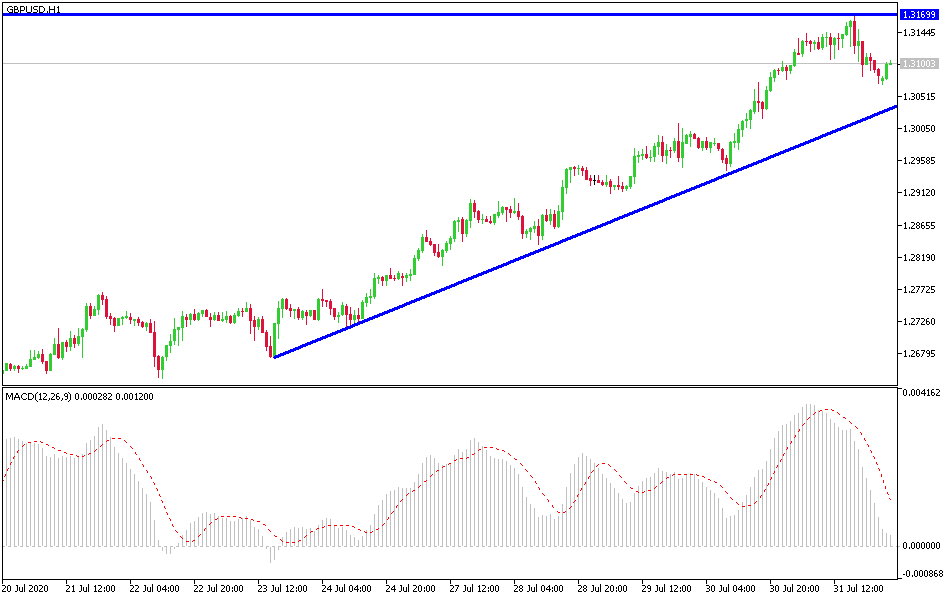

GBP/USD: 1.3000 psychological resistance awaits Brexit developments

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3170.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3045, 1.2990, or 1.2955.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

Forex traders took advantage of the market sentiment not being preoccupied with any Brexit developments except positive press comments regarding the possibility of reaching an agreement in the end. This was an opportunity for the GBP/USD to move towards the 1.3170 resistance, its highest level since the beginning of last March. The US currency returned to express itself in last Friday's trading session. Despite the negative US economic figures, the US central bank is cautious.

Technical indicators reaching overbought areas were a valid reason for profit-taking at the end of July. The general trend is still bullish and the real threat may be stability below the support at 1.3000 - psychological resistance - before the recent fall of the US dollar.

I still hold onto my technical view of selling the GBP/USD pair from every bullish level, as the future of the Brexit is still unclear and optimistic statements are tentative and are used to calm investor concerns.

Regarding the GBP, the UK PMI reading will be announced. As for the US dollar, the ISM Manufacturing PMI and construction spending data will be announced.