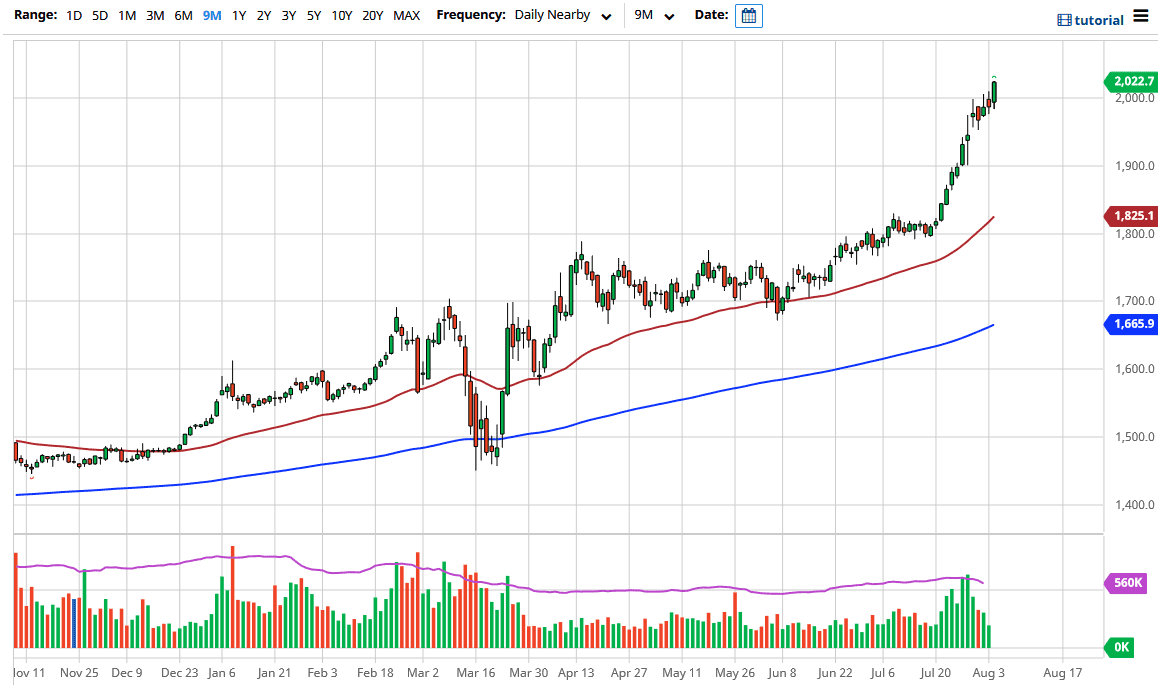

Gold markets broke out to the upside during the trading session on Tuesday, clearing the $2000 level handily. Gold continues to shoot straight up in the air and therefore it is likely that we will continue to see buyers every time it dips. The fact that we have broken so clearly through the $2000 level suggests that we have much further to go. A pullback to the $2000 level will almost certainly be met with buying pressure, as it should now be massive support. I like the idea of owning gold, and certainly would not be a seller but it is so difficult to buy it at these elevated prices.

If we break down below the $2000 level, then the $1940 level would be the next major support level. There is a small gap there that has not quite been filled but it has been for the most part. This type of parabolic move is typically done poorly, but we have a long cycle to go before that changes as the Federal Reserve is pumping the world full of US dollars. The candlestick closing towards the top of the range is a very bullish sign, and we are obviously in a strong trend.

It is not until we break down below the $1800 level that I would consider changing my attitude with gold, and that is clearly not going to happen anytime soon. Furthermore, the uncertainty out there continues to work against the value of the risk appetite of traders around the world, and the liquidity being shoved down the throats of everyone will continue to force money into various assets, with gold being a way to get far from devalued currencies. The US dollar is obviously getting hammered right now, but most currencies out there have been getting hammered for a while and when you look for gold in contracts in foreign currencies, you can see that gold had broken out against them quite a while ago. This is a bullish market, and there is no need to over complicate things. Simply buy pullbacks and take advantage of value when it appears in the gold contracts. Longer-term, I believe that we are probably going to go to $2500, but obviously not in a straight line. The next target of course is $2100, which might be a place we get to somewhat quick.