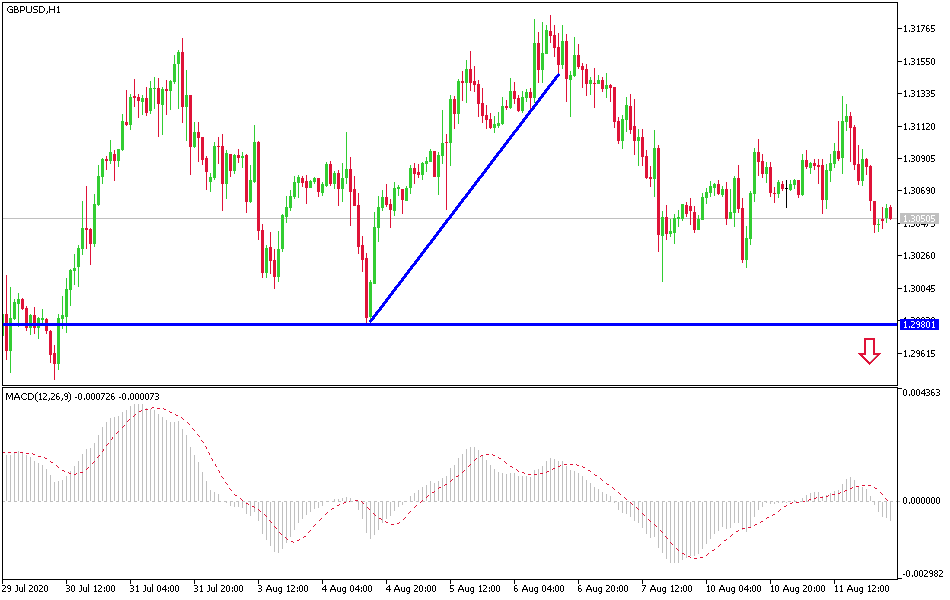

GBP/USD: A correction awaits momentum.

Today's GBP/USD Signals

- Risked 0.75%

- Trades must be taken before 5 pm London time today.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2975 or 1.2920.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3130, 1.3200.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

Continuous GBP/USD attempts, as I mentioned yesterday, to avoid moving below the 1.3000 support so as not to increase the pressure of the bears. The strength of the US dollar was evident during yesterday's trading session amid improving producer price index readings and amid profit-taking selloffs by investors after its recent collapse to its lowest level in more than two years. Traders have a net selling of 14.7k Pounds as of 4 August, the lowest since mid-May. The bulls added another 6.6,000 contracts to the total long position that reached 46,000 contracts. In early March, long deals totaled 76,000 contracts. It dropped to 27K in early June. The bears covered 4,000 contracts, reducing the total short positions to 60.7,000 contracts. In previous reporting mode, the total short position reached its highest level for the year so far.

UK employment data may spur pressure to increase the final leave program. In the second quarter, employment decreased by 220k, and the number of claimants increased by 94.4 thousand in July. July payrolls were 770k lower than they were in March. Many people are discouraged from looking for work in the current circumstances, and this helps keep the unemployment rate at 3.9% (three months to June). It was at 3.9% for the whole year, except for February, when it rose briefly to 4.0%.

Separately, reports indicate that the UK’s bid to obtain better terms than Japan has given the European Union jeopardizes the ability to conclude a trade agreement by the end of this month. The report noted that the FTA with Japan, which eliminated British tariffs on cars and their parts, is estimated to boost the UK's GDP by 0.7% on the long run while its exit from the European Union costs an estimated 5% of GDP.

Selling pressure on the GBP/USD will increase if it stabilizes below the 1.2965 support.

For the British pound, GDP growth rate, investment in business rate, industrial production rate, the services index and the trade balance of goods will be announced. For the US dollar, CPI reading will be announced.