For the second day in a row, the EUR/USD pair bounced back upwards after a failed attempt by the bears to reverse the uptrend. As the pair was pushed at the beginning of this week's trading towards the 1.1695 support, the pair stabilized upwards towards the 1.1904 resistance before settling around 1.1862 time of writing. The strong figures for the Eurozone retail sales in June confirm that the rebound in the bloc may be V-shaped, which is the pattern that has pushed investors to push the value of the Euro higher in recent weeks. Retail sales rose 5.7% on a monthly basis in June with annual numbers reading at 1.3% according to the Eurostat report, which is significantly higher than the previous month's figure of -3.1% and better than forecasts of -0.5%.

Commenting on optimism from the economic releases, Klaus Westen, chief economist for the Eurozone at Pantheon Macroeconomics, said: “A V-shaped recovery was seen in Eurozone data. This data has been very strong in the past few months. The rise in June kept retail sales 0.2% above the pre-crisis level at the end of the second quarter, which is impressive.

Looking at the breakdown of each country, the European statistics agency Eurostat data revealed strong gains in Spain and Italy, of + 16.5% and + 13.8% per month respectively, and a strong increase of 9.5% in France. Sales fell 1.6% in Germany. The sectorial collapse revealed that non-food sales in physical stores increased 12.1%, adding 38.7% in May, while online sales fell 6.8% during the month as consumers returned to the streets.

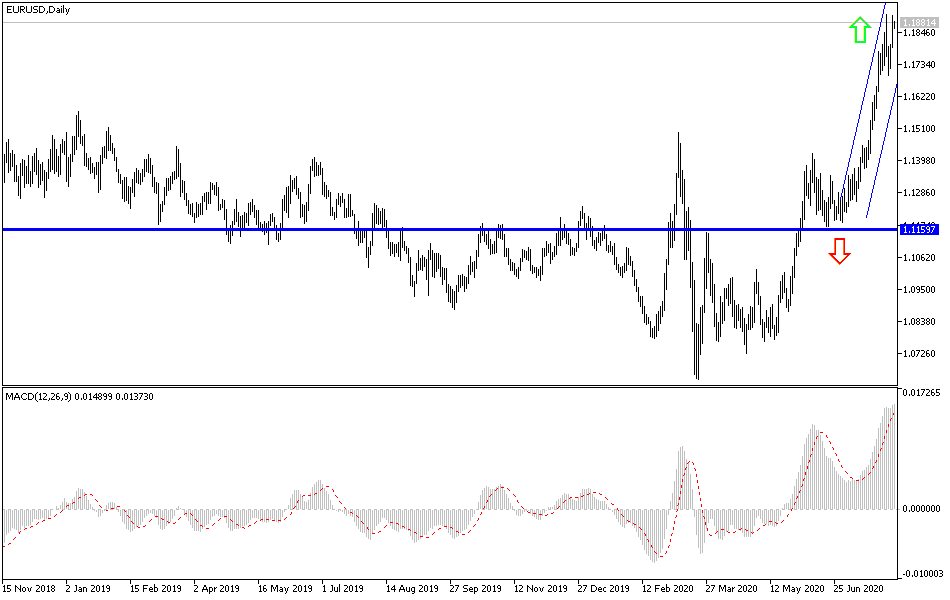

The Eurozone's relative economic performance against the United States is a major driver of the EUR's recent strong performance against the Dollar, as investors see the multi-year period of the US's outperformance likely to end due to the effects of COVID-19. In line with the rest of the expectations, the EUR/USD rose from a low of around 1.08 in March to a multi-year high of 1.19088 on July 31. Since then, the market has regained calmness towards the current levels at 1.18. The current question for forex traders is whether the EUR/USD reached the end of its rally, or is it a natural stabilization awaiting new stimulus?

A possible answer to this question will come from the data in the coming weeks as investors request for more strong showings from the Eurozone, while any significant rebounds in US data could undermine the superior performance of the Euro and help the US dollar recover, keeping in mind the announcement of Non-farm payrolls figures tomorrow, Friday.

According to the technical analysis of the pair: On the daily EUR/USD chart, the general trend is still upward, and as I mentioned before, stability above the 1.1800 resistance will motivate investors to move the pair to the 1.2000 psychological resistance as soon as possible, especially if the results of the US economic releases fall below expectations, specifically with regard to the US labor market. In return, there will be no real reversal of the current trend without breaching the 1.1600 support level. From the Eurozone, German Factory Orders will be announced. Then the U.S weekly jobless claims numbers.