Throughout the July trading, the EUR/USD performance was in a permanent upward correction pushing it to the 1.1908 resistance, the highest level in months. In the last trading session of this month, the pair retreated in light of a downward correction performance in profit-taking sell-offs, and we have noted this before near the 1.1761 support. The pair closed the week’s trading near this support ahead of important trading this week, which includes the announcement of US job numbers. The pair retreated in last Friday's session, supported by the negative results of the economic data. The most prominent announcement was made by the European Statistics Agency, Eurostat, that the bloc’s economy shrank by -12.1% during the second quarter of 2020, which is greater than expected by -12%. The economic contraction in the last quarter was historic but much less than that in other parts of the world. When combined with the estimate of the first-quarter GDP that rose from -3.8% to -3.6%, the single currency bloc economy was better than many believed during the first half of the year.

Fiona Haines, an economist at Berenberg, said: “Both the highly important data and the traditional monthly survey data indicate that activity increased more during the first month of the third quarter. The European Commission's Economic Sentiment survey in July showed that production expectations among manufacturers turned positively for the first time since February. This bodes well, and with the help of the primary effect, the third quarter should show a strong rebound in GDP compared to the second quarter, which fell due to severe weakening in April. With optimism, the European economy may recover nearly half of its losses in the second quarter”.

Some analysts believe that the decline of the Euro may be temporary. On the same day, it was announced that the core inflation figures were higher than expected, with an increase from 0.8% to 1.2%, and expectations were for no change. The CPI also increased from 0.3% to 0.4%. The core inflation tends to attract more attention from the markets as it excludes energy and food prices as well as tobacco and alcohol, as these prices can be greatly affected by factors not related to domestic demand. Increasing inflation numbers can raise currencies when viewed as likely to facilitate a positive change in monetary policy, either by raising interest rates or bond yields, but in the world of the devastating COVID-19 interest rates for 2020, bond yields are unlikely to rise for a long period of time regardless of where the inflation is.

This is likely to make higher inflation a net negative for currencies and may explain the weakening of the Euro’s subsequent performance, partly because higher inflation also reduces the already low returns offered by bond yields crushed by central banks this year.

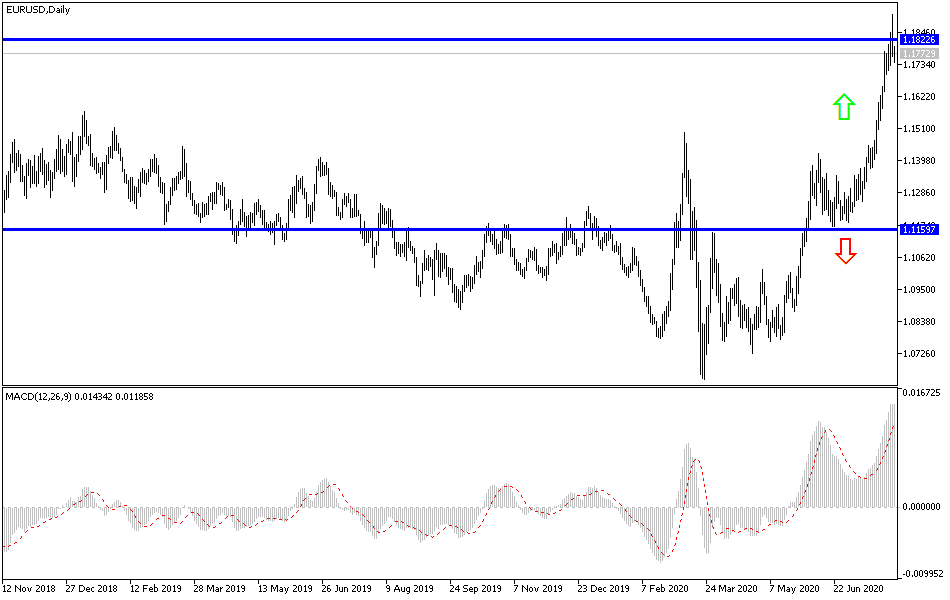

According to the technical analysis of the pair: On the daily EUR/USD chart, the bulls' control of the performance still exists despite last Friday’s performance, and we have noted many times that technical indicators reaching strong overbought areas and waiting for the profit-taking selling. The negative economic data results were an opportunity for investors to make this happen. There would be no real trend reversal without moving towards the 1.1480 support. On the other hand, the return of stability above the 1.1800 resistance will support the move towards the 1.2000 psychological level soon.

As for the economic calendar data today: The industrial PMI for the Eurozone economies will be announced. From the United States of America, the ISM Manufacturing PMI will be released.