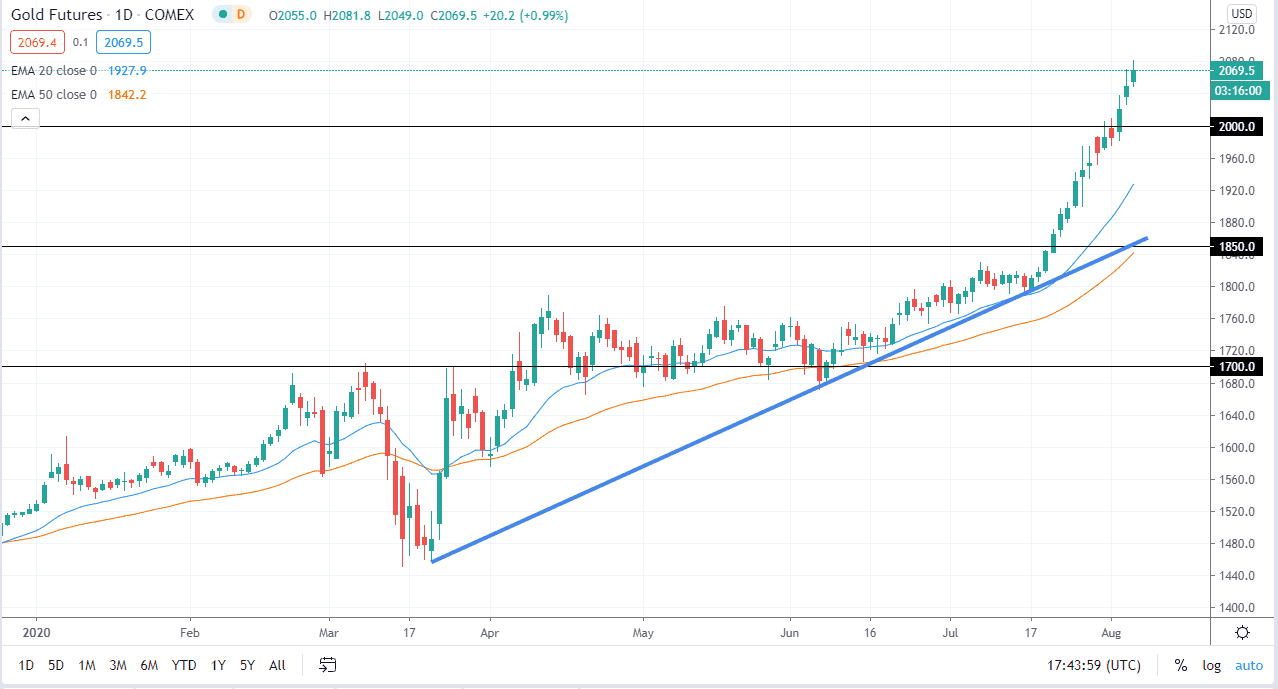

Gold markets have rallied a bit again during the trading session on Thursday, reaching towards the $2080 level before pulling back just a bit. Having said that, the market is well overdone at this point, so it is difficult to start buying here. You are either long of gold, or you are waiting for an opportunity to buy it. Shorting this market is a great way to wreck your trading account. Granted, we will almost certainly get some type of pullback in this massive move, but even if you told me you knew when it was going to happen I still would not short this market. It is simply far too strong to try to get cute with it at this point.

The $2000 level would be a very interesting level for me to start buying this market, as it is an area that has been important from a psychological standpoint and did offer a bit of resistance for a couple of days. Ultimately though, I think that there is even more value to be found at lower levels, perhaps near the $1925 level in the form of the 20 day EMA and the massive neutral candlestick that formed two weeks ago.

The market is decidedly bullish and as long as the Federal Reserve continues its loose monetary policy, it will continue to be so. With that being the case, it makes quite a bit of sense that we would see gold continue to go higher over the longer term as the US dollar loses value. After all, the gold market is priced in the same US dollar, so it is going to take more of them to buy an ounce. That being said, nothing goes in one direction forever so I anticipate a pullback coming in the Non-Farm Payroll announcement could be the catalyst for that short-term pullback. Nonetheless, I look at that as value and would be more than willing to take advantage of it if I get the opportunity to buy on the dips. I will not be a seller of gold anytime soon and I believe that we could go looking towards the $2500 level given enough time. Longer-term, we could go even further than that but by the end of the year I think we will be looking at that level, as we have seen a significant amount of money flowing into this commodity as well as others.