For the third day in a row, the price of the EUR/USD is moving in a downward correctional range, which pushed it to the 1.1722 support at the time of writing, and ahead of the announcement of the ZEW reading for the German economic sentiment. This performance came with the support of profit-taking selling after the currency pair rose to its highest level in 27 months and after the announcement of better results than expected for US jobs at the end of last week. In addition, the number of new Coronavirus cases has increased in the Eurozone countries, which threatens the currently faltering economic activity there. As we mentioned before, the recent optimism, which was the cause of the Euro’s gains due to the approval of the economic recovery plans by the European Union, will not last long because the markets will focus on the results of economic releases from there, along with the interaction with the Coronavirus path.

Investor confidence in the Eurozone rose for the fourth month in a row during August to its highest level since February of this year, as the assessment of the current economic situation improved and the outlook remained positive, according to the survey data from Syntex. Accordingly, the investor confidence index increased to -13.4 from -18.2 in July. Economists expected a reading of -15.1. The current status index of the survey increased to -41.3 from -49.5 in the previous month. The most recent reading was the highest since March.

"After all, such a low level for the index means that the third quarter is still in a recession," Sentix said in a statement. "However, recovery is increasing.”

The sub-index of expectations eased slightly to 19.3 from 19.5 in July. "The outlook remains consistently positive, which means that the economic recovery must continue," Sentix said. The company said that it is striking in this context that the second wave of Corona cases does not leave a new reflection of fear in economic indicators. Investor sentiment improved for the fourth consecutive month in Germany. The benchmark index rose to -4.5 from -10.5, the highest since February. The current situation result was the highest since March.

Globally, the Asian region led the improvement in August as the general index for Asia excluding Japan rose above zero. The think-tank said the recovery in the United States and Latin America remains disappointing.

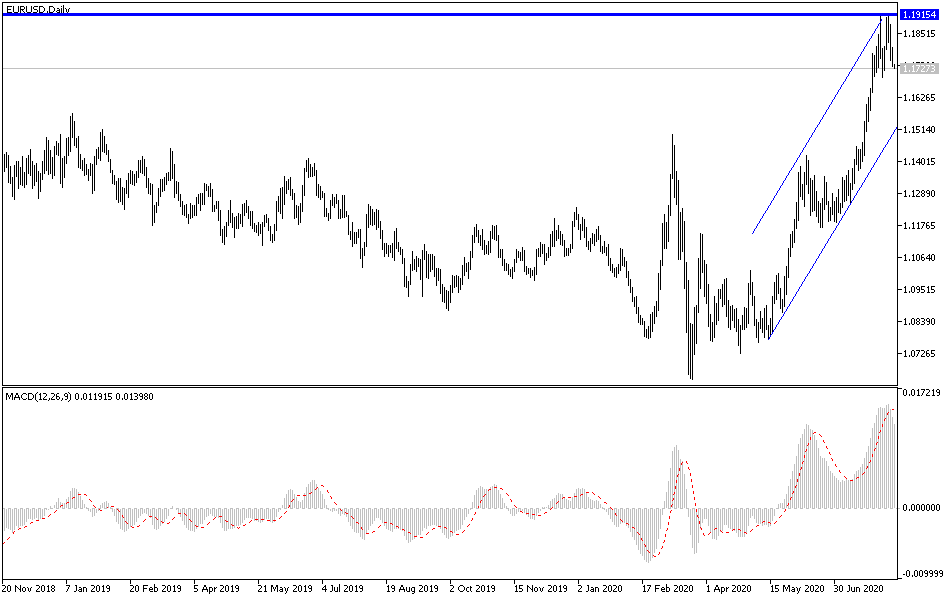

According to the technical analysis of the pair: Despite the recent EUR/USD performance, the general trend is still bullish, as is evident in the performance on the daily chart below. There will be no real reversal of the trend without pushing the pair towards the support levels at 1.1685 and 1.1590, respectively. As I mentioned before, I confirm now that the bulls' control over the performance will be strengthened in case the pair moves towards the resistance levels at 1.1800 and 1.1885, because that paves the way for testing the 1.2000 psychological resistance, which gives the bulls the move towards higher levels as is the path recently.

As for the economic calendar data today: From the Eurozone, the ZEW survey reading of the German economic sentiment, the largest in the bloc, will be announced. During the US session, the PPI reading will be announced.