Throughout last week’s trading, the GBP/USD was moving in a limited range between the 1.3005 support and the 1.3142 resistance and closed the week’s trading around 1.3090. This cautious performance warns of a stronger movement in one direction or the other. Going back to factors affection the pair’s performance; trade talks between the EU and the UK didn’t yield any breakthrough yet and remains a cause of concern for investors. It seems that negotiators are determined on finding a way forward and the extension of talks at the end of July confirmed their willingness to finding a solution for a deal. We believe that markets carefully raised expectations regarding reaching a “simple” trade deal by October, which helped the Pound.

British chief negotiator David Frost said at the end of last week that a Brexit deal with the European Union could be reached in September. Frost stated, “As we continue to say, we are not looking for a special or unique agreement. We want an agreement, in essence, a free trade agreement like the one agreed by the European Union with other friendly countries, such as Canada”. “The sovereignty of the UK, over our laws, our courts, or our fishing waters, are of course is not up for debate and we will not accept anything that harms it - just as we are not looking for anything that threatens the integrity of the European Union. And the single market”, he added.

Frost's suggestion that there is a possibility of a deal in September comes before another round of negotiations next week and it should serve as a reminder that the two sides remain committed to reaching an agreement, even if they maintain a cautious stance on this outcome. “It appears that the negotiations on the post-Brexit deal have been more successful behind closed doors than they have been at the main stage,” says Thomas Fleury, a strategic expert at UBS. However, markets appear to be quite calm now. Currently we do not see any obstacles on the horizon for Brexit that could derail the GBP's path.”

Another possible driver of the sterling's recent performance is the view that the UK's economic recovery is starting to pick up some speed after it suffered one of the deepest, if not the deepest, recessions among the developed world in the first half of 2020. The UK economy was among the last economies to shut down, but endured a longer lockdown period than many of its peers, which was a particularly big blow to the economy in which the services sector accounts for 80%.

But with the beginning of July, bars, restaurants, hotels and other elements of the service sector were opened, so the economy should recover some speed in the second half of the year. How the recovery compares to the recovery of other economies is important when it comes to exchange rates, as we are in a world in which economic outperformance is re-emerging again, and this may be one of the aspects to consider when approaching the GBP/USD in the coming weeks.

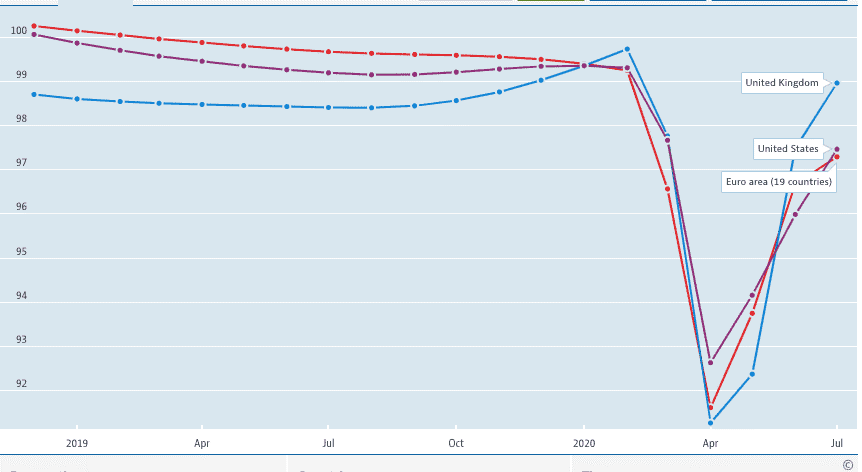

The Organization for Economic Cooperation and Development collects timely economic data from the largest economies in the world and aggregates them into its leading composite index that gives insight into key turning points in the economic cycle and allows us to see how economies perform in relation to one another. The following trends are the major composite indices for the UK, US, Eurozone and Australia:

Economic performance.

As can be noted, the UK has recently seen an acceleration in its recovery and this is one possible explanation for the better sterling performance since around July 22nd.

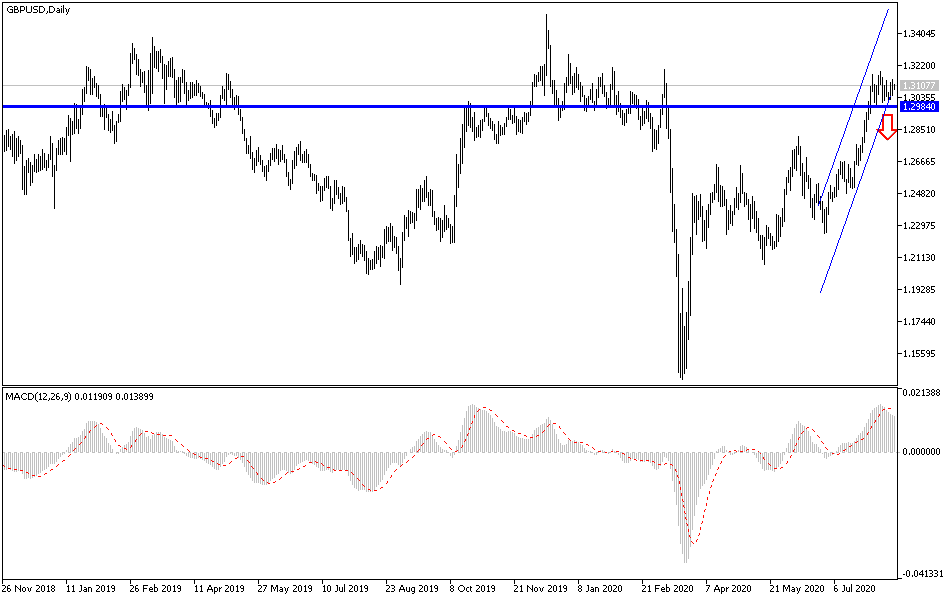

According to the technical analysis of the pair: The general GBP/USD trend is still bullish, and stability above the 1.3000 resistance will remain supportive. Bulls are waiting to push the pair above the 1.3200 resistance to confirm the strength of the upward correction. Without moving below the 1.2975 support, there will be no chance for the bears to make a direction reversal. Despite recent optimism, I still prefer selling the pair from every higher level.

As for the economic calendar data: No important British economic releases are expected today. From the United States, the Empire State Industrial Index and NAHB Housing Market Index will be announced.