Ahead of the announcement of the British economic growth rate, which is expected to have a sharp and historic contraction in the COVID-19 era, the GBP/USD pair is stabilizing under downward pressures that pushed it towards the 1.3016 support before settling around the 1.3045 level at the time of writing the analysis. The pound saw some fluctuations in the wake of the British employment statistics, yet the British currency remained well supported above the key 1.11 area against the Euro and 1.30 against the US dollar after data showed that the country's unemployment rate reached 3.9% in June, which is better than the markets had expected at 4.2%. The Office for National Statistics reported that 220,000 people had stopped working in the three months to June as the COVID-19 crisis actually affected the economy, yet this was below expectations of 288,000.

Analysts believe that data from the United Kingdom will become increasingly important to the sterling exchange rates in the coming weeks, as foreign exchange markets are likely to pay more attention to how economies recover from the COVID-19 pandemic relative to each other. Economies that recover quickly from the effects of the pandemic will be the most profitable and will outperform other currencies. “The near-term drivers of the British pound are now returning to tracing the path of economic re-opening in the face of the scattered hotspots of COVID-19 and the associated domestic constraints,” says Paul Megeesy, forex strategist at JPMorgan.

After the release of UK employment data, we saw a drop in the GBP, followed by a rebound. Overall, the headline numbers were broadly supportive of the British Pound, however, the number of claimants and wage data were lower, and that may explain some of the fluctuations in the Pound after the release. As for those seeking unemployment compensation, it rose by 94.4K in July, 10K more than the market had expected. Average wages, including bonuses, fell by -1.2% in June, which was steeper than the -1.1% decline that markets had expected, while average wages fell 0.2% which is worse than the 0.1% decline that markets had been expecting.

UK employment data is the first of two major economic releases due this week, and interest is likely to wane when the GDP statistics are released today. The forex market reaction to employment data has been somewhat muted given that the outlook for the UK labor market will ultimately depend on what happens to Boris Johnson's government, which has approved plans to stimulate the labor market from the repercussions of the pandemic. The government’s plans to support wages are expected to expire in October, and there are fears of a sharp rise in unemployment at this point. However, the continuation of the program may cushion the blow, although this will create more significant demands on the country's finances while also potentially delaying any post-virus recovery as employers face an economic downturn.

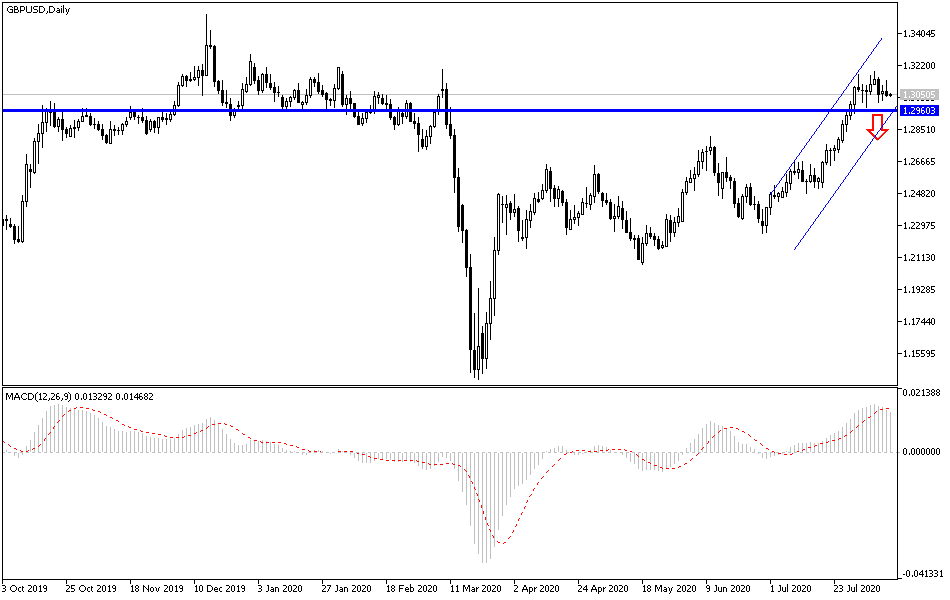

According to the technical analysis of the pair: The closer the GBP/USD approaches the perimeter of the 1.3000 support level, the more pressure on the pair will be to complete its recent ascending path. Because moving below that level will bring the bears the necessary momentum to complete the long-term downtrend. At that time, the closest support levels to the pair’s performance will be 1.2980 and 1.2880, respectively, and at that time, the hopes for completing the correction to the current high evaporate. On the upside, the 1.3200 resistance will remain an important target for the bulls to complete the upward correction opportunity, which the pair started since the middle of last month. As I expected very much, the pair's gains will remain a selling target as the outlook for Brexit remains bleak.

Regarding today's economic calendar data: From Britain, the GDP growth rate, the business investment index, the services index, the trade balance of goods, and the rate of industrial production will be announced. From the United States, the Consumer Price Index will be announced.