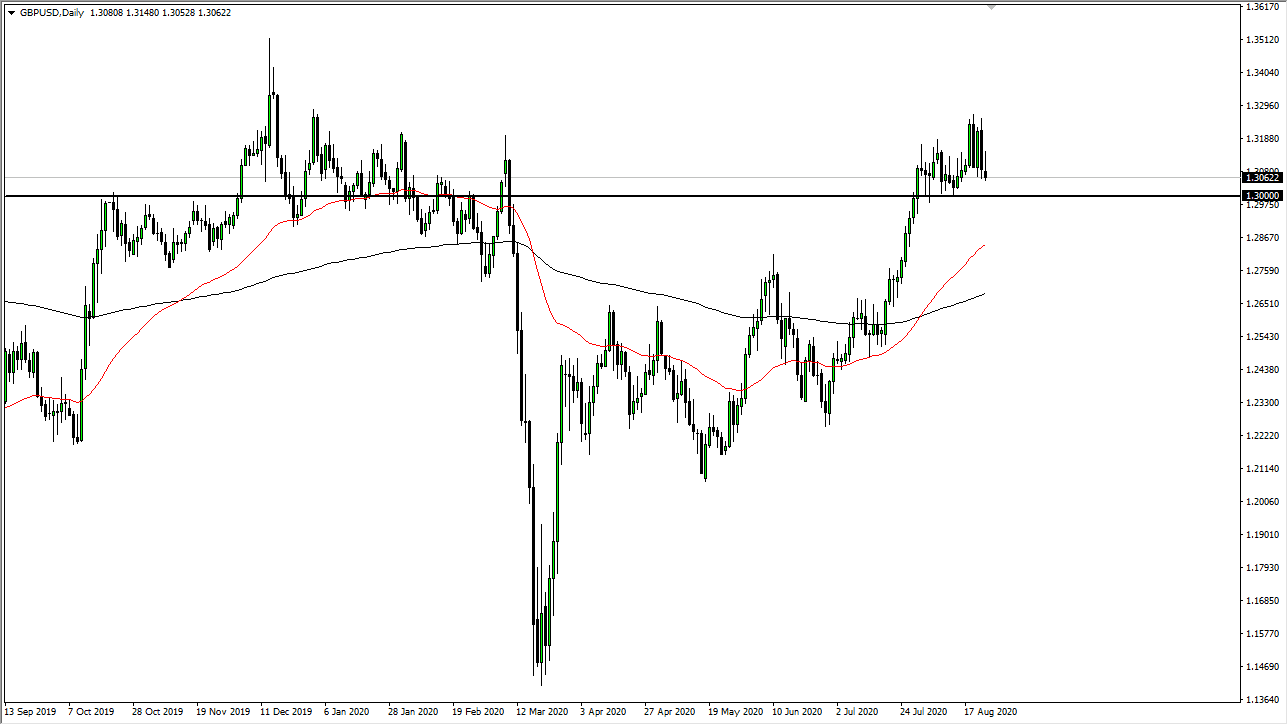

The British pound initially tried to rally during the trading session on Monday but gave back the gains in order to show less than impressive momentum. Ultimately, this is a market that I think will continue to show a lot of volatility, as nobody really knows what to do next. The US dollar is oversold so we may see a little bit of follow-through when it comes to the downside but I think it is only a matter of time before we get buyers back into this market due to the fact that the Federal Reserve is likely to continue to flood the markets with US dollars, and of course the central banks around the world continue to work against the value of currency in general. That being said, the British pound has been a major benefactor of the Federal Reserve’s actions.

Looking at the shape of the candlestick, it is very negative, but I would not be overly concerned unless we got a move below the 1.30 level that I would be aggressively short of this pair, but even then I think we will probably see plenty of support at the 1.2750 level that extends down to the 1.2650 level. Ultimately, I think that this is a market that will continue to see a lot of volatility, but I do think that the buyers will ultimately be the winners. The US dollar been oversold of course can cause a little bit of a pullback, but quite frankly that is nothing that is out of the realm of normalcy.

If we were to turn around a break above the highs, then it is likely that we will go looking towards the 1.35 level, which of course is my longer-term target. Ultimately, this is a market that I think is one that has much further to go longer term, but obviously we have to build up more momentum in order to take off to the upside. The candlestick being broken to the upside would of course be a very bullish sign, because then it turns this candlestick into an “inverted hammer”, which of course is a bullish sign once it kicks off. That being said, it could be the beginning of something rather special. Otherwise, I think that a pullback will simply be bought into given enough time.