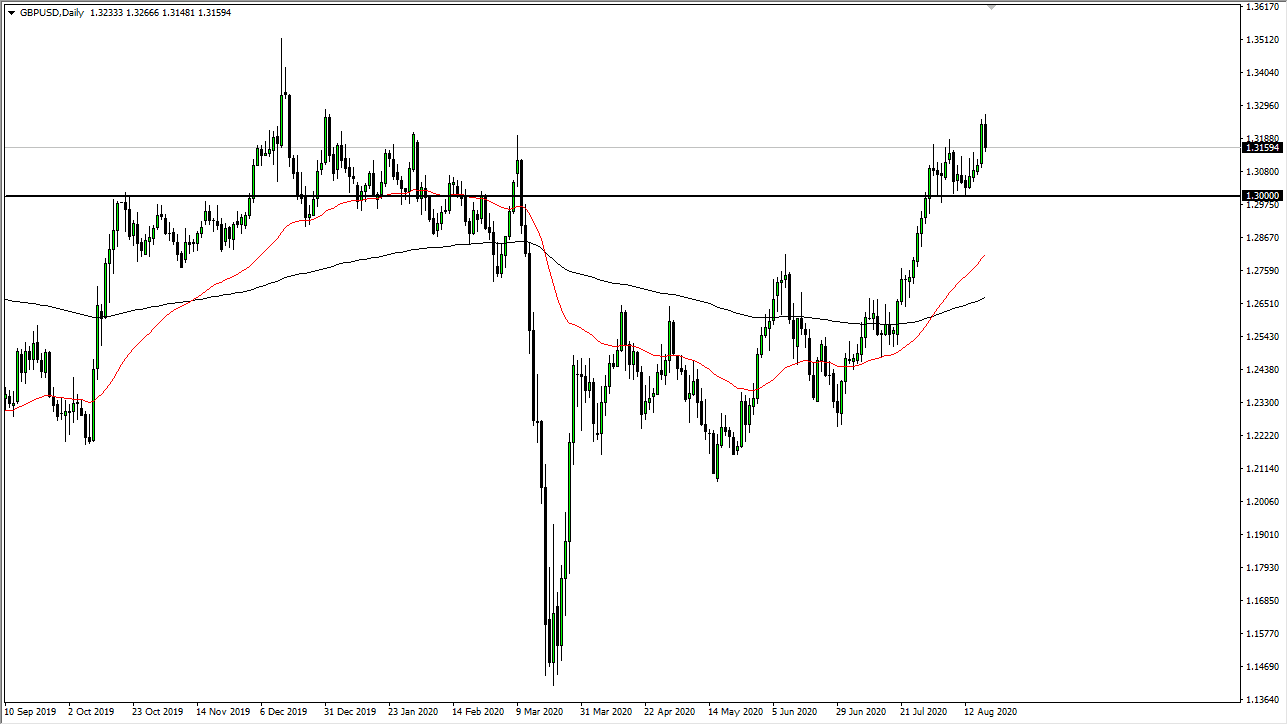

The British pound has pulled back rather significantly during the trading session on Thursday, as we may have gotten a bit ahead of ourselves. The 1.32 level has offered resistance, and now the question is whether or not the noise underneath will offer support? At this point, I would anticipate that the 1.30 level does, in fact, look attractive to buyers and that they would be more than willing to jump in and pick up the Pound in this general vicinity. After all, the US dollar itself is on the back foot, but you can also make an argument for the fact that the greenback is oversold.

As long as the Federal Reserve looks to flood the market with greenbacks, it is difficult to imagine a scenario where we have longer-term US dollar strength without some type of major shock to the system. That being said, a major shock to the system would not exactly be out of the realm of possibility at this point anyway. If we were to break down below the 1.30 level, then it is likely that we go down to the 1.2750 level. That is an area where we see about 100 pips worth of support, and I would be more than willing to buy some type of bounce from that area. Longer-term, I fully anticipate that the British pound will continue to rally because of the Federal Reserve.

I recognize that Brexit is still a thing, but evidently the market does not. All things being equal, I think that the hysteria over Brexit is starting to disappear, and the fact that there is no agreement does not really seem to be much of a concern. After all, currency trading is a relative value game, in the European Union is not exactly strong at the moment either. In other words, as long as the European Union struggles, people will not necessarily punish the British pound too harshly. Furthermore, as long as the United States keeps piling on debt and stimulus that might help the British pound as well. This is not necessarily a sign of strength in the British pound, it is more or less a move away from the US dollar that I am seeing on this chart.