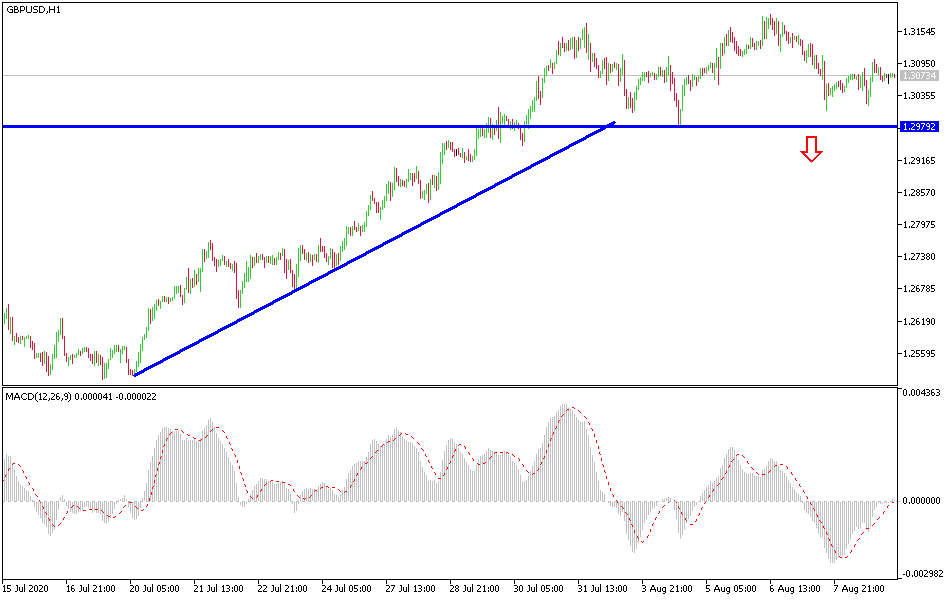

GBP/USD: 1.3010 and 1.2940 are buying levels.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3010.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3130, 1.3200.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

As I mentioned yesterday, the future of the GBP/USD bullishness depends on stability above the 1.3000 resistance. Which explains the pair’s attempts to avoid moving below that level. The pair holds around 1.3080 before the UK jobs and wages figures are released. The exchange GBP/USD rate moved towards its highest level since March during last week's trading, but it is likely to decline further in the coming days with the escalation of tensions between the United States and China. Major economic reports loom on the horizon, and the charts warn of a correction for both the pound sterling and the dollar.

The jobs data for July today is followed by the industrial production release for June (Germany, France, Spain and Italy recorded strong gains last week before the total figure this week) and trade numbers. This led to an increase in GDP estimates for the second quarter on August 12th. The median forecast in a Bloomberg survey is for a contraction of -20.7% (QoQ), which will be among the worst in Europe. Separately, surveys indicate that one in three employers plan to reduce the number of employees in the current quarter, and that 40% of private companies plan to reduce the number of employees in Britain.

Many analysts are looking for the British pound to trade down towards $1.28 in the coming days, with any gains remain below 1.32, as the greenback is oversold, and the GBP/USD charts warn of a correction that can happen any time.

It is not clear if more clarity regarding the US financial support will be sufficient to maintain the dollar's recovery, although the collapse of the Turkish currency is likely to support the dollar and threaten the British pound given its correlation with the EUR/USD, which is one of the fundamental factors. The primary channels through which the dispute will take place between the Turkish authorities and the market. Moreover, the disagreement between the US and China and the economic data will help fuel risk appetite.

The UK job numbers will be released on Tuesday at 07:00 while the GDP data will be released at 07:00 on Wednesday. Investors may pay more attention to the GDP data given how the government holiday plan has kept the official unemployment rate subdued. Forecasts are looking for the rate to rise from 3.9% to 4.2% for the month of June while an economic contraction of -20.5% is expected, which would put the UK at the bottom of the global recovery schedule from the COVID-19 pandemic.

For the British pound, unemployment rate change, unemployment rate, and average wages data will be released. For the US dollar, PPI, an inflation measurement tool, will be announced.