As investors abandon the USD, the price of the GBP/USD remains in a stable upward correction range above the 1.3100 resistance, awaiting stronger incentives to achieve more gains. The pound is still under pressure due to the future of the weaker British economic performance and the Brexit file that faces uncertainty. The pair’s performance remains positive as long as it remains stable above the 1.3000 level, which is the same performance since the beginning of this month. Nevertheless, the pound may witness volatility in its performance this week due to the beginning of Brexit trade negotiations again, while the markets are cautiously awaiting the announcement of the British manufacturing and services sectors PMI readings. As the focus of forex traders is currently on the comparison between global economies in terms of recovery from the Coronavirus consequences.

As for the dollar, the release of the minutes of the last Fed meeting in July will be of interest.

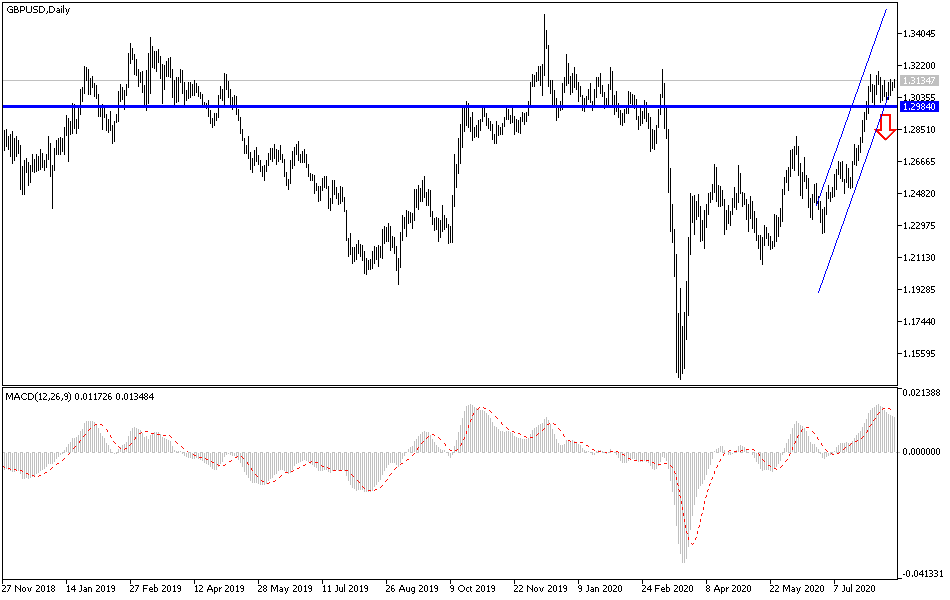

Forex analysts are frustrated by the inability of the GBP/USD to break above the 1.3200 resistance, says Karen Jones, Head of the Technical Analysis Research Team at Commerzbank: “The GBP/USD pair continues to move sideways and is now in a neutral position.” And added: “The market is currently stable below the bullish level of 1.3186 which was tested last week. Declines are expected to find initial support at 1.2814, June high, ahead of the 200-day moving average at 1.2713, and remain contained at 1.2659 support line. It faces strong resistance at 1.3186, the recent high and March 2020 high at 1.3201.”

The most prominent expectation is that if the GBP/USD exchange rate rises above the February high of 1.3213, then the market will likely target the 1.3500 resistance zone, which is the December 2019 high/January 2009 low. However, if the exchange rate slides below the low Level OF May at 1.2072, a more negative outlook would be provided and a slide back to 1.1409 March low would be possible.

The way the pound ends the week's trading will likely depend on the briefing on Friday from EU and UK negotiators following this week's trade negotiations. The two sides will meet today in Brussels and are expected to try to settle their differences. We do not expect any breakthroughs on the key issues, but instead, both sides will make further progress towards this outcome. However, any unexpected successes or apparent breakdown in the negotiation track, as usual, is likely to increase the volatility of the pair.

For the time being, the markets continue to assume that a deal will be struck, which should ultimately keep the GBP somewhat supported. In this regard, Irish Prime Minister Michel Martin said last week that Prime Minister Boris Johnson showed a "real desire" to finalize a trade deal and that he did not want to compound the Coronavirus crisis with an economic shock of a “no-deal”.

According to the technical analysis of the pair: I do not see any significant change in the GBP/USD performance, as the bullish opportunity remains intact as long as it is stable above the 1.3000 resistance and the bulls are waiting for the pair to move through the 1.3200 resistance to confirm their control of the pair. We still prefer selling the pair from every ascending level above that resistance. There will be no strong return to the bears without moving below the 1.3000 support - previous psychological resistance - the pair does not await any important British economic data today. From the United States, building permits and housing starts data to be announced. This is in addition to any comments from the Brexit teams on the course of negotiations.