The gold markets rallied a bit during the trading session on Friday, as we continue to see a lot of bullish pressure in a market that continues to react to the Federal Reserve and its ultra-loose monetary policy. At this point in time, the Federal Reserve has stated on Thursday that the bar to raising interest rates is even higher than originally thought, and that has people selling the US dollar. As the US dollar falls in value, it makes quite a bit of sense that it would take more of those US dollars to buy gold.

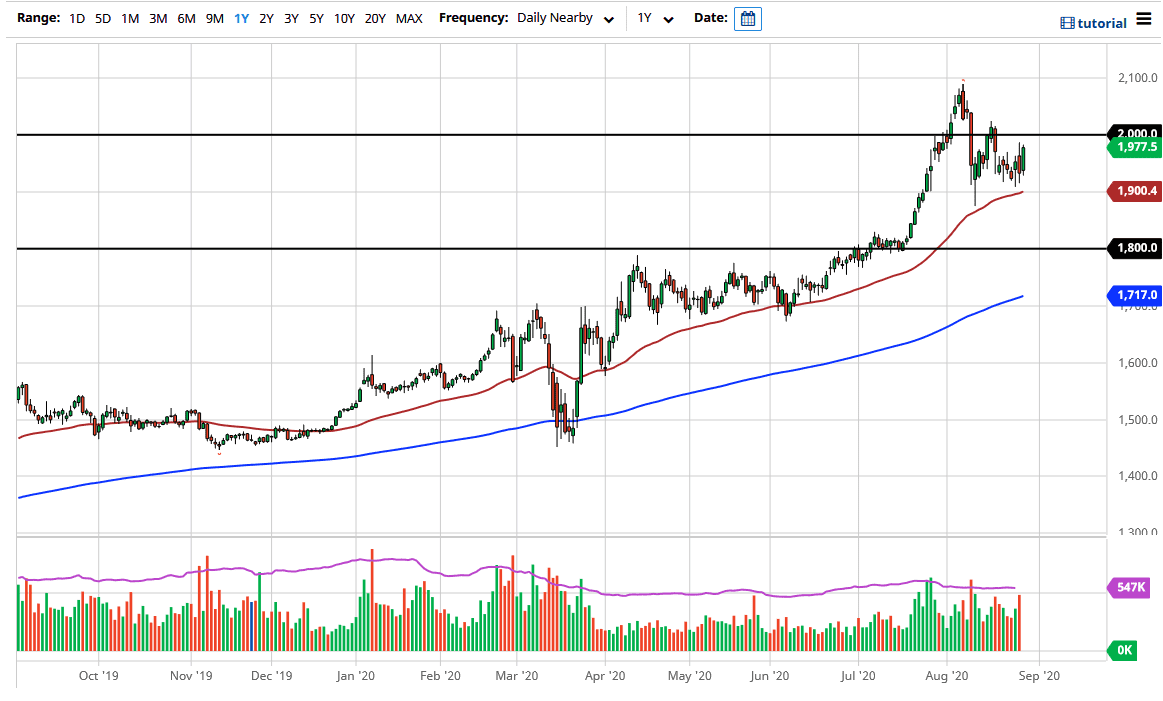

If we were to break above the $2000 level, then the market should continue to go higher, reaching towards the $2100 level. If we can break above there, then the market is likely to go even further. Pullbacks at this point in time should be thought of as buying opportunities with the $1900 level underneath offering support, not only from a structural standpoint but the fact that the 50 day EMA is crossing that level as well. All things being equal, you could even make an argument for the market forming a little bit of a bullish flag at this point, and therefore I think we could go much higher.

I think this is a market that you should buy on dips in little bits and pieces, perhaps which is little in the way of leverage. This is a longer-term trend that we are just starting, and therefore it should not be overly surprising if gold truly explodes to the upside. The 50 day EMA is crucial support, but even if we break down below there, I think there is even more support to be found on at the $1800 level which was structurally resistive for what seems like ages. Truthfully, if we get down there I will become even more aggressive about buying gold because there is no reason whatsoever gold to sell off for a longer-term move, not as long as central banks around the world are printing money, and buying gold at the same time. At this point in time, it is very likely that we will see more upward pressure, working in waves and cycles. Obviously, markets do not go in one direction forever, but I do think we have to trade from the long-only perspective.