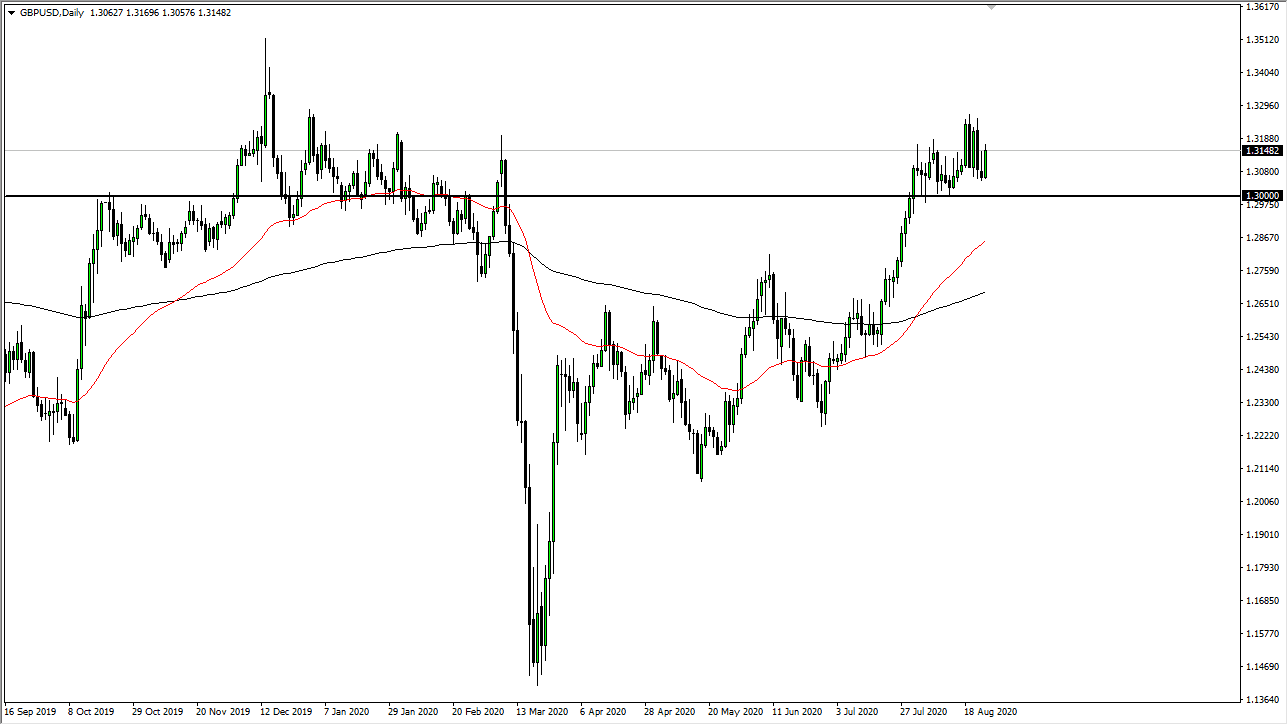

The British pound has recovered nicely during the trading session on Tuesday, breaking above the inverted hammer from the previous session. Ultimately, this is a pair that looks as if it is ready to go higher, and therefore I think that it is only a matter of time before we break out. We have been grinding sideways for a while, so short-term pullback should continue to be nice little buying opportunities. I do not necessarily think that we are ready to go much higher, but I do think that opportunity is coming. Short-term pullbacks should find plenty of buyers closer to the 1.30 level, as the market is going to pay attention to the fact that it is a large, round, psychologically significant figure.

To the upside, I believe that the market will eventually go looking towards the 1.35 handle, which is also a large, round, psychologically significant figure. That is an area that I think will attract a lot of attention and makes a great target. That being said, you should also keep in mind that the candlestick from the previous week was a shooting star, so although we have a negative weekly candlestick, I do not give it as much credence as I would if the 1.30 level was not so obvious just underneath offer significant support.

If we did break down below the 1.30 level, then it is likely that the 50 day EMA underneath should offer support. Underneath that level, we probably will go looking towards the 1.2750 level, with a significant amount of support all the way down to the 1.2650 level. That is an area that I think will attract a lot of attention and therefore I would be more than willing to jump into this market at that point as well. We are in an obvious uptrend, and there is no need to try to fight that. After all, the Federal Reserve will do everything it can to kill the US dollar over the longer term, and on Thursday we have the speech from Jerome Powell from Jackson Hole that could move what goes on with the US dollar as well. At this point in time, dips continue to offer value and that is really the only thing that seems to be a constant in this pair. Now, it is all about the US dollar and not the British pound.