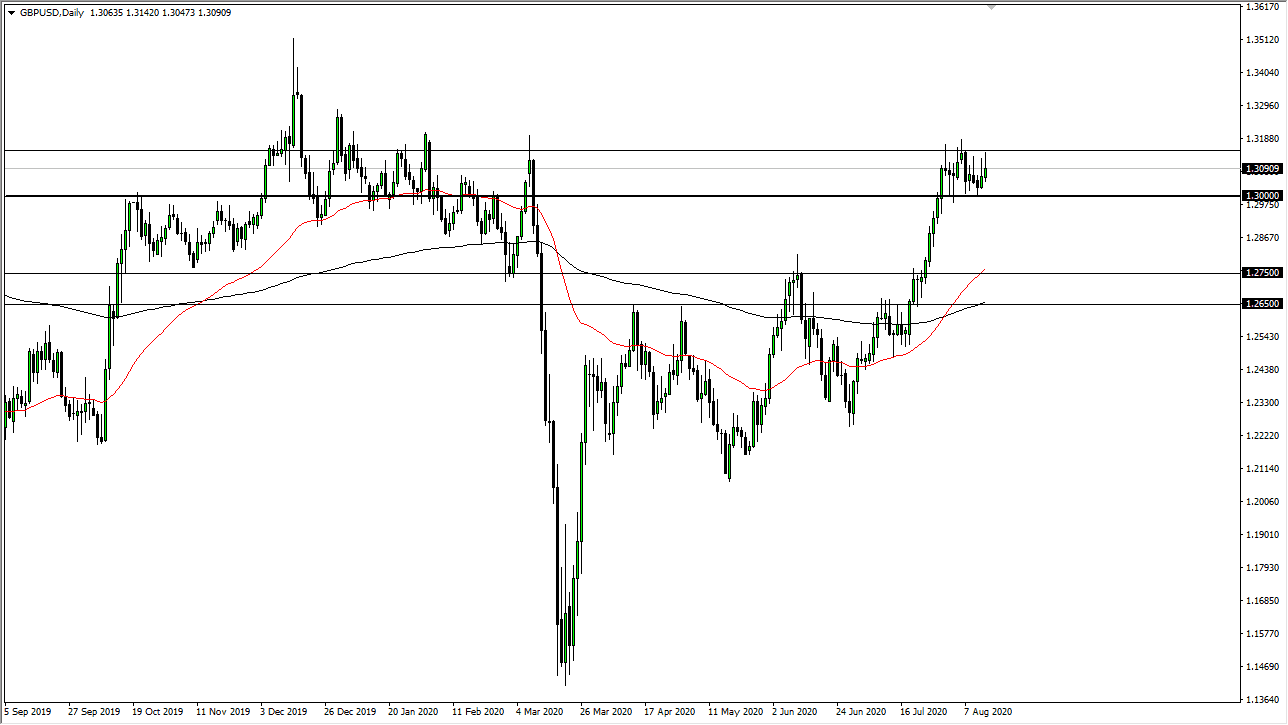

GBP/USD: Potentially strong bullish breakout above 1.3134

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered prior to 5 pm London time today.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3134.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3072.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

We have seen a long-term bullish trend rise again in this currency pair over recent weeks. However, there is no doubt that the trend is stronger in the EUR/USD currency pair. If you take a look at the EUR/GBP cross you can see the action there is broadly bullish, which confirms this.

Despite the question over further bullish advances here, there is still quite a good chance this will happen, as the U.S. Dollar looks poised to fall again this week.

The standout technical feature in the price chart below is the strength of the resistance level at 1.3134 which is bottling up the price consolidating below it. This suggests that a bullish breakout above 1.3134 will lead to a bullish movement of some strength. Another bullish sign is the beginning of a bullish price channel which we see start to form over the past two or three trading days.

I will take a bullish bias on this currency pair today if we get two consecutive hourly closes above 1.3134 by 10 am New York time.

There is nothing of high importance due today regarding either the GBP or the USD.