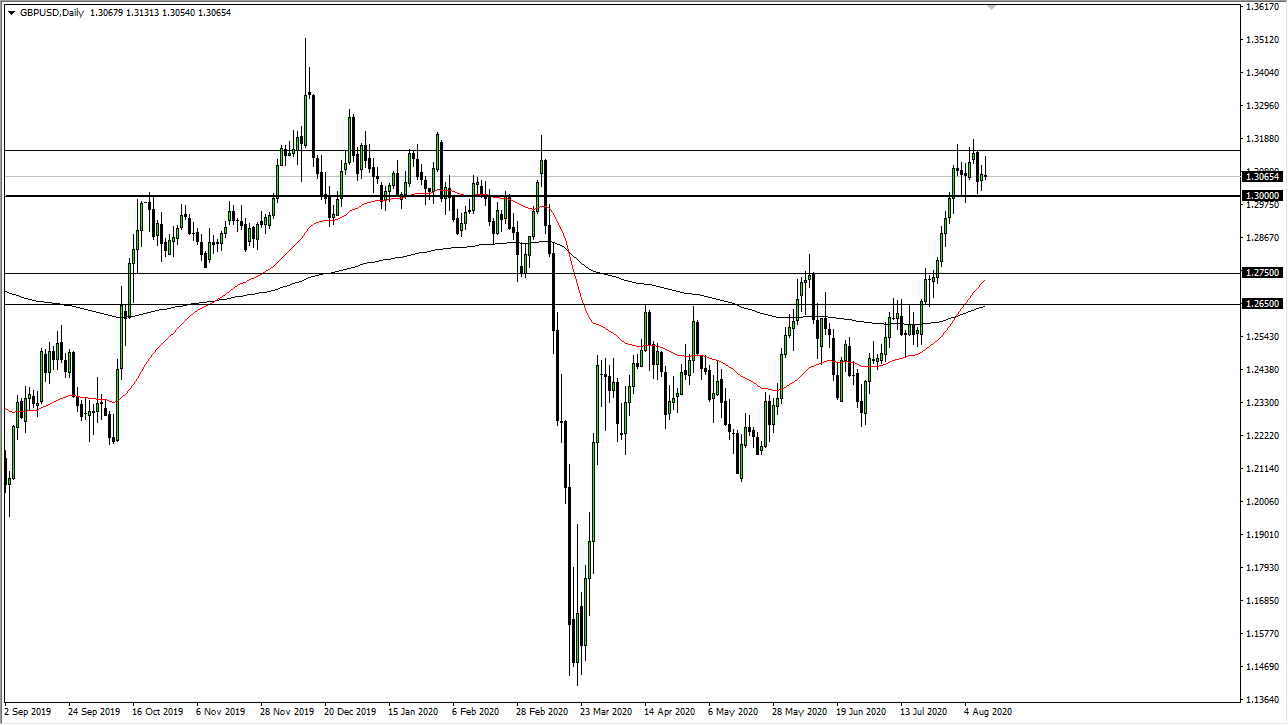

The British pound rallied significantly during the trading session on Tuesday, giving back significant gains. That being said, the market looks very likely to see a lot of volatility going forward, and I think it is worth paying attention to the 1.30 level underneath. That is an area that should see a lot of buying but at this point in time, we are simply going back and forth and looking for some type of clarity. After all, we had rallied significantly previously to get overbought, and the US dollar started to see a lot of buying pressure towards the middle of the day.

The market needs to digest the gains at the very least, and I think that is what we are doing. However, if we were to break down below the 1.30 level significantly, we could see a rather tense pullback to the 1.2750 level, an area that I think will continue to be crucial, as it offers 100 points of support underneath. The 200 day EMA currently sits there, and I think it is time that value hunting will come into play if we get down there. Alternately, if we were to break above the top of the candlestick over the last couple of sessions, it could open up the door to the 1.35 handle, but it does not look like we're quite ready to do that yet. With this, I think it is a matter of time before we continue the upward trend, but it looks as if the US dollar is ready to gain a bit in the short term, or at least put some type of fight.

Looking at this chart, it is likely that we will find buyers on dips and I think that continues to be the case. Over the longer term, I do think that we go looking towards the 1.35 handle, but no trend can go straight up in the air forever. At the very least we are going to go sideways and the trading action during the session on Tuesday clearly points this out. With this, I think it is a matter of waiting for a buying opportunity and we may or may not get that at the 1.30 level. The first place I would be looking to buy, and if we were to break down below there then the 1.2750 level becomes a massive “value area.” I have no interest in selling this pair as if the British pound continues to benefit from the Federal Reserve and its loose monetary policy over the longer term.