The pressure returns on the USD in anticipation of Jerome Powell’s important statements today. The GBP/USD pair got enough momentum to correct upward to reach towards the 1.3223 resistance at the beginning of Thursday’s trading. Despite the positive move by the pair, I still prefer selling, as the Brexit saga has reached a dead end. Brexit talks were extended to continue last week but ended by a warning from both sides that time was running out and that a deal was still out of reach.

The red lines resulting from incompatible targets on both sides could be said to have been in the context of the impasse. The UK has sought to restore independent policymaking capacity in all the ever-increasing areas were the European Union has had influence on during UK membership, while the EU seeks to hold the whip in a host of areas.

Accordingly, it is necessary for both parties to not only reach an agreement before December 31 on the future commercial relationship, but also to ratify it through a legal process, which will include voting in all European institutions as well as member states. Therefore, the resulting uncertainty regarding future trade between parties, who are among the largest trading partners of each other, is a large part of the continuing pressure factors on the Pound.

Investor sentiment about the British pound has turned increasingly positive in recent weeks, as the latest data from the Commodity Futures Trading Commission (CFTC) showed that traders have shifted from the general downtrend of the British pound to a general bullish trend. CFTC data is released once a week and provides unique insight into how investors anticipate trading the currency in the future.

The latest batch of data shows an additional drop in active bets against the British pound, extending the trend that has been in place for a number of weeks now and coming despite the passage of time on trade negotiations between the EU and the UK. The closing of “short” positions on the pound creates a technical supply of the currency, which is one reason analysts say that the pound has advanced against the Euro and the Dollar over the past four weeks.

Commenting on the Pound’s performance, Francesco Bisol, Forex Strategist at ING Bank says, “The sterling position is a good indication of how investors are currently sticking to a very satisfied approach to the Brexit story. And while the collapse of Brexit late negotiations last week will only be reflected in the CFTC status report next week - we may see the rebuilding of some sterling short positions - as the pound is still far from the levels it was hovering around when the markets were pricing a no-deal Brexit”

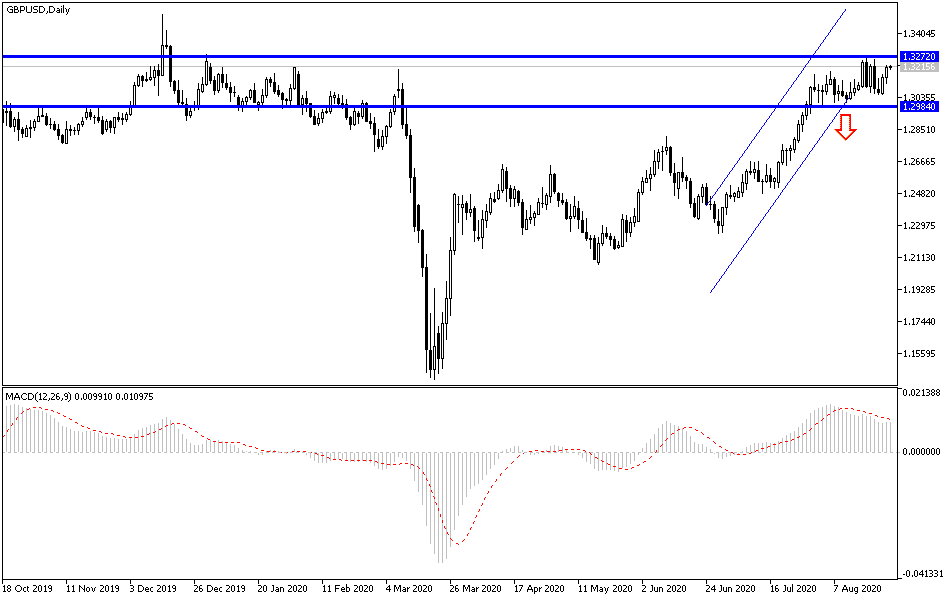

According to the technical analysis of the pair: On the daily chart, the GBP/USD is still trying to maintain its ascending channel by moving above the 1.3200 resistance, and it will have the best opportunity today to continue the path in the event that the US data results fall short of expectations and Jerome Powell's statements came below markets’ expectations. Therefore, the resistance levels at 1.3285, 1.3360 and 1.3420 may be legitimate targets for the bulls. On the downside, there will be no reversal of the current trend and a strong turnaround without the pair reaching around and below the 1.3000 psychological support level - the psychological resistance just a month ago - I still prefer selling the pair from every upside level.

Regarding today's economic calendar data: For the third consecutive day, there are no significant British economic releases. All of the focus will be on the US session data, jobless claims, the rate of growth of US GDP, pending home sales, and most importantly statements by Fed Governor Jerome Powell.