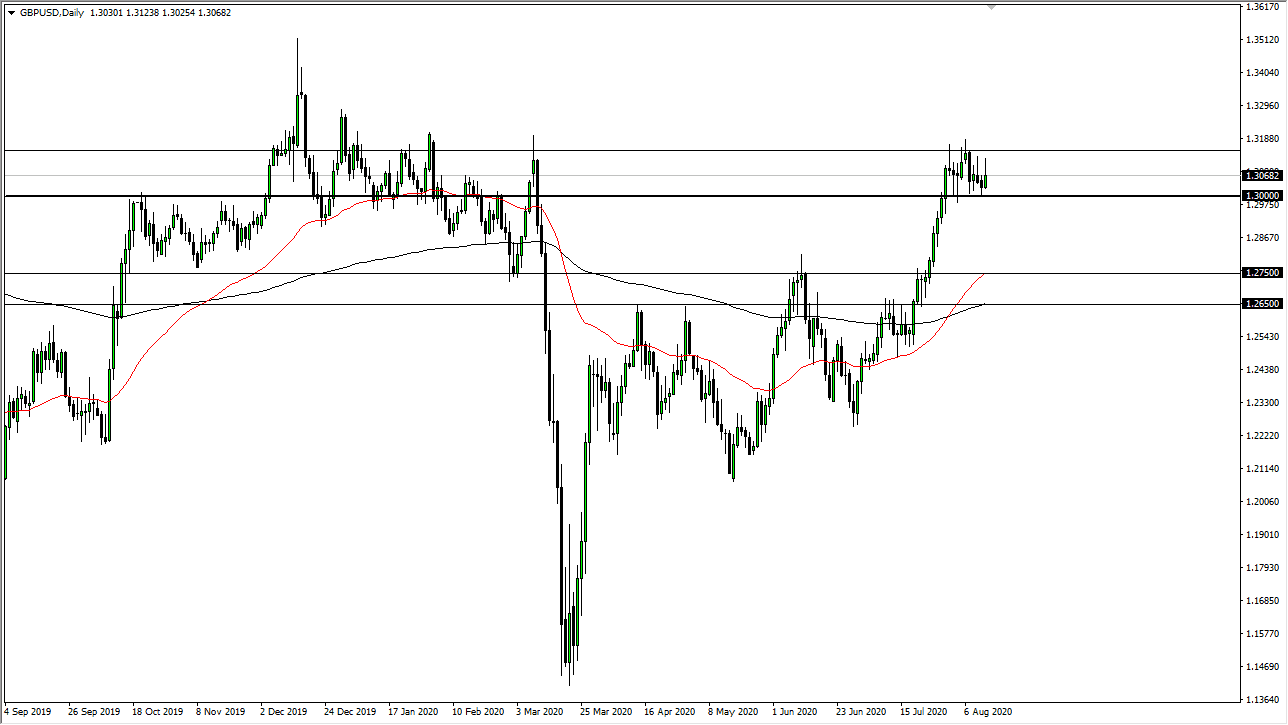

The British pound initially tried to rally during the trading session on Thursday but gave back a significant amount of the gains to show that we are not quite ready to break out yet. That being said, it is likely that we could see a lot of volatility in the short term, but it is hard to imagine that this pair suddenly reverses and start selling off drastically. At this point, even if we were to break down below the 1.30 level, I think that the 1.2750 level is a significant support level just waiting to pick up the British pound at that point. In fact, we have the 50 day EMA at that level and it is the beginning of a 100 point support “zone.”

I am more than willing to buy that pullback, but I also recognize that I may not even get the opportunity. Sideways between the 1.30 level in the 1.3150 level could be the way forward, so short-term traders could be relatively active. This is the wrong time of year to see a lot of major moves, as most traders are more worried about vacation than anything else. Because of this, it does make quite a bit of sense that we sit in this range. A break above the 1.3150 level could open up a move towards the 1.35 handle, but that might take some time to happen.

The British pound is mainly gaining due to the Federal Reserve flooding the market with greenbacks, so it does make sense that we continue to see this market rise, even if there is a significant pullback. In fact, I do not have any interest in shorting this pair, because I believe that we have hit a major inflection point when it comes to the value of the greenback, and that will continue to be something worth paying attention to. All things being equal, this is a market that is destined to go much higher, so it is hard to imagine a scenario where I am willing to short the market, at least not without the Federal Reserve changing its overall attitude. The Federal Reserve did try to tighten monetary policy slightly about a year ago, and that ended up in disaster. With that being the case, it is obvious that the US dollar is now on its back foot.