After the recent strength of the US dollar against the rest of the other major currencies, the bears faced a loss of momentum to move the GBP/USD currency pair below the 1.3060 support. The pair's gains in the past week were capped by testing the 1.3266 resistance, its highest in eight months, and settled around 1.3095 at the beginning of this week's trading. The failure of the negotiating round, as expected, between Britain and the European Union, supported the bears in their latest downward rebound. After that round, expectations of more losses in the pair increased in the coming days, according to a group of analysts who see a bullish dollar correction ahead of an important speech from Fed Governor Jerome Powell later this week.

At the end of last week's trading, we noticed a decrease in the PMI surveys readings for the Eurozone economies. In contrast to the pound sterling, which was less affected by the resulting weakness in European currencies thanks to the bullish surprises in the readings of both the manufacturing and services sectors which were specific to the first month in which the British economy was almost completely reopened all the time. Despite the pessimistic update from the Brexit negotiators, the European Union was the most influential.

Commenting on the pair's performance, Athanasios Vamvakidis, chief forex analyst at Bank of America Global Research says, “Despite the immediate rally with the other G10 currencies against the US dollar, the average GBP/USD forecast for the fourth quarter of 2020 has not materially returned to the level it had at the beginning of the year. The expected high volatility in the GBP/USD also reflects the uncertainty in post-Brexit trade deals and the dismal economic outlook.”

Eurozone PMIs contradict the prevailing narrative of the continental economic performance of the US, which is believed to have been instrumental in driving the recent heavy sell-off in the US dollar. Add to that a second wave of the Coronavirus outbreak in Europe and the components of the dollar correction could be on the table. This, combined with renewed Brexit fears, may be enough to deprive GBP/USD of yet another attempt to reach 2020 highs reached last week around 1.3265. In other words, the Pound may be past its best for the time being.

The British private sector witnessed the fastest growth since late 2013 as the manufacturing and services sectors recovered in August after reopening the economy after the closure, so the composite production index - which includes the manufacturing and services sectors together - rose to a reading of 60.3 in August from a reading of 57.0 in July. The statement indicated the fastest growth since October 2013, which was also higher than economists' expectations of 57.1. The manufacturing sector grew at a slightly faster rate than the service sector activity in August. The manufacturing PMI reached its highest level in 30 months at 55.3 versus a reading of 53.3 in July.

The UK Services PMI came to a reading of 60.1, its highest level in 72 months in August and up from a reading of 56.5 recorded in July. The total new work volume expanded for the second month in a row in August, and the latest increase was the fastest since mid-2014. However, concerns about the speed and duration of the recovery have led to an ongoing deduction of jobs in the private sector.

Despite slowing inflation, average cost burdens rose strongly in August. Survey respondents indicated that higher fuel bills and higher costs for imported materials had led to higher operating expenses, which were only partially offset by higher average prices charged. Moreover, trade optimism has softened slightly since July as some manufacturers indicated concerns about the long-term sustainability of the recovery.

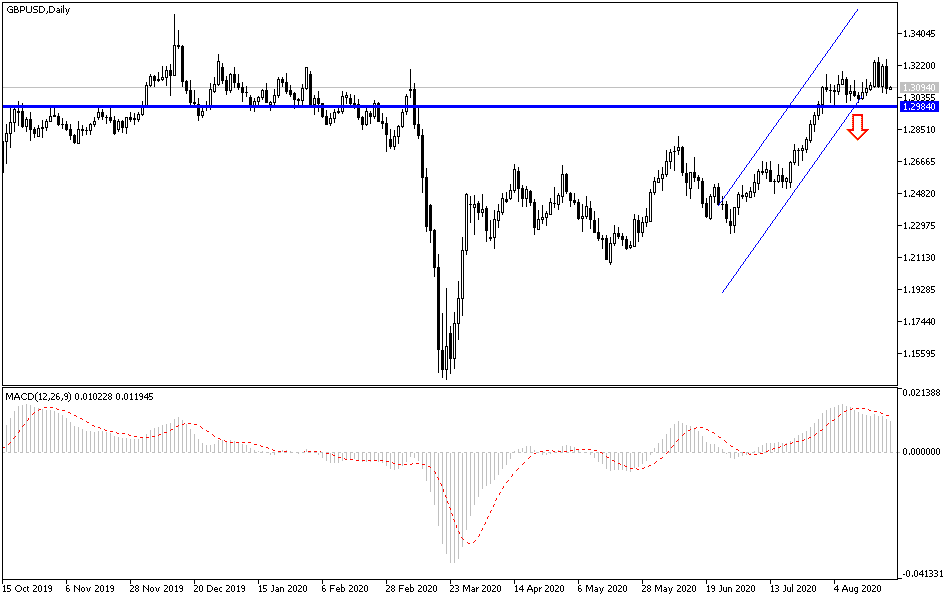

According to the technical analysis of the pair: On the daily chart, the GBP/USD currency pair still has an opportunity for an upward correction, and those hopes may collapse if the pair moves below the 1.3000 psychological support. As is my technical view, I am still preferring to sell the pair from every higher level, and the closest resistance levels for the pair now are 1.3165, 1.3220, and 1.3300, respectively. Today's economic calendar has no important or influential data, whether from Britain or the United States. The pair will interact with investors’ risk appetite, Brexit anxiety and the strength of the second wave of the COVID-19.