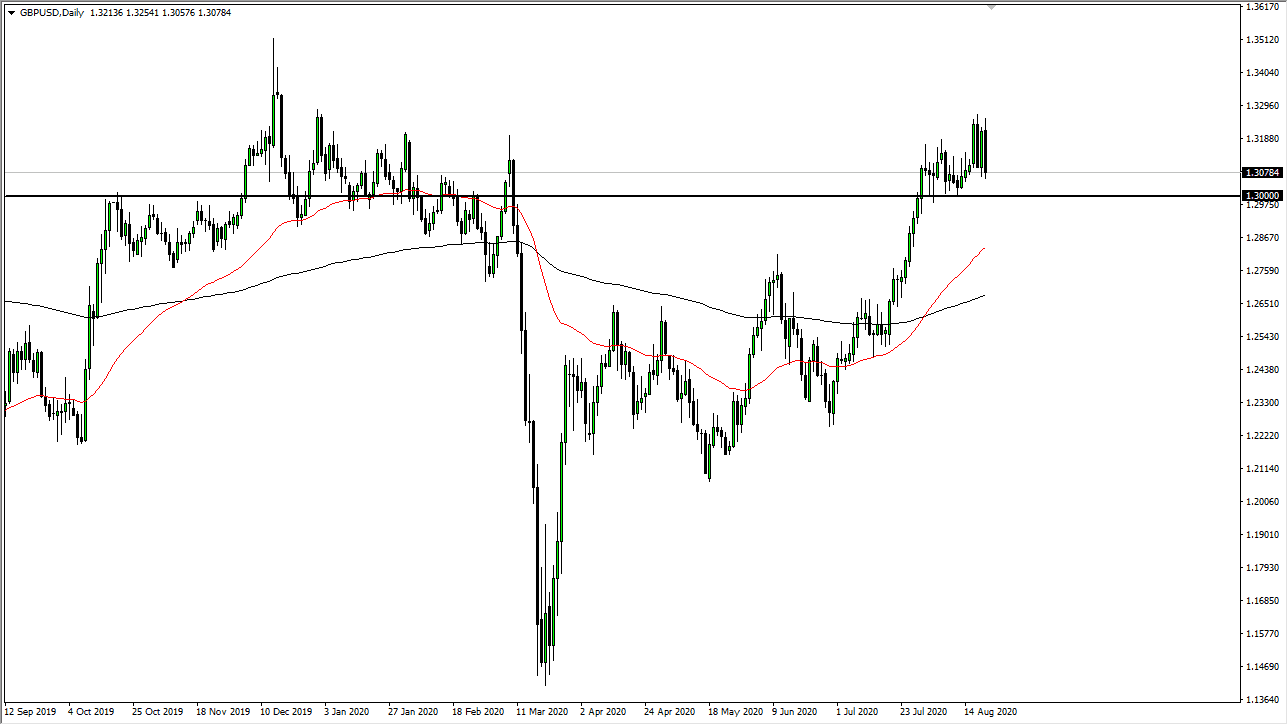

The British pound initially tried to rally during the trading out on Friday, but then pulled back to reach towards the 1.31 level again. There is a significant amount of support between there and the 1.30 level, so it should not be a surprise at all that we stopped where we did. Ultimately, even though this was a very negative candlestick and we are in the midst of a consolidation area. It is worth noting that not much has changed, despite the fact that the market has been noisy and the US dollar is oversold from a short-term perspective.

Part of this may have been profit-taking heading into the weekend but there was also a bit of a “risk-off” field to the marketplace as the Germans reported a less than bullish looking PMI figure. That being the case, it makes quite a bit of sense that we should continue to see traders looking at this as a potential “buy on the dips” type of scenario. The question now is whether or not the 1.30 level holds as support. If it does, then traders will jump right back in trying to reach towards the top of the consolidation. However, if the area does not hold then it is likely that we go down to the 1.2750 level. That is the beginning of significant support that runs at least 100 points, so I like the idea of buying it on a dip.

I do not have any interest in shorting the British pound right now, although I am the first to admit that this is certainly an area where we will probably struggle. That being said, the market is also suffering at the hands of vacation season, as a lot of the bigger traders are away for the time being. This market will continue to see the 1.30 level as crucial, so I will wait to see what happens on Monday and what the reaction is to that area before putting money to work. I do not have any interest in trying to guess what is happening next, but I do recognize that there is a high potential for support to come back into play rather soon as the 1.30 level will attract a lot of attention and headline noise. Remember, the Federal Reserve continues to flood the market with greenbacks.