Spain, Italy, Germany, France, and Sweden are the five most infected Covid-19 countries in the European Union. Aside from Sweden, they are also part of the Eurozone and are heavily dependent on manufacturing and exports, both under significant stress from the global pandemic. Eurostat, the official statistical office of the European Union, reported a record 12.1% GDP plunge in the second quarter for the Eurozone. Despite mounting challenges, the EUR/USD, inside of its resistance zone, surfaced as a prime benefactor of intensifying US Dollar weakness, plagued by excessive debt and a worsening economic outlook.

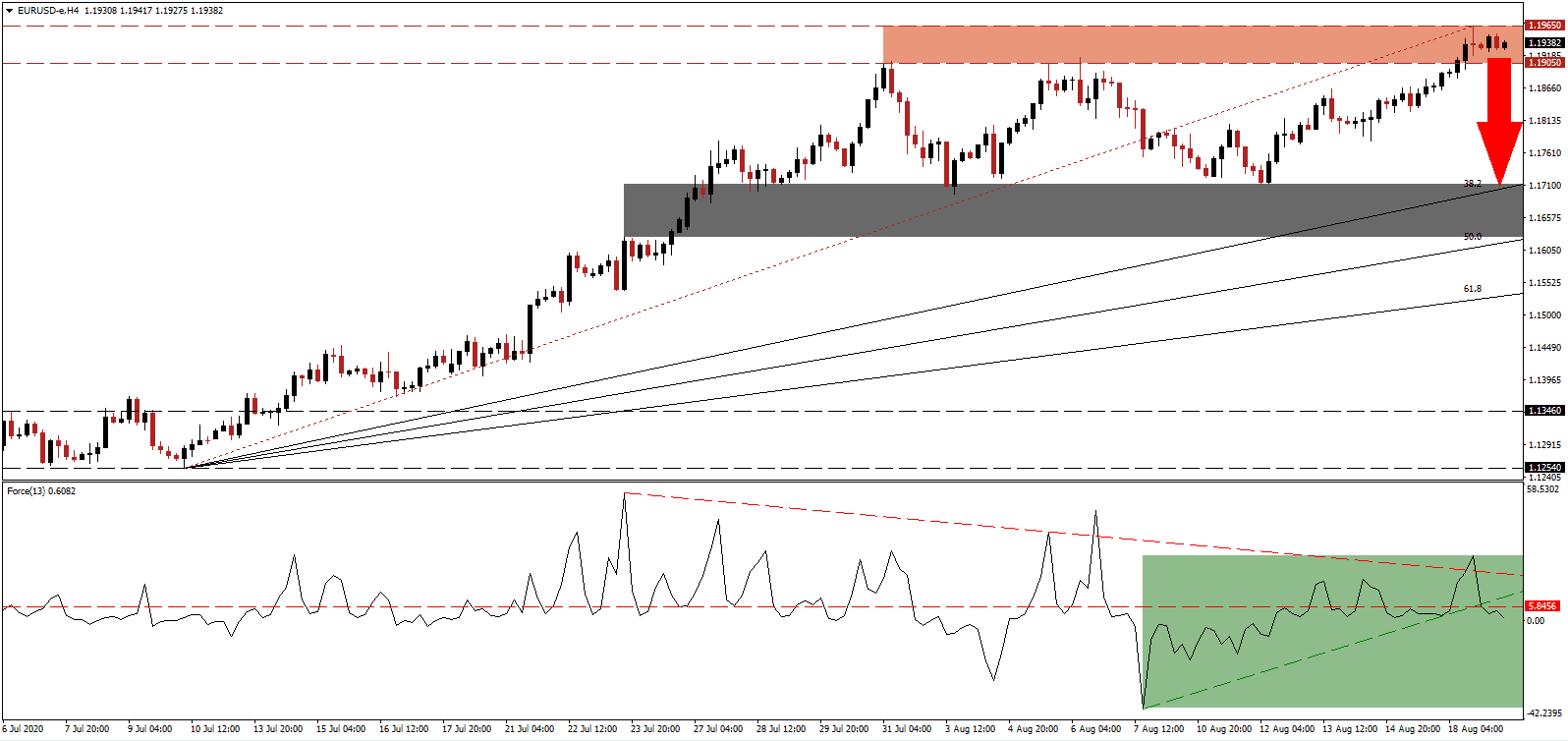

The Force Index, a next-generation technical indicator, briefly spiked above its descending resistance level before retreating below its horizontal resistance level, as marked by the green rectangle. It also moved below its ascending support level and is now on course to move below the 0 center-line. Bears wait for this technical indicator to correct into negative territory to resume full control over the EUR/USD.

Eurozone employment dropped by 2.8%, prompting Spain to formally request €20 billion in assistance form the new €100 billion assistance program by the EU labeled Support to mitigate Unemployment Risks in an Emergency (SURE). It supports public programs to compensate employees for lost income and reduced working hours. The EU Commission expects most members to apply for aid, but with Spain requesting 20% of the total, SURE is likely to require more funds. The EUR/USD faces a breakdown below its resistance zone located between 1.1905 and 1.1965, as marked by the red rectangle.

Labor unions were highlighted as a growing problem, nurturing the North-South divide persistent in the EU and between the core and periphery. Fears of a well-established EU-race-to-the-bottom pattern may prompt a temporary profit-taking sell-off in the EUR/USD, clearing the path for a renewed advance and likely breakout above the psychological 1.2000 resistance level. The downside remains confined to its upward revised short-term support zone located between 1.1626 and 1.1711, as identified by the grey rectangle. It is enforced by its ascending 50.0 Fibonacci Retracement Fan Support Level.

EUR/USD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.1935

Take Profit @ 1.1710

Stop Loss @ 1.2010

Downside Potential: 225 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 3.00

A sustained push in the Force Index above its descending resistance level will bypass a minor correction in the EUR/USD, and enforce the dominant long-term bullish chart pattern. Given the intensifying debt and deficit issues out of the US, while the EU prints monthly twin surpluses, Forex traders should consider any sell-off as an excellent buying opportunity. The next resistance awaits between 1.2154 and 1.2239.

EUR/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.2050

Take Profit @ 1.2240

Stop Loss @ 1.2010

Upside Potential: 190 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 4.75