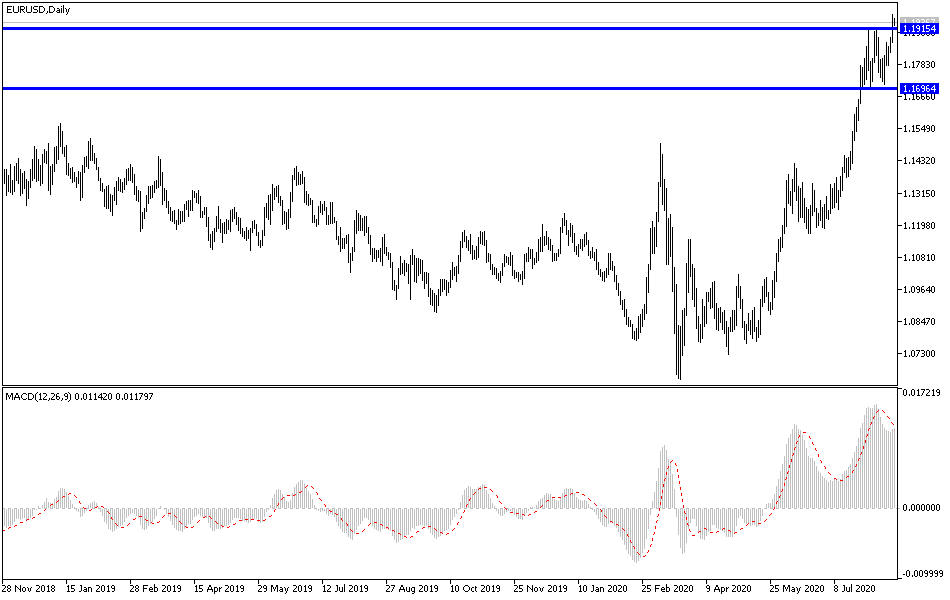

There is a new and exciting move by bulls towards the EUR/USD pair, as it rose towards the 1.1965 resistance, its highest level in two years, before settling around the 1.1930 at the time of writing. Ahead of the announcement of the Eurozone inflation figures and the contents of the US Federal Reserve last meeting’s minutes. The pair has gained nearly 7% since the beginning of 2020 and more than 11% since March 20, around the time of the implementation of lockdowns across the continent. The single European currency reached its highest level since May 2018 and was strengthened last month through the European Union agreement on 750 billion Euros (820 billion dollars) recovery fund for the Coronavirus through joint borrowing.

The strengthening of the Euro is a challenge to current monetary policies. It sustains inflation because the prices of imported goods are falling. But the European Central Bank has been striving for years to reach its annual target of “less than but close to 2%” (its only official mandate), and is trying, on the contrary, to increase inflation and growth. Inflation is now estimated to be 0.4% per year. Moreover, the appreciation of the currency makes European exports more expensive in foreign markets, which could weaken the recovery in the trade-oriented European economy. So far, recovery in most European countries has been dependent on domestic consumption; households will resume spending after three months of strict lockdown to contain the outbreak of the COVID-19. The strong Euro will start to harm European companies when the economy returns to normal and global trade revives.

Officially, the European Central Bank is not targeting the exchange rate, as its officials keep repeating it. But this does not mean that this is indifferent. The level of central bank discomfort tends to rise when the Euro rises above the $1.15 mark. What matters now is that a strong currency gives ammunition to the proponents of more monetary stimulus in the future, particularly in the form of buying more bonds - in addition to the € 1,350 billion already spent fighting the recession. The more monetary stimulus will make it cheaper for governments to finance their financial market deficits.

According to the technical analysis of the pair: The general trend of the EUR/USD currency pair is increasing momentum towards more gains, and recent gains may be capped with a test around and above the 1.2000 psychological resistance, which is a legitimate target for the bulls for complete control over performance. The US currency continues to bleed losses, however, it must be taken into account that technical indicators have begun to give overbought signals, and therefore currency traders may think to activate sell orders above the 1.2000 resistance to harvest the movements of profit-taking sell-offs. At the moment, the closest support levels for the pair are 1.1880, 1.1800 and 1.1745, and the last level is a clear threat to the current trend, and with it, the bears begin to control the performance.

As for today's economic calendar data: From the Eurozone, the Consumer Price Index and the Current Account will be announced. Then the most important item will be announced during the American session, with the release of the last Federal Reserve MoM.