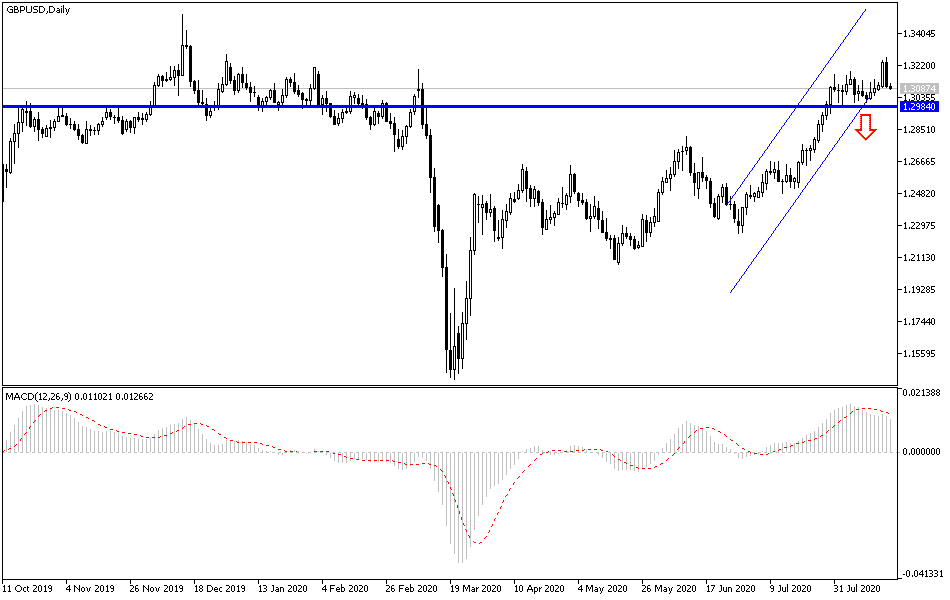

According to the trading strategy, which has always been recommended, to sell the GBP/USD currency pair from every ascending level, the pair abandoned its highest levels during 2020 trading. The pair stabilized around the 1.3074 support at the time of writing, after reaching the 1.3266 resistance during yesterday's session. The pair plunged by nearly 200 points after the USD’s uprising after the announcement of the last MoM of the Federal Reserve Bank, which showed bank officials pessimism about the outlook for the largest economy in the world as long as the Coronavirus persists. Bank officials linked the strength of the recovery to the rapid end of the pandemic. Despite this, they ruled out raising interest rates in the near future and preferring to maintain interest rates as is and increase stimulus plans.

The British pound fell against the rest of the major currencies as normal behavior for the currency market after recent strong gains. As the possibility of concluding a Brexit deal remains more likely, and on the other hand, the markets have been affected more by the Financial Times announced that the trade talks are heading towards a new dead end. The outperformance of the pound came after British inflation figures showed better than expected results, but the reaction from the Brexit path was the most influential in the end. As I mentioned before, this is the most influential factor in any gain of the pound.

HSBC trading experts expect the GBP/USD rate to reach 1.20 by the end of the year.

The British pound rose above the 55-month moving average around 1.2727 in August in moves that came along with huge gains from the EUR/USD, with which the GBP/USD interacts naturally. It has not closed in any month above its 55-month average for more than five years. According to the technical data, the pair needs to consolidate above the 1.3150 resistance for the bulls to maintain control over the performance. In return, breaking the 1.32 resistance again will support the stronger bullish move towards the 1.3500 resistance, the highest since early 2018.

Thursday's trading session could be a choppy day for the pound, the Euro, and other major currencies since the Turkish Central Bank will announce its latest policy decision at 11:00. Both positive and negative surprises may affect the GBP/USD and EUR/USD pair. Some expect the pace of interest rate hike to end in the coming months and move to a long cycle of rate cuts that reduced the liquidity rate from 24% in January 2019 to 8.25% in 2020.

This has crushed real, inflation-adjusted, investor returns from Turkish bonds.

And if the market decides to punish the Lira for anything today, Thursday, then the EUR/USD and USD/TRY will be among the most affected of major pairs and this may also affect the GBP/USD due to the relationship with the EUR/USD pair, along with The UK being also a large trading partner to Turkey, so the sterling exchange rates are also an important part of the Turkish lira equation.

According to the technical analysis of the pair: the GBP/USD currency pair has the last chance to consolidate within the range of its recent ascending channel, and a real shift in the trend may occur if the bears pushed the pair below the 1.3000 support. Which may increase the selling of the pair. On the upside, the 1.3200 resistance is still a mark of stronger bulls’ control over performance. Overall, I would still prefer to sell the pair from every higher level. There are no significant UK releases today. With the focus being only on US data, which are jobless claims and the reading of the Philadelphia Manufacturing Index.