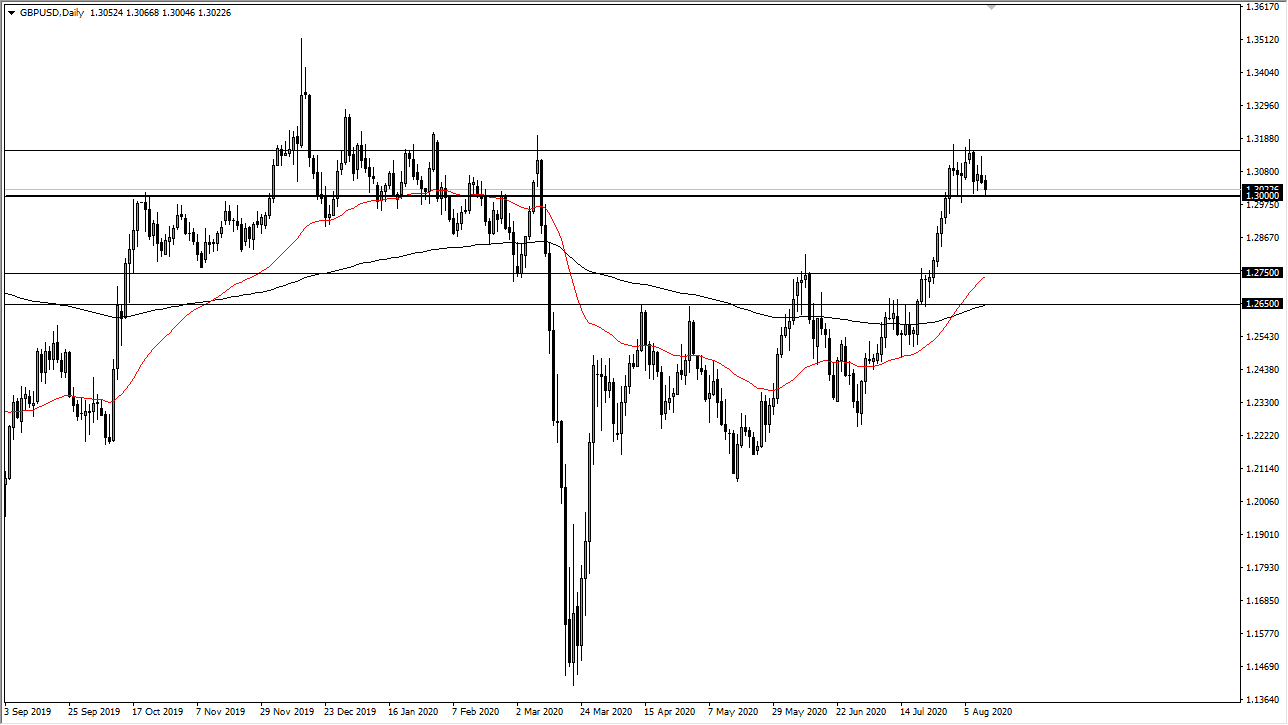

The British pound fell a bit during the trading session on Wednesday, reaching down towards the 1.30 level before bouncing a bit. That being said, the market looks as if it is going to grind back and forth between here and the 1.3150 level. That is an area that should continue to be important, as we have seen a lot of back and forth trading on short-term charts, as the British pound is taking a bit of a breather after shooting straight up in the air. At this point, I have no interest in shorting the British pound but there are a couple of areas that I am interested in buying in.

If the market breaks above the 1.3150 level I would be interested in a breakout above that on a daily close. At that point, I think that the market then goes looking towards 1.35 handle which is what I expect to see happen eventually. However, it is very possible that we may see this market pullback in the meantime, perhaps reaching down towards the 1.30 level multiple times as we try to “kill time” after going so parabolic. Ultimately, we could break down below the 1.30 level, which would be a very negative sign. However, there is massive support underneath that should continue to be seen at the 1.2750 level, which extends down to the 1.2650 level. I do think that it is only a matter of time before buyers would show up in that general vicinity.

Looking at this as a market, we either go sideways or offer value more likely than not. A breakout is something that I would follow, especially if we can go sideways for a while. After all, “running out the clock” can have a massive effect on the market as well, as it will get people used to the idea of the British pound being in this general vicinity. Regardless, the Federal Reserve continues to flood the markets with liquidity so it makes quite a bit of sense that the US dollar should fall in value. As long as that is the case, then the British pound will rally by default as it simply is not the greenback. The market continues to be very choppy, but I have no interest in shorting.