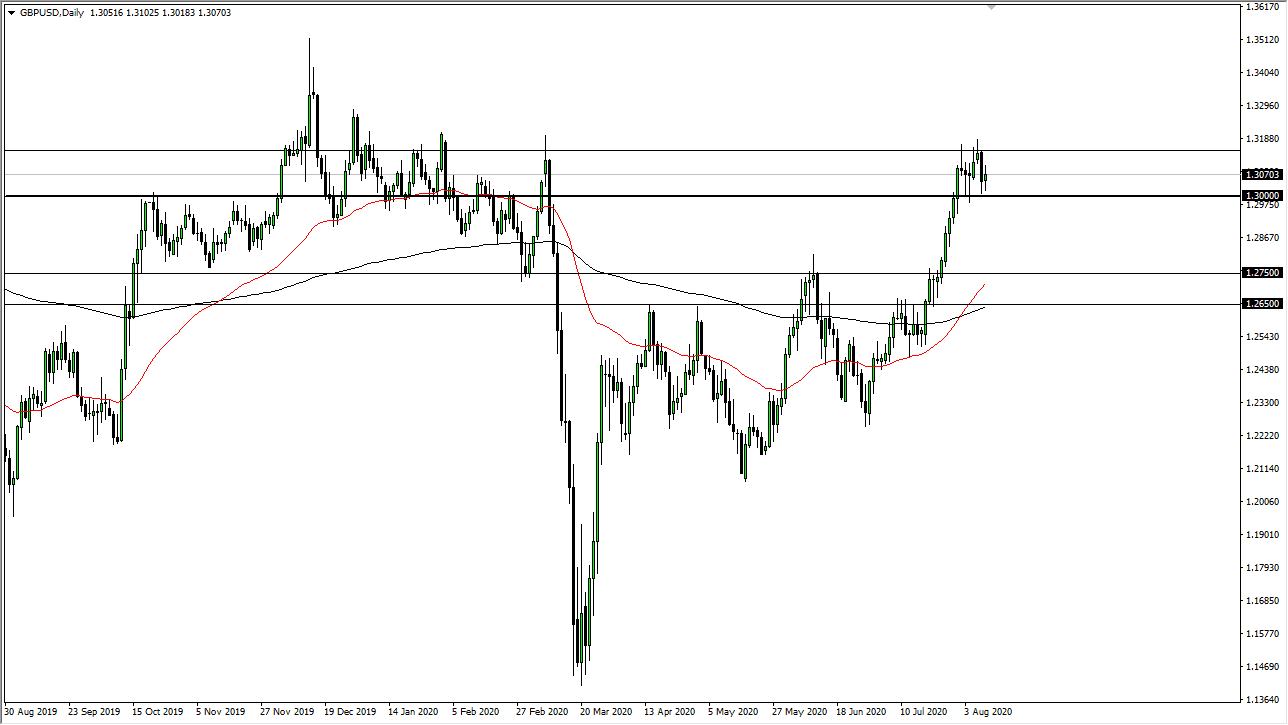

The British pound found support during the trading session on Monday, initially shooting higher but then breaking back down towards the crucial 1.30 level. That is an area that has attracted a lot of attention in the past that it is a large, round, psychologically significant figure, which also causes a lot of headlines, so at this point in time it makes quite a bit of sense that we would see buyers jump in. The neutral candlestick suggests that the selling pressure that was seen on Friday is probably already in the back burner, as traders continue to look at the US dollar and something that should be shorted due to the Federal Reserve.

The British pound is likely to get a bit of a boost from employment figures, but at the end of the day, the United Kingdom also has to worry about Brexit. Guess what? It does not seem to matter at this point in time, because FX markets are focusing more on the Federal Reserve than anything else right now.

The 1.30 level being broken to the downside would invite a lot of selling down towards the 1.2750 level, which I think that a lot of buyers would jump into at that point. The 50 day EMA is sitting just below that level and I also believe that there is at least the 100 pips of support underneath there. Ultimately, I think that the market will find plenty of buyers eventually, as the only game in town is playing the Federal Reserve. After all, the central banks around the world are easy and monetary policy but nobody can bring out the monetary bazooka like Jerome Powell.

We may have to go sideways for a while until we get some type of momentum back into this marketplace where we will make a much more permanent decision. If we can break above the highs of last week it is likely that we would go looking towards 1.35 level. That is an area that I also see a lot of resistance in but longer-term I think this pair goes much higher due to what the Federal Reserve is currently doing. I have no interest whatsoever in shorting this market, as the trend has changed quite drastically over the last several months.