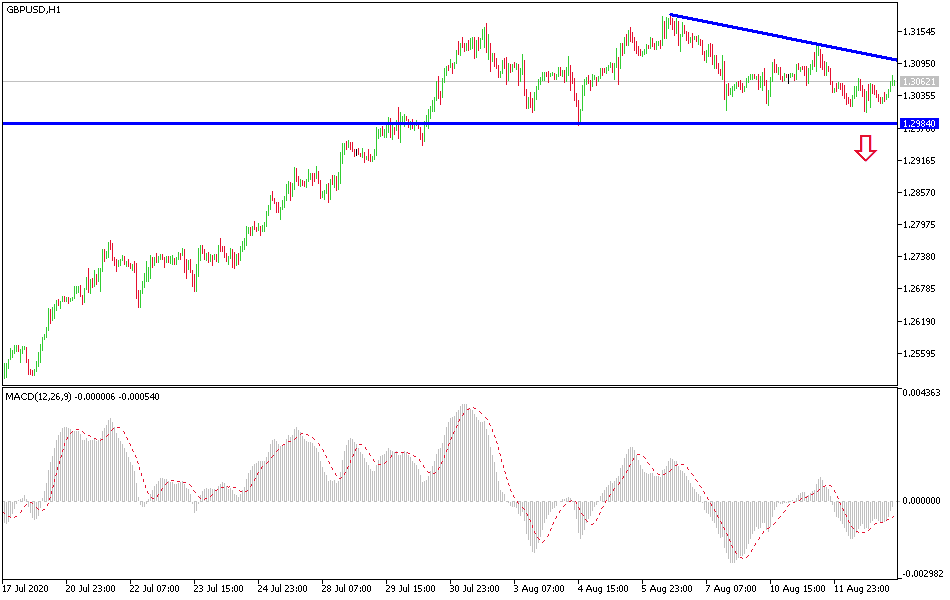

GBP/USD: A correction awaits momentum.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2975 or 1.2920.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3130, 1.3200.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

As I mentioned yesterday, the GBP/USD ascending path will depend on the failure of stability below the 1.3000 psychological support. The pair is stabilizing around 1.3065 at the time of writing. What weakened the rebound up again was the announcement of the largest economic contraction of the United Kingdom compared to the contraction of other global economies in the era of the COVID-19 epidemic. The British economy is expected to grow by 15 percent in the third quarter after the record contraction in the second quarter, if the Coronavirus is contained, as per the National Institute for Economic and Social Research NIESR.

Prior to that, official data revealed that the British economy contracted by a record - 20.4% in the second quarter after a slowdown of -2.2% in the first three months of the year, thus the economy entered into a technical recession. The Office for National Statistics also said it was the first recession since the global financial crisis of 2009 and the largest ever for the British economy.

Meanwhile, the monthly GDP estimate for June revealed 8.7 percent growth, as more companies returned to work after further easing of Covid-19 lockdown measures. However, June GDP is below its level in February. The Research Center expects a 10 percent drop in GDP this year and 6 percent growth next year, assuming the pandemic does not re-emerge, and containment measures are not reintroduced. NIESR expects the service sector, which makes up 80% of Britain's GDP, to grow by 14%, and production to grow by 16.1% in the third quarter. Manufacturing production is expected to jump 20.3 percent and construction to increase by 35 percent.

The GBP/USD pair moving below the 1.3000 support will bring pressure on the pair, but with pressure on the US currency, there will be an opportunity to buy the pair, and the closest levels to that are currently 1.3010, 1.2955 and 1.2880. In return there will be no opportunity to reach a buying peak without the pair crossing the 1.3200 resistance.

For the British pound, there are no important announcements expected today. For the US dollar, weekly unemployed claims will be announced.