The GBP/USD currency pair is trying to reap more gains from the pressure on the US currency. Its gains have not exceeded the 1.3170 resistance since the beginning of this week’s trading, as Brexit anxiety weakened the bulls' opportunity to start again. The pair stabilized around the 1.3150 level at the beginning of today's trading, awaiting stronger catalysts for an upward correction to the top. Even with the UK's economic recovery apparently accelerating, the pound's true potential will not be realized until the political risks surrounding the post-Brexit trade relationship are erased. Now, markets are still “objecting” to the possibility of reaching an agreement, which would provide some negative protection for the British Pound and thus limit their losses.

“We should note that Barnier, as the spokesperson for the European Union, will always be pessimistic until the moment of the deal,” says Neil Wilson, Senior Market Analyst at Markets.com. “However, on some basic principles, the gap appears to be too large to be bridged. Dealing with competing concerns about sovereignty (the United Kingdom) and the integrity of the single market (the European Union) is at the heart of the talks. Both sides need to make philosophical compromises before practical compromises can follow. And here I began to feel anxious about reaching a large, comprehensive deal.”

The resumption of negotiations between the European Union and the United Kingdom in September may support the Pound’s move in narrow and limited ranges in the coming days.

Marshall Gittler, Head of Investment Research at BDSwiss Group said. “Britain’s exit from the European Union no longer appears to be a big problem for the foreign exchange market. The risk reversals have moved recently, however, there has been no significant hesitation around the 5-6 months zone, which will cover the end of the year in which a no-deal Brexit is likely. Maybe this is already being priced.”

The British government has come under new pressure to change course and encourage high school students in England to wear face masks when they return to their schools next week, at least in public areas such as corridors. This is a day after the World Health Organization changed its guidance on children wearing masks, and therefore Scotland changed its advice, a step that increased pressure on other countries in the United Kingdom to follow suit. In this context, Prime Minister Boris Johnson said that his government, which oversees schools in England, will support a change "in some contexts" if medical evidence shows that face masks are helping in the battle to contain the Coronavirus.

Within the United Kingdom, which has the highest number of COVID-19-related deaths in Europe with about 42,000 dead, Scottish schools have reopened first, followed by those in Northern Ireland. Schools are due to reopen in England and Wales in September. Two weeks after schools reopened in Scotland, one school in the city of Dundee was forced to close after the outbreak.

US consumer confidence fell for the second month in a row, dropping to its lowest level in more than six years as COVID-19 cases re-emerged in many parts of the country fuelling mounting pessimism. Accordingly, the Conference Board, a New York-based think tank, reported on Tuesday that the consumer confidence index fell to a reading of 84.8 in August, the lowest level since May 2014.

The decline, which followed July's decline to 91.7, put the index 36% below its highest point for the year it reached in February before the Coronavirus began to seriously affect the United States. With consumer spending accounting for 70% of economic activity in the United States, the drop in confidence is garnering much attention from economists.

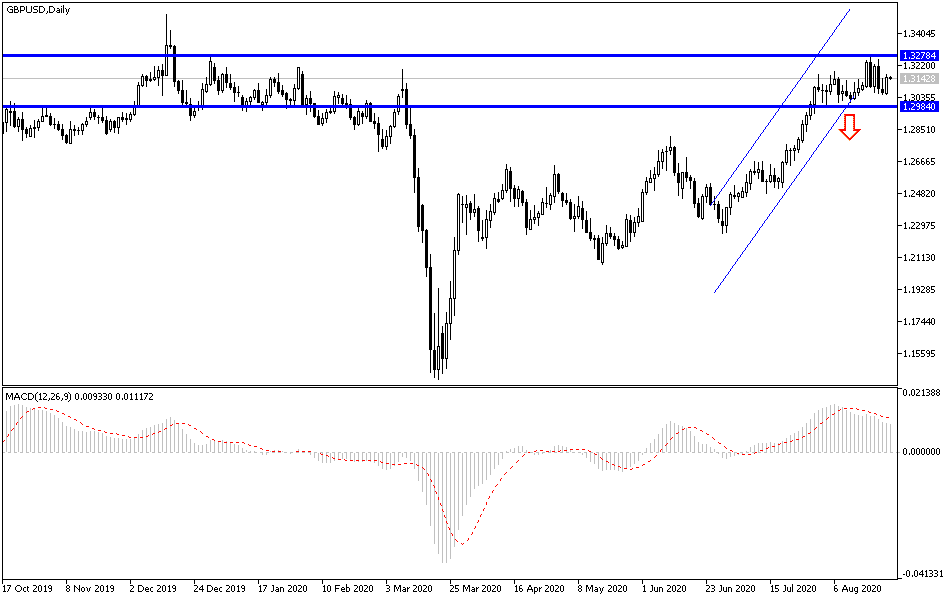

According to the technical analysis of the pair: There is some neutrality in the GBP/USD performance in the recent trading sessions, and the bulls are waiting to cross the 1.3200 resistance again to push the pair to stronger bullish levels, from which we will support the idea of the return of selling the pair, and the most important resistance levels for the pair may currently be 1.3200 And 1.3285 and 1.3360, respectively. The strongest threat to the uptrend will be the bears pushing the pair below the 1.3000 psychological support. For the second day in a row, the economic calendar has no major British releases, and the main focus will be on the US durable goods order numbers.