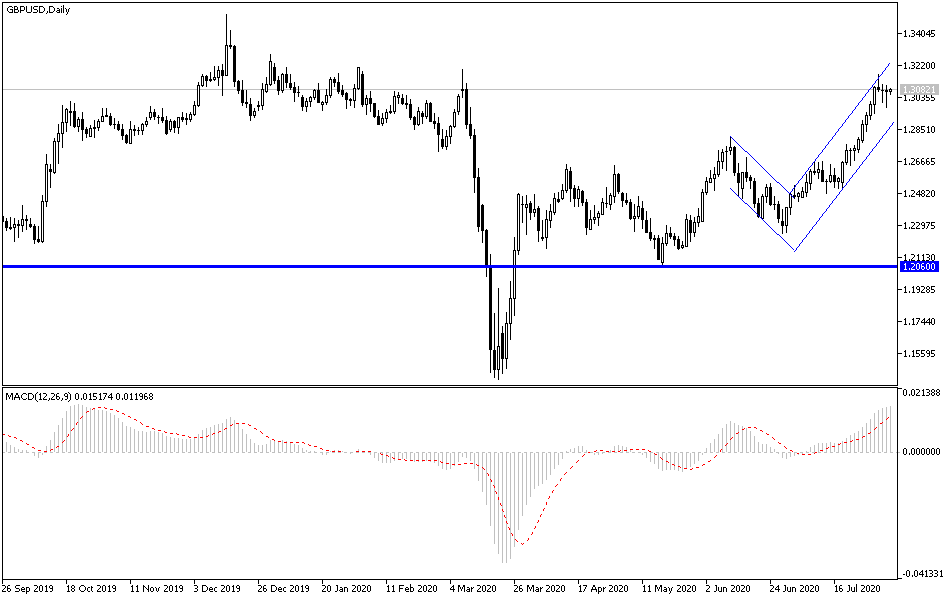

GBP/USD: The 1.3200 peak chance.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.3200.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3010, 1.2935.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

A rapid bounce back in the GBP/USD pair after the sell-off that pushed it towards the 1.2980 support. As I mentioned yesterday, bulls are trying to maintain the 1.3000 psychological resistance to move the pair to stronger bullish levels. It now settles around 1.3086. The attention of Forex traders shifted from the Brexit dossier to the BoE monetary policy update tomorrow, Thursday. And the reaction from the US employment figures for July on Friday. Bulls crossing the 1.3200 prominent resistance level on the daily chart will be a catalyst for new higher breakouts. The collapse of the US currency is still in place, as political anxiety in the United States, along with the delay in the approval of the stimulus by Congress and the record cases of the pandemic, are the most important factors pushing investors to sell the dollar.

The pair’s recent gains were mainly due to the weak dollar that suffered from being abandoned by investors as a safe haven. Speculation is weakening for more federal stimulus - as the yield on the YCC curve is pushing downward, sending the dollar lower with it. US second-quarter GDP growth came in better than expected but still a devastating slowdown of -32.9% annually. Moreover, the persistent jobless claims for the week ending July 17 - the period in which non-farm job surveys are conducted - have disappointed by crossing the 17 million claims.

On the other hand, the UK imposes restrictions before coronavirus cases increase, and on the contrary, some US states are not equally stringent - or at least the results are far from satisfactory. The number of cases has stabilized at a high rate of about 70,000 cases per day while daily deaths continue to increase, exceeding the average of 1,200 dead. The UK government is keen to provide relief and stimulus, and in return, US lawmakers continue their struggle over the next steps, while the unemployed lose their own federal benefits. Optimism about progress in talks between Republicans and Democrats could help the dollar. But when will this happen?

For the British pound, the British PMI will be released. For the US dollar, ISM services PMI, ADP survey numbers for nonfarm sector jobs and trade balance will be announced.