GBP/USD: 1.3000 psychological resistance awaits Brexit developments

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3220.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3030, 1.2965, or 1.2880.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

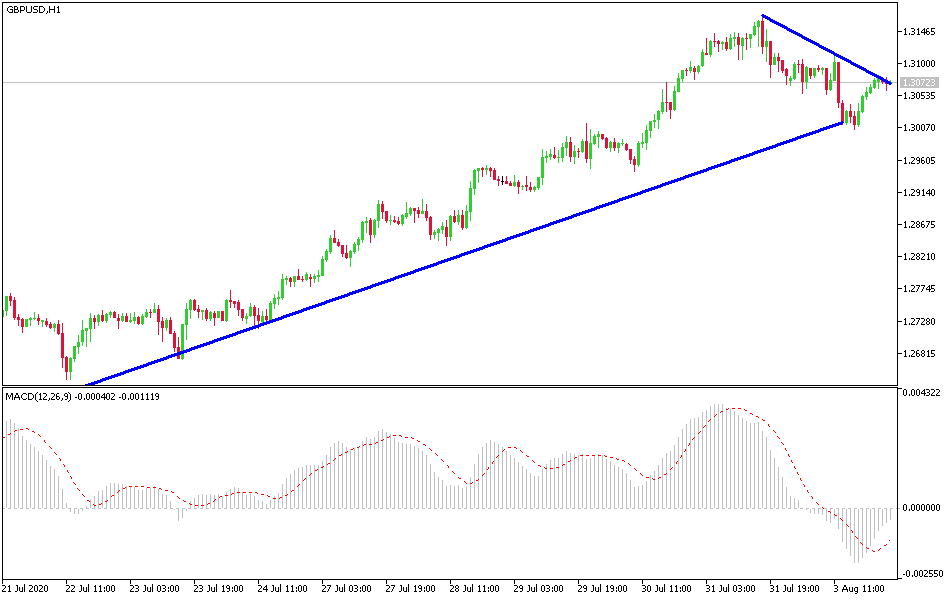

GBP/USD Analysis

Bears were unable to move the GBP/USD pair to break below the 1.3000 psychological support level, the psychological peak after the pair broke down at the end of June. The pair settled around the 1.3075 level now in a position confirming that bulls still control the performance. Brexit talks’ factors, Coronavirus fears and its impact on the world economy, and the comparison of economic performance and monetary policies between Britain and the United States will remain the most important influences on the pair in the coming days and weeks. The UK pandemic figures are still under control, at least for the time being. However, Britain was badly affected by COVID-19 - including the experience of Prime Minister Boris Johnson where he was closest to death. Britain has a world ranking in the number of deaths.

In an attempt to influence the European Union, Lise Truss, the British Foreign Secretary for International Trade, is in the United States for talks with US Trade Representative Robert Lighthizer to try to negotiate a trade agreement after Britain leaves the European Union. Despite the "special relationship," the negotiations have yet to produce any progress and expectations about a deal before the US elections are still weak. On the other hand, more reports about the delay in concluding an agreement may affect the sterling in the forex market.

The GBP/USD dropped from its bullish channel that lasted for more than a week. However, other technical indicators remain bullish - the 4-hour chart's RSI has dropped below 70 - while the momentum remains positive. Support is awaited at the daily low at 1.3050, followed by 1.2970, which is also a starting point on its way up. The next level to watch is 1.2910, which also kept the cable down last week, and on the upside, resistance is at a daily high of 1.3110, followed by the last high at 1.3170. The next levels to watch are 1.32 and 1.3270.

Regarding the sterling, there are no major economic releases from Britain today. As for the US dollar, US factory order numbers will be released.