-taking after an upward trend that pushed it towards the 1.1908 resistance, the highest level since May 2018. The latest move pushed it towards the 1.1695 support before settling around 1.1740 at the time of writing. This move was expected and markets were waiting for a correction opportunity. This was the strongest since the improvement in the economic data results for the Eurozone, as final data from IHS Markit showed that the manufacturing sector in the Eurozone returned to growth in July, and for the first time in a year and a half, as production and demand continued to recover with further easing of restrictions related to containing the outbreak of the COVID-19 pandemic.

According to the data results, the Manufacturing PMI increased to a reading of 51.8 in July from a reading of 47.4 in June. This was also above the expected reading of 51.1. Both production and new orders returned to growth in July. The marked growth in production was recorded for the first time since the beginning of 2019 and the growth in new orders was the strongest since early 2018.

However, companies continued to work below capacity and employment fell for the 15th consecutive month. On the price front, the survey showed that input prices remained within the deflationary region. Due to competitive pressures and weak demand, this led to a further reduction in production fees. Finally, looking ahead to the next 12 months, corporate confidence continued to recover in July, rising from June to its highest level since January.

Commenting on the results, Chris Williamson, chief economist at IHS Markit, said that the numbers for the next few months will all be important in assessing whether the recent rise in demand can continue, helping companies recover lost production and alleviating some of the need to further reduce costs in the future. At the country level, only Greece and the Netherlands recorded PMI readings below 50.0 as the majority returned to growth in July. Spain was the strongest performing country. France posted strong gains, while Germany and Italy registered moderate growth.

Where will the EUR/USD move in the future?

Ulrich Leuchtmann, head of Commerzbank foreign exchange and commodities research, said that the strength of the Euro appears to be justified, based on recent developments, which includes the perspective of the permanent market, that the federal monetary policy is very broad and the record low resulted in US revenues, besides the fact that the United States (unlike 2008) is worse in dealing with the crisis than Europe. On Thursday, the US president's proposal to postpone the elections, "appears to confirm the worst concerns about the future of American democracy." Based on all of the above, the movement of the EUR/USD towards the 1.2000 psychological resistance soon is justified.

In the same context, analysts at Nordic lender SEB say that conditions are available for the continued strength of the EUR/USD exchange, noting that some of the newer and longer-term factors for the strength of the US dollar are fading. As the dollar rose sharply in early 2020 as markets rush to liquidity, this was followed by the collapse of financial markets due to the outbreak of the COVID-19 pandemic. But “the defensive qualities of the US dollar and the global demand for liquidity in US dollars, which benefited from it at the height of the Covid19 crisis earlier this year, became negative for the US dollar as the global risk appetite recovered amid unprecedented political responses by global central banks and governments.”

But perhaps the most significant shift in demand and performance in US dollars depends on the Fed's policy and its impact on the return paid on US government debt.

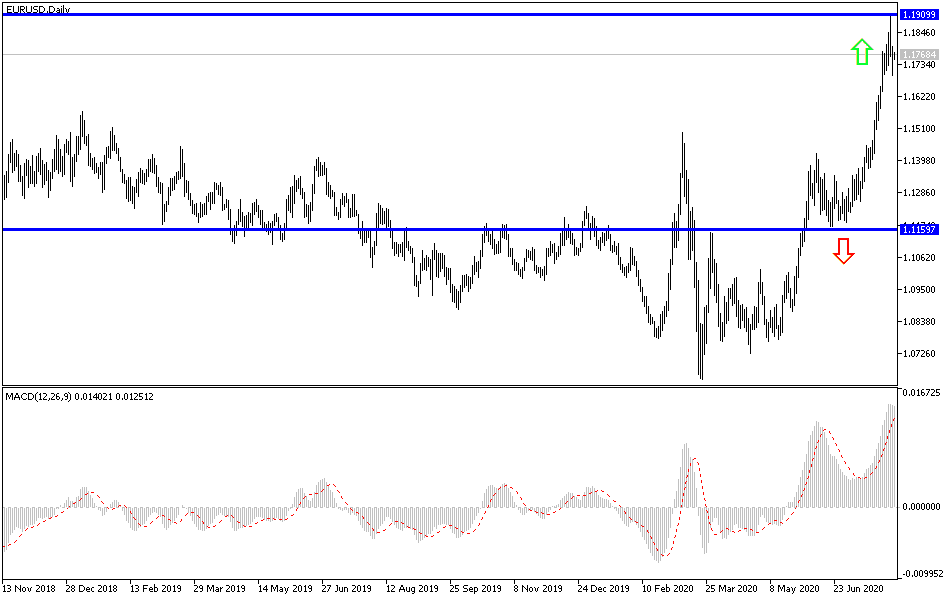

According to the technical analysis: According to the recent performance of the EUR/USD, the profit-taking operations may be opportunities to return to buy the pair, and the closest support levels for that are 1.1675, 1.1600, and 1.1520, respectively. On the other hand, returning to the 1.1860 resistance will pave the way for the bulls to test the 1.2000 psychological resistance soon.

As for the economic calendar data today: The focus will be on announcing the Eurozone Producer Price Index and the change in Spanish unemployment, as well as factory orders from the United States.